The Apple-Qualcomm Courtroom Showdown Kicks Off

17 April 2019 - 1:26AM

Dow Jones News

By Tripp Mickle

SAN DIEGO -- Trial arguments in the legal battle between Apple

Inc. and Qualcomm Inc. were scheduled to begin Tuesday with lawyers

representing the tech companies likely to trade barbs in federal

court over how royalties are collected on innovations in smartphone

technology.

During opening remarks in front of a nine-person jury about 15

miles from Qualcomm headquarters, Apple's lawyers are expected to

portray Qualcomm as a monopolist that has used its patent portfolio

to charge onerous licensing fees of 5% of the sales price of

iPhones sold world-wide, up to $400. They also have said the chip

company blocked Apple for years from using another supplier of

modem chips.

Qualcomm's attorneys are likely to defend its licensing

practices and paint Apple as a bully that is responding to a

slowdown in its core iPhone business by forcing Qualcomm to accept

less money than it deserves for its contributions to the smartphone

era.

Chief Executives Tim Cook and Steve Mollenkopf, of Apple and

Qualcom respectively, are expected to amplify those messages when

they take the stand in the coming weeks, a testament to the chasm

between the companies' competing viewpoints on the value of

smartphone innovations .

At stake is the future of Qualcomm's business. An unfavorable

ruling could force it to overhaul a licensing business that once

accounted for half of its profit.

Meanwhile, Apple's legal challenge has left it without access to

Qualcomm's market-leading 5G modem chips, putting its most

important product, the iPhone, a step behind Android competitors in

the race to the next big advance in wireless.

Billions of dollars in damages are up for grabs. Apple's

contract manufacturers, who paid the disputed royalties under the

Apple-Qualcomm licensing agreement, are seeking $9 billion in

alleged overpayments to Qualcomm -- a sum that could soar to $27

billion under U.S. antitrust law that allows a jury to increase

damages in cases involving anticompetitive behavior.

Qualcomm has countered by seeking $7 billion in royalties those

Apple manufacturers started withholding as the legal battle

commenced more than two years ago. Qualcomm could also argue that

Apple, which it says encouraged the manufacturers to violate their

contractual obligations, should pay a penalty of as much as $14

billion.

Attorneys in the Apple-Qualcomm case must simplify their

clients' complex dispute and make it accessible to jurors

unfamiliar with intellectual property law, said Michael Salzman, an

attorney with Hughes, Hubbard & Reed who specializes in

antitrust law related to intellectual property.

"This is up front and personal between the two parties," Mr.

Salzman said. "The jury is trying to figure out between the two who

has the white hat and who has the black hat."

The two-year feud started as global smartphone sales slowed,

pressuring both their businesses. Apple had paid Qualcomm $7.50 in

royalties on every iPhone it sold since 2007 -- a price the parties

reached with complex agreements that lowered Qualcomm's standard

royalty rate through rebate and incentive payments. Apple also

agreed to make Qualcomm the exclusive provider of modem chips for

iPhones from 2011 to 2016.

Apple added chips from Intel Corp. to some iPhone models in

2016, as its most recent contract with Qualcomm concluded. It then

slapped Qualcomm with a lawsuit in January 2017.

The companies were expected to settle their dispute long before

the trial began. However, they have been so at odds over royalties

that it has been difficult to make headway, people familiar with

the situation said.

Other issues have heightened the distrust. For example, Qualcomm

executives suspected Apple of supporting a hostile takeover bid by

Broadcom Inc., and Apple executives were angered that Qualcomm

hired an opposition-research firm with ties to a news outlet that

published articles calling the iPhone maker Silicon Valley's

biggest bully.

The companies are awaiting a ruling from a federal judge in an

antitrust case brought by the Federal Trade Commission against

Qualcomm that could weaken or strengthen Qualcomm's position -- by

deciding whether Qualcomm's pricing policy for chips stifled

competition.

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

April 16, 2019 11:11 ET (15:11 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

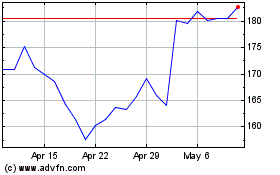

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

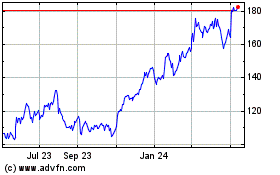

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024