Express Scripts to Offer a Way to Lower Insulin Costs -- Update

04 April 2019 - 9:31AM

Dow Jones News

By Joseph Walker

One of the largest managers of prescription-drug benefits will

offer clients the option of limiting how much diabetics owe

out-of-pocket each month for their insulin, the latest step by a

health-care company under pressure to curb drug costs.

Express Scripts, a pharmacy-benefit manager owned by health

insurer Cigna Corp., said Wednesday it will immediately begin

offering employers, labor unions and other clients the option to

cap at $25 a month the copayments and other out-of-pocket costs

that diabetics must pay to fill their insulin prescriptions.

The cap, if picked up by employers, would save the average

patient about $15 a month, or 40%, and even more for patients

covered under a typical high-deductible health plan, according to

Express Scripts. Patients could start benefiting from the lower

out-of-pocket costs in the next few months, depending on when

employers decide to opt-in, a company spokesman said.

The offering will include all insulin types, including those

made by Eli Lilly & Co., Novo Nordisk AS and Sanofi SA, three

of the biggest makers of diabetes drugs. Express Scripts and Cigna

insure about 700,000 patients taking insulin, said Glen Stettin,

chief innovation officer at Express Scripts.

"Lowering the high out-of-pocket costs some people pay at the

pharmacy for insulin is our priority," a Lilly spokesman said in an

email. "We're glad Express Scripts is looking for ways to make that

happen, and we support their efforts."

Novo Nordisk is "working closely with [Express Scripts] to

finalize our participation in this effort," a Novo spokesman

said.

A Sanofi spokeswoman said the collaboration was part of its

effort to make its medicines accessible and affordable to

patients.

The rising list prices for insulin have figured prominently in

mounting criticism of drug costs. Patients, doctors and lawmakers

have criticized Lilly, Novo Nordisk and other drugmakers for

raising prices, while the pharmaceutical companies have sought to

shift blame to the pharmacy-benefit managers.

Amid the scrutiny, Lilly said last month it would introduce a

generic version of Humalog, among the most widely used insulins, at

half the list price of the brand-name product.

The drug company released data last week saying the sum it was

paid for Humalog had dropped $12 to $135 a patient a month last

year from 2014, as a result of the rebates and other discounts it

paid to PBMs, while the list price increased 52% during that

time.

The Trump administration and members of Congress have picked up

on the criticism of PBMs, saying the health-care companies have

been able to collect ever-larger rebates as a result of the price

increases.

The Senate Finance Committee is conducting an investigation into

insulin prices and has sent detailed information requests to

insulin-makers and PBMs including Express Scripts as part of the

probe. Committee Chairman Sen. Chuck Grassley (R., Iowa) on

Wednesday questioned the timing of the Express Scripts insulin

program.

"Why couldn't this have been done years ago?" Mr. Grassley said

in a statement. "It shouldn't take bad press and congressional

scrutiny to get health plans, their pharmacy benefit managers and

pharmaceutical companies to arrive at a fair price for a drug

that's been on the market for nearly a century."

The average out-of-pocket cost for insulin for a typical patient

insured by Cigna or Express Scripts last year was $41.50 a month,

Express Scripts said. Many patients in high-deductible health plans

paid an average of about $100 per monthly prescription.

Health-plan sponsors, such as employers and labor unions, will

have to opt-in to an out-of-pocket cap program in order for

patients to benefit from it, according to Express Scripts. The PBM

isn't making the program available to government-funded health

plans, which often have restrictions on pharmaceutical companies

helping to pay patients' out-of-pocket costs.

The Express Scripts program will be funded with a new pot of

money that some drugmakers agreed to pay to the PBM to offset

patient out-of-pocket costs, Dr. Stettin said. That money is

separate from the rebates that insulin-makers already pay to

PBMs.

"We figured out a way to get additional money from the

pharmaceutical manufacturers," Dr. Stettin said in an interview.

"They're reinvesting money they could've spent elsewhere and

helping us make the insulin more affordable to the patients that we

serve."

Write to Joseph Walker at joseph.walker@wsj.com

(END) Dow Jones Newswires

April 03, 2019 18:16 ET (22:16 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

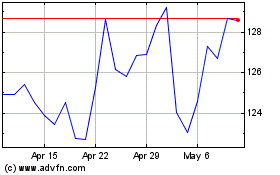

Novo Nordisk (NYSE:NVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

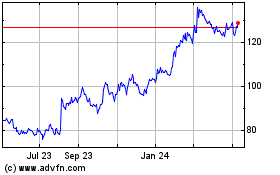

Novo Nordisk (NYSE:NVO)

Historical Stock Chart

From Apr 2023 to Apr 2024