Disney Nears Sale of YES Network -- 2nd Update

09 March 2019 - 7:15AM

Dow Jones News

By Joe Flint and Miriam Gottfried

Walt Disney Co. is in advanced talks to sell a majority stake in

YES Network to a group that includes the New York Yankees, Sinclair

Broadcast Group Inc. and Amazon.com Inc., in a deal that would

value the sports network at around $3.5 billion, according to

people familiar with the matter.

The New York City outlet that carries Yankees games is

considered the crown jewel among the 22 regional sports networks

that Disney is required to sell as part of its $71.3 billion

purchase of the bulk of 21st Century Fox Inc.'s entertainment

assets.

The YES Network was valued at $3.9 billion in 2014 when Fox

bought its 80% stake. The Yankees own the remainder.

The decline in YES's value is indicative of the challenges

regional sports networks are facing as more consumers abandon their

traditional cable and satellite pay-TV providers in favor of

streaming services.

Representatives for Disney and the Yankees didn't immediately

respond to a request for comment. Fox Business Network earlier

reported on the progress toward a deal.

The auction for the regional networks has attracted a range of

bidders, including Major League Baseball, sports teams and

private-equity firms. The deal making is likely to lead off with

YES and then accelerate for the remaining channels, people familiar

with the matter said.

Disney had been seeking a price in the $5 billion to $6 billion

range for YES and more than $15 billion for the other 21 networks,

according to people close to the talks.

However, bids from interested parties have been much lower and

the sales effort has dragged as a result, the people said. It

didn't help that both the new Fox company that will be launched

after the Disney deal closes and Comcast Corp., a large owner of

regional sports networks, indicated they weren't interested in the

channels.

For Sinclair, the deal would inch the Baltimore-based

broadcaster closer to becoming a major player in the regional

sports network business. It is one of the bidders for the remaining

21 networks, a person close to the company said, and last month

partnered with the Chicago Cubs on a new sports channel in

Chicago.

For Amazon, a stake in YES would provide another path into the

sports media business. It already streams National Football League

games live on Thursday nights on its Prime platform and has talked

with other leagues in recent years about partnerships.

Should the YES deal proceed, Amazon isn't likely to immediately

begin streaming Yankees games on its platforms, a person close to

the team said. Furthermore, Major League Baseball restrictions

likely would prevent Amazon from streaming games outside the New

York market.

Disney has six months to sell the channels after its Fox deal

closes, which is expected to happen in the coming weeks.

Write to Joe Flint at joe.flint@wsj.com and Miriam Gottfried at

Miriam.Gottfried@wsj.com

(END) Dow Jones Newswires

March 08, 2019 15:00 ET (20:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

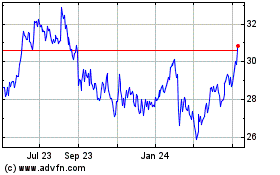

Fox (NASDAQ:FOX)

Historical Stock Chart

From Mar 2024 to Apr 2024

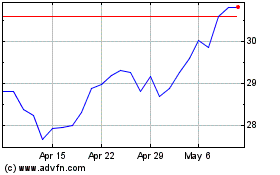

Fox (NASDAQ:FOX)

Historical Stock Chart

From Apr 2023 to Apr 2024