Company appoints chief financial wellness officer to lead

business-wide efforts

Prudential Financial, Inc. (NYSE: PRU) announced the

introduction of a range of new financial wellness solutions to help

address the most pressing financial challenges facing American

consumers. The solutions, which will be available via employers,

will help individuals manage student loan debt, navigate job

changes, access financial coaching and develop a personalized

financial roadmap.

The new capabilities build on Prudential’s existing financial

wellness offerings, including the company’s digital financial

wellness platform, which has been deployed to more than 7 million

individuals across more than 3,000 organizations, and Prudential

Pathways®, the company’s on-site financial education program, which

has been adopted by nearly 600 employers. The new solutions also

build on Prudential’s market-leading position as a provider of

401(k)s, pensions, and group life, disability and voluntary

insurance offerings.

“The workplace is the front line of financial wellness,” said

Andy Sullivan, Prudential’s head of Workplace Solutions. “It’s the

place where millions of Americans make decisions that have a

significant and lasting effect on their own financial health, and

their contributions as employees. That’s why more employers are

thinking holistically about financial wellness. They recognize that

saving for retirement is just part of the picture and that

employees need help tackling lots of different challenges in their

financial lives, both short and long term. We are laser-focused on

partnering with our customers to design financial wellness programs

that deliver two things: behavior change and business results.”

Prudential is introducing the following new solutions in the

workplace:

Expanded digital and on-demand solutions

Prudential’s innovative workplace financial wellness platform

now includes LINK by Prudential, an interactive, personalized

resource that enables people to identify their most important

financial milestones and create a path toward achieving them.

Already available to individuals through Prudential’s website,

employees can use LINK to create an online personal profile and

establish goals like building an emergency fund, insuring loved

ones, saving for retirement or purchasing a home. LINK by

Prudential leverages AI technology, allowing employees to integrate

their existing Prudential retirement accounts and non-Prudential

financial accounts to help round out their financial wellness

roadmap. The LINK experience enables employees to be self-guided,

work with an investment advisor via video chat or phone or meet in

person with a financial professional from Prudential Advisors.

Prudential is also expanding its financial wellness engagement

capabilities to include a financial coaching service, available via

phone and one-way screen share. This coaching service is designed

to help individuals learn about and adopt healthier financial

behaviors, such as developing and sticking to a budget. The service

is being piloted with selected employers.

Expanded needs-based and life event solutions

The company is adding several new solutions that focus on

specific life events and customer needs. In addition to the

emergency savings and budgeting solutions it already offers,

Prudential is launching Student Loan Assistance, an online resource

that enables individuals to evaluate student loan consolidation and

repayment options, and allows employers to make one-time or ongoing

repayment contributions. Prudential is partnering with Vault, an

Austin, Texas-based student loan technology benefits firm, to

provide this service.

The company is also introducing PruPassages SM, a new program

that helps people make more-informed decisions and maintain

financial wellness during a job transition. As part of the service,

a licensed financial professional from Prudential Advisors

proactively reaches out to employees to offer guidance on their

options to continue life insurance coverage. Employees can also

receive a complimentary evaluation of their financial needs,

priorities and goals.

In addition, Prudential is providing new beneficiary services

for individuals who have just lost a loved one, with an easier

claim process and resources to help guide their decision-making.

These new capabilities include digital submission of claim forms,

text and email status alerts, and online resources that help

beneficiaries navigate tasks like planning a funeral and managing

their loved one’s financial and social media accounts.

“Each person’s journey to financial wellness is deeply personal

and constantly evolving,” said Judy Dougherty, who was recently

appointed Prudential’s chief financial wellness officer. “We all

face pivotal financial decisions throughout our lives, when the

choices we make have the potential to either put us on a track

toward financial health or derail us. This insight has guided our

work on new solutions that are designed to be as in sync as

possible with our customers’ lives. From digital experiences to

coaching and in-person advice, our goal is to meet our customers

where they are, and to help them to make informed decisions that

establish and sustain their financial wellness over a

lifetime.”

To learn more about Prudential’s Financial Wellness offerings

for the workplace, visit

prudential.com/employers/financial-wellness.

About Prudential Financial, Inc.

Prudential Financial, Inc. (NYSE: PRU), a financial services

leader with more than $1 trillion of assets under management as of

Dec. 31, 2018, has operations in the United States, Asia, Europe,

and Latin America. Prudential’s diverse and talented employees are

committed to helping individual and institutional customers grow

and protect their wealth through a variety of products and

services, including life insurance, annuities, retirement-related

services, mutual funds and investment management. In the U.S.,

Prudential’s iconic Rock symbol has stood for strength, stability,

expertise and innovation for more than a century. For more

information, please visit news.prudential.com.

LINK by Prudential is an umbrella marketing name for Prudential

Customer Solutions LLC, an SEC-registered investment adviser,

Prudential Annuities Distributors, Inc. and various subsidiaries of

The Prudential Insurance Company of America.

Certain offerings and content are sponsored by Prudential

Workplace Solutions Group Services, LLC (“PWSGS”). PWSGS is an

affiliate of Prudential Financial, Inc. PWSGS is not a licensed

insurance company, does not provide insurance products or services,

and does not provide investment or other advice. Certain offerings

not available in all states.

Student loan assistance services are provided by Student Loan

Benefits, Inc., doing business as Vault. Vault is a third-party

provider that is independent from Prudential and its subsidiaries.

Access to Vault student loan assistance services is provided

through PWSGS.

1019764-00001-00

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190411005028/en/

MEDIA:Monique

Freeman973-802-3745monique.freeman@prudential.comTwitter:

@MoniqueR_PruPR

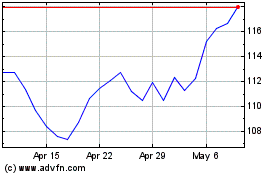

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Mar 2024 to Apr 2024

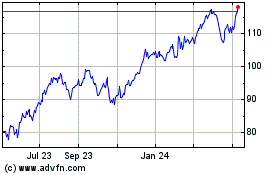

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Apr 2023 to Apr 2024