Intel to Stop Making Modem Chips for 5G Smartphones -- Update

17 April 2019 - 12:49PM

Dow Jones News

By Asa Fitch

Intel Corp. dropped plans to make modem chips for 5G

smartphones, it said Tuesday, hours after its chief rival in that

market, Qualcomm Inc., resolved a yearslong legal dispute with

Apple Inc.

The decision by Intel removes a major rival to Qualcomm for a

critical component in the new generation of mobile handsets

expected to dominate the market over the next several years. It

followed a settlement between Qualcomm and Apple, which has been

Intel's biggest customer for smartphone modem chips. That

settlement includes a multiyear deal for Qualcomm to supply Apple

with modems, a major reversal after the iPhone maker shifted to

Intel as its sole supplier for those chips after years of using

Qualcomm.

Intel's withdrawal, meanwhile, leaves only a handful of

competitors to Qualcomm for 5G modems, which are small chips that

manage connection and the transfer of data between smartphones and

cell towers. Only a few other companies have 5G modems in the

pipeline, including Taiwan's MediaTek Inc., which supplies many

Chinese smartphone makers. China's Huawei Technologies Co. and

South Korea's Samsung are also developing 5G modems for their own

handsets.

Intel declined to comment on whether its announcement was

related to news of the Apple-Qualcomm deal.

In a statement, Chief Executive Bob Swan said that while Intel

is excited about 5G, in the modem business, "it has become apparent

that there is no clear path to profitability and positive returns."

He added that the new generation of wireless technology remains a

strategic priority, and that Intel is "assessing our options to

realize the value we have created" in 5G, including opportunities

with other devices and platforms.

Intel could sell the business, although it isn't clear who would

buy it, said Srini Pajjuri, an analyst at Macquarie Research.

Without a customer like Apple in place and with regulatory scrutiny

of any transaction, the proposition may not look attractive.

"They could look to sell, but I don't know if there are many

buyers out there," he said.

Investors and analysts had long looked askance at Intel's

smartphone modem business because profit margins were weaker than

its other businesses even though it brought in revenue. Angelo

Zino, an analyst at CFRA Equity Research, estimated that the

division produced gross margins of around 40%, compared with more

than 60% for other product segments.

"Intel benefits longer-term because now they can focus on

higher-margin, more profitable businesses and take their foot off

supplying Apple's iPhone business, which at the end of the day

wasn't a great business for them," he said.

Intel shares rose 4% to $58.97 in after-hours trading following

its announcement. The shares had closed up 0.76% in regular trading

Tuesday.

Intel's move illustrates Mr. Swan's approach to leading Intel,

which takes a hard look at whether the company's many ventures make

financial sense. Mr. Swan, who was Intel's chief financial officer

and then acting CEO until taking the helm permanently in January,

was "looking at the business differently and looking at where the

real opportunities lie," Mr. Zino said.

Intel has worked for years to build up its wireless business. It

plowed millions of dollars into developing smartphone chips under

previous CEO Brian Krzanich, who touted 5G and mobile technology as

a big new revenue stream for a company that has long dominated the

computer-processor market.

The company won a deal to supply modems for some of the iPhones

Apple started selling in 2017. It became Apple's sole supplier of

modem chips, starting with the iPhone XR that was launched last

year, amid worsening tension between Apple and Qualcomm.

But Intel got a late start when it came to 5G and hasn't been

able to keep pace with rivals like Qualcomm. Mr. Krzanich's abrupt

departure last June for violating company policy by having a

relationship with an employee left the future of the modem

initiative uncertain.

Intel had expected to start sending sample 5G modem chips to

customers in the second half of this year and put them into

production next year before dropping those plans on Tuesday.

Qualcomm, by contrast, is already working on its second-generation

5G modem.

--Tripp Mickle contributed to this article.

Write to Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

April 16, 2019 22:34 ET (02:34 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

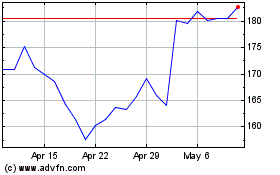

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

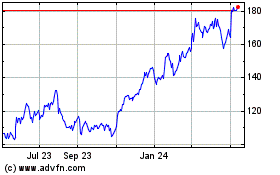

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024