HSBC Board Wins $590 Million Battle Over Pension Deductions

13 April 2019 - 12:56AM

Dow Jones News

By Adam Clark

HSBC Holdings PLC's (HSBA.LN) board has defeated a campaign to

end the bank's practice of reducing pension payments to some

employees who receive state benefits.

At the bank's annual general meeting on Friday shareholders

overwhelmingly rejected a resolution to abolish the "state

deduction" applied to the pensions of around 52,000 U.K. staff who

joined HSBC between 1974 and 1996. Only 3.5% of votes cast were in

favor.

British unions and some lawmakers pressured the bank to get rid

of the deduction, which campaigners claim penalizes the lowest

paid. HSBC had warned the proposed move could cost it 450 million

pounds ($590 million) and said the overall pension benefit remains

competitive.

"We must be fair and equitable to all remaining 140,000 members

of the U.K. pension scheme, more than half of whom are defined

contribution members, and not just to those final salary members

who would benefit if the state deduction ceased," Chairman Mark

Tucker said at the AGM in Birmingham, England.

HSBC had already staved off one potential source of shareholder

discontent by slashing its executives' pension allowances to 10% of

their base salary from a previous level of 30%, bringing them into

line with the majority of the bank's employees.

Write to Adam Clark at adam.clark@dowjones.com

(END) Dow Jones Newswires

April 12, 2019 10:41 ET (14:41 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

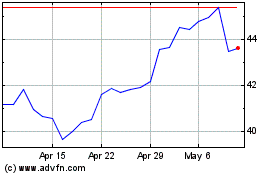

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

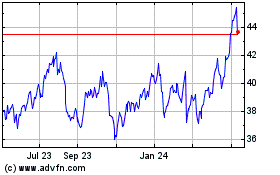

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024