HSBC's 2018 Profit Misses Analysts' Expectations

19 February 2019 - 7:56PM

Dow Jones News

By Margot Patrick and Chester Yung

HSBC Holdings PLC reported lower than expected fourth-quarter

profit Tuesday as choppy financial markets, U.S.-China trade

tensions and Brexit uncertainty weighed on the global bank.

HSBC shares dipped 2% in Hong Kong after it said cost growth

outstripped revenue at the end of 2018. The bank said customers

held off on business when markets turned volatile last year,

hitting revenue in its global markets business and retail banking

and wealth management units. It reported a full-year net profit of

$12.6 billion, less than the $13.71 billion analysts expected.

HSBC Chief Executive John Flint in an interview said the bank

had been on track to meet fourth-quarter cost control targets until

revenues collapsed in parts of the bank in November. He said it was

"very much a fourth-quarter problem" and that the bank started 2019

in a "fundamentally different" position.

Mr. Flint is marking his first year as CEO and didn't signal any

shifts in a strategy update on HSBC's focus on Asia for growth. He

said the trade dispute between the U.S. and China hadn't had any

effect on the credit quality of customers but had resulted in

weaker loan demand. HSBC Chairman Mark Tucker in a statement

Tuesday said differences between the U.S. and China are likely to

continue to "inform sentiment" this year.

The bank said it adjusted provisions for potential loan losses

relating to trade and tariff-related tension, and took a $165

million charge in the fourth-quarter to reflect the increased level

of economic uncertainty in the U.K. from its departure from the

European Union.

Mr. Flint said the bank is prepared for Brexit but that

uncertainty around the terms of the exit have caused some

businesses to delay investment and that "customers are desperate

for certainty."

Full-year revenue at the bank was $53.78 billion, up from $51.4

billion in 2017. Fourth-quarter revenue was up across HSBC but some

units posted double-digit declines.

Mr. Flint said the turnaround of the bank's U.S. business is

still a work in progress and that it still has "a long way to go"

to hit a 6% return on equity target by 2020.

Also on Tuesday, HSBC said the European Commission has asked it

for information around potential coordination in foreign exchange

options trading. It said the matter is at an early stage.

--Joanne Chiu contributed to this article.

Write to Margot Patrick at margot.patrick@wsj.com and Chester

Yung at chester.yung@wsj.com

(END) Dow Jones Newswires

February 19, 2019 03:41 ET (08:41 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

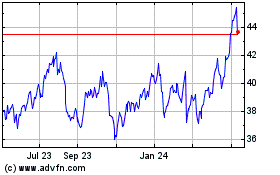

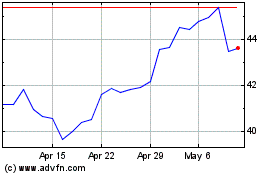

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024