10 Billion Corporate Debt Sale Highlights Credit Market's Recovery

15 March 2019 - 9:29PM

Dow Jones News

By Sam Goldfarb and Soma Biswas

The world's largest maker of automotive batteries is set to sell

more than $10 billion worth of speculative-grade debt Friday to

fund its purchase by an investor-group led by Brookfield Business

Partners LP, underscoring the recent resurgence in demand for

low-rated bonds and loans.

Power Solutions, the automotive-battery business currently owned

by Johnson Controls International PLC, is poised to sell roughly

$3.7 billion worth of secured and unsecured bonds, denominated in

both dollars and euros, along with around $6.5 billion in loans,

also split between euro and U.S. dollar tranches.

The long-anticipated sale is on track to be relatively easy for

a large group of underwriting banks, as investors have eagerly

embraced what many see as a stable business that is able to

shoulder the large amount of debt being placed on it.

The expected completion of the Power Solutions deal is a

testament to the improved tone in high-yield debt markets, several

investors said. Though fears of an economic slowdown led to a sharp

decline in bond and loan sales in the final months of 2018,

issuance picked up in the middle of January and has been fairly

steady since then.

Through Wednesday, businesses had sold a total of $106.9 billion

of speculative-grade bonds and loans this year, according to LCD, a

unit of S&P Global Market Intelligence. That is down from $162

billion in the same period last year.

After a lengthy roadshow, banks this week were able to cut the

expected yields on all of the bonds and loans, an indication that

demand had well outstripped supply, investors said. They were also

able to increase the size of the loan portion of the deal by $1

billion while decreasing secured bonds by the same amount. That was

a positive sign for private equity-backed companies that typically

prefer to borrow in loans because they are usually easier than

bonds to repay ahead of their scheduled maturities.

Among the multiple pieces of the debt package is an expected

$1.95 billion worth of unsecured bonds due 2027, which investors

late Thursday were anticipating will initially yield around 8.5%,

down from original guidance of roughly 9.25%. JPMorgan Chase &

Co. was the lead underwriter for the secured dollar bonds and

loans, while Barclays PLC led marketing of the euro debt and Credit

Suisse Group AG was the lead underwriter of the unsecured dollar

bonds.

Some investors cautioned that the likely success of the Power

Solutions deal doesn't necessarily mean other businesses will find

it as easy to sell such a large amount of debt in the current

market. Even using conservative assumptions, analysts expect the

company should be able to generate ample free cash flow in the

coming years. Its secured bonds and loans, in particular, appealed

to investors who have been eager to buy debt at the higher end of

the speculative-grade ratings scale.

Not everything about the deal pleased investors. Prospective

buyers were able to make some changes to the package of investor

protections, known as covenants, an unusual outcome for such an

in-demand deal. Yet the result, some said, still gives the

company's owners plenty of room to pay themselves dividends and

remove collateral from the business, in keeping with the long-term

trend toward weaker covenants.

Johnson Controls, an industrial and technology conglomerate with

headquarters in Cork, Ireland, announced in November it was selling

Power Solutions to the Brookfield Business Partners-led group for

$13.2 billion in cash. The deal is expected to close by June

30.

Write to Sam Goldfarb at sam.goldfarb@wsj.com and Soma Biswas at

soma.biswas@wsj.com

(END) Dow Jones Newswires

March 15, 2019 06:14 ET (10:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

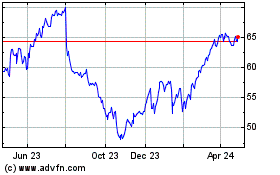

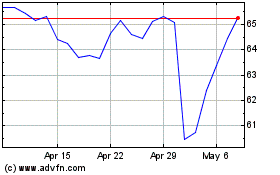

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024