HSBC Profits Hurt by Choppy Markets and Trade Tensions

19 February 2019 - 8:30PM

Dow Jones News

HSBC Holdings reported lower than expected fourth-quarter profit

as choppy financial markets, US-China trade tensions and Brexit

uncertainty weighed on the global bank.

KEY FACTS

-- HSBC said cost growth outstripped revenue at the end of 2018.

-- Customers held off on business when markets turned volatile last year.

-- That hit revenue in the global-markets, retail-banking and

wealth-management units.

-- Full-year net profit was $12.6bn, less than the $13.71bn analysts

expected.

WHAT THE BANK SAID

HSBC CEO John Flint in an interview said the bank had been on

track to meet fourth-quarter cost control targets until revenues

collapsed in parts of the bank in November. He said it was "very

much a fourth-quarter problem" and that the bank started 2019 in a

"fundamentally different" position.

WHY THIS MATTERS

Flint is marking his first year as CEO and didn't signal any

shifts in a strategy update on HSBC's focus on Asia for growth.

Since 2011, the bank has undergone major restructuring, in part by

exiting most of Latin America and placing more focus on its Asia

operations. The UK and Hong Kong are its two major markets.

A fuller story is available on WSJ.com

WSJ City: The news, the key facts and why it matters. Be deeply

informed in less than five minutes. You can find more concise

stories like this on the WSJ City app. Download now from the App

Store or Google Play, or sign up to newsletters here

http://www.wsj.com/newsletters?sub=356&mod=djemwsjcity

(END) Dow Jones Newswires

February 19, 2019 04:15 ET (09:15 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

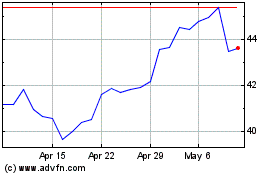

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

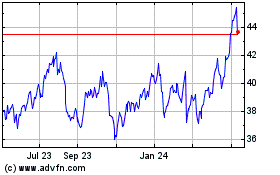

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024