Societe Generale to Sell Businesses in Balkan Region

28 February 2019 - 10:59PM

Dow Jones News

By Pietro Lombardi

Societe Generale SA (GLE.FR) said Thursday that it is selling

two businesses in the Balkan region.

The deals are the latest in a string of sales that are part of

SocGen's plan to rejig its geographical presence and focus its

international retail-banking operations on countries where it has

critical size and sees potential for synergies.

France's third-largest listed bank by assets is selling Societe

Generale Montenegro to OTP Bank (BISI.RS) and Ohridska Banka

Societe Generale to Steiermaerkische Sparkasse.

The deals should add 2 basis points to the French bank's CET1

ratio--a key measure of capital strength--and reduce its

risk-weighted assets by roughly EUR1.1 billion ($1.25 billion).

Risk-weighted assets, or RWA, are a bank's assets weighted by how

risky they are. A EUR66 million impact of the deals was included in

a EUR241 million exceptional charge the bank reported in its

fourth-quarter results.

Societe Generale Montenegro will be part of a cooperation

agreement between the French bank and OTP Bank and focused on

services in different fields, including investment banking and

capital markets.

"These transactions are in line with the divestment process

already undertaken in the Balkan region," Deputy Chief Executive

Officer Philippe Heim said.

SocGen has sold businesses in Serbia, Albania, Bulgaria and

other countries over the past 12 months.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

February 28, 2019 06:44 ET (11:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

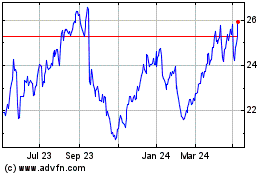

Societe Generale (EU:GLE)

Historical Stock Chart

From Mar 2024 to Apr 2024

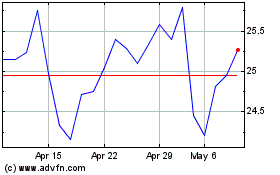

Societe Generale (EU:GLE)

Historical Stock Chart

From Apr 2023 to Apr 2024