BHP Profit Jumps, Dividend Steady

19 February 2019 - 5:12PM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--BHP Group Ltd. (BHP.AU) reported an 87% rise in

first-half net profit and kept its midyear payout unchanged as the

company generates solid cash flow from its mines and oil

fields.

BHP, the world's largest listed miner by market value, said it

made a profit of US$3.76 billion in the six months through

December. Net profit in the year-earlier period was US$2.02

billion, weighed down by one-off items totaling US$2 billion mainly

because of large expenses linked to the U.S. tax overhaul.

Underlying profit from continuing operations was down 8% at

US$4.03 billion, below the US$4.21 billion median of eight analyst

forecasts compiled by The Wall Street Journal. During the period,

BHP sold most of its U.S. onshore shale division to BP PLC (BP.LN)

in a more-than US$10-billion deal.

The company kept its interim dividend unchanged at US$0.55 a

share. It had paid a US$1.02 special dividend to shareholders late

last month funded from the sale of the shale operations.

Earnings were aided by stronger petroleum markets. BHP's average

price for oil was up 29%, while natural gas increased by 12% and

liquefied natural gas by 36%.

BHP is different from global miners because of its large

oil-and-gas division, which typically accounts for one-fifth of

earnings.

BHP faced some operational setbacks in other divisions during

the half. The miner recorded a productivity hit totaling US$460

million because of disruptions to operations that included a train

derailment in a remote part of Australia. BHP had also reported an

acid-plant outage at its Olympic Dam copper mine in Australia and a

plant fire at its Spence mine in Chile.

The company said unplanned outages meant it now expected

productivity to be broadly flat in the current fiscal year.

"A strong second half is expected to partially offset the

impacts from operational outages in the first half, with unit costs

across our business forecast to improve," Chief Executive Andrew

Mackenzie said.

BHP last month reported mixed first-half production of its main

commodities. It produced 2% more iron ore on a year earlier. That

commodity accounts for roughly two in every five dollars it

earns.

The price it sold iron ore for during the period fell, however,

by 2%. Underlying earnings before interest, tax, depreciation and

amortization from that division rose by US$34 million to US$4.3

billion, the miner said.

Output of steelmaking coal was also slightly higher, although

BHP produced less energy coal and petroleum on the year-earlier

period.

BHP also produced less copper. The miner's copper division

meantime grappled with weakening prices, which fell by 18% on the

year-earlier period. Underlying earnings from that division fell

roughly 40% year-on-year, the miner said.

Still, the company said it cut net debt by US$1 billion since

mid-2018, to US$9.89 billion.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

February 19, 2019 00:57 ET (05:57 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

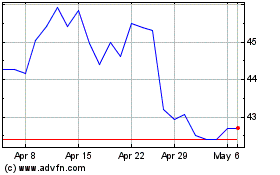

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

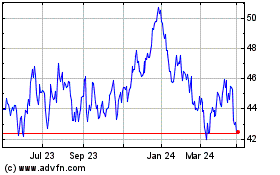

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024