By Chris Matthews and William Watts, MarketWatch

IBM earnings miss weighs on the Dow

U.S. stocks whipsawed between gains and losses in Wednesday

morning as investors continued to process new earnings releases,

while offering a muted reaction to data that showed China's

economic growth stabilized.

What are major indexes doing?

The Dow Jones Industrial Average fell 11 points, or less than

0.1%, to 26,442, while the S&P 500 index rose less than a point

to 2,907. The Nasdaq Composite index was up 15 points at 8,015, an

advance of 0.2%.

See:U.S. stock-market euphoria may be nearing a dangerous level,

says RBC strategist

(http://www.marketwatch.com/story/us-stock-market-euphoria-may-be-nearing-a-dangerous-level-says-rbc-strategist-2019-04-17)

The S&P 500 on Tuesday ended just 0.8% away from its

all-time closing high of 2,930.75 set on Sept. 20, while the Dow

and Nasdaq each stand around 1.4% away from their record closes set

last year.

What's driving the market?

Investors continue to wade through corporate results as the

earnings season moves into full swing, with an earnings miss from

International Business Machines Inc. (IBM) caused the stock to fall

2.3%, weighing heavily on the Dow.

Health care stocks were also burdening the market, led by

insurers Athem Inc. (ANTM), Cigna Corp. (CI) and Dow component

UnitedHealth Group Inc. (UNH), which was down 2.8% on the day after

falling 4% Tuesday. Analysts pointed to

(http://www.marketwatch.com/story/health-care-stocks-are-down-in-early-wednesday-trade-led-by-anthem-cigna-and-unitedhealth-2019-04-17)

the ongoing debate over health care reform, which has taken center

stage in the race for the Democratic nomination for president, and

which could significantly affect profits in the managed care and

health services sectors if reform legislation is ultimately

passed.

Chinese government data showed the country's economy grew at a

6.4% rate, year-over-year

(http://www.marketwatch.com/story/chinas-economy-grew-64-in-q1-beating-expectations-2019-04-16)

in the first quarter of 2019, maintaining the pace seen in the last

quarter of 2018 as factory output picked up steam. The figure was

slightly higher than many economists expected.

The data failed to provide much spark to European markets, but

analysts said signs of stability could soothe investor worries

about the world's second-largest economy. Stock-market gains since

the end of last year have been tied in part to expectations for

stimulus efforts by Chinese authorities and a potential deal to end

the U.S.-China trade battle that would limit the scope of the

country's slowdown and alleviate fears of a global economic

crunch.

What stocks are in focus?

Shares of Netflix Inc. (NFLX) have whipsawed between gains and

losses following the release of its first-quarter earnings, Tuesday

evening. The company announced a record number of subscribers

(http://www.marketwatch.com/story/netflix-reports-record-subscriber-gains-but-forecast-hurts-stock-2019-04-16),

but issued guidance for second quarter that some have interpreted

as disappointing. After rising as much as 2.4% at the start of

trade Wednesday, it fell 0.8%.

Read:Netflix is burning money and lacks a good business model,

this tech investor says

(http://www.marketwatch.com/story/netflix-is-burning-money-and-lacks-a-good-business-model-this-tech-investor-says-2019-04-16)

Shares of Qualcomm Inc.(QCOM) were up more than 12.9%, after

soaring more than 20% on Tuesday

(http://www.marketwatch.com/story/qualcomm-stock-surges-as-apple-agrees-to-settlement-2019-04-16)

after the chip maker and Apple Inc.(AAPL) settled patent litigation

against each other.

Opinion:Qualcomm gets big windfall in surprise settlement, but

Apple may have saved the iPhone from 5G doom

(http://www.marketwatch.com/story/qualcomm-gets-big-windfall-in-surprise-settlement-but-apple-may-have-saved-the-iphone-from-5g-doom-2019-04-16)

Following the settlement, chip maker Intel Corp.(INTC) said it

would get out of the business for 5G modem chips

(http://www.marketwatch.com/story/intel-drops-out-of-5g-modem-business-after-apple-qualcomm-settlement-2019-04-16)

in which it was trying to compete with Qualcomm. Intel shares were

up 4.8% Wednesday morning.

Shares of PepsiCo Inc.(PEP) were up 3%, after the beverage and

snack giant Wednesday morning reported first-quarter profit and

revenue that topped Wall Street expectations

(http://www.marketwatch.com/story/pepsicos-stock-surges-toward-record-high-after-profit-revenue-rise-above-expectations-2019-04-17).

Shares of Bank of New York Mellon Corp. (BK) fell 8.7%, after

the financial services company reported sharper declines

(http://www.marketwatch.com/story/bank-of-new-york-mellon-earnings-fall-short-2019-04-17)

in first-quarter sales and profits than Wall Street had

expected.

Morgan Stanley(MS) stock rose 2.6% Wednesday morning, after the

company reported first-quarter profit

(http://www.marketwatch.com/story/morgan-stanleys-stock-jumps-toward-7-month-high-after-profit-and-revenue-fall-less-than-expected-2019-04-17)

and revenue that fell less than expected.

Shares of United Continental Holdings Inc. (UAL) rose 2.6%,

following the airliner's release of earnings figures Tuesday

evening that beat analyst forecasts

(http://www.marketwatch.com/story/united-shares-rise-on-better-than-expected-fourth-quarter-earnings-2019-04-16).

What are the analysts saying?

"We're in the early days of earnings season, but it feels like

first-quarter earnings will be a bottom, and that's getting baked

into expectations," Kevin Divney, senior portfolio manager at

Russell Investments, told MarketWatch.

"The week after next is when we have the bulk of earnings, so

we're at a pause here" as investors don't yet have a broad enough

picture of management expectations for the remainder of the year,

he added.

"It's still much too small a sample size to generate

conclusions, but the bottom line is that earnings season is not off

to a very good start," wrote Tom Essaye, president of the Sevens

Report in a Wednesday morning research note. "While stocks are

looking past that courtesy of dovish Fed speak and hopes of better

global growth, earnings will need to get better during the next two

weeks--because so far the results, while not a disaster, aren't

that great."

What's on the economic calendar?

The U.S. trade deficit fell 3.4% in February to the lowest level

in eight months

(http://www.marketwatch.com/story/us-trade-deficit-shrinks-again-in-february-to-lowest-level-in-eight-months-2019-04-17),

the Commerce Department said Wednesday.. Meanwhile, wholesale

inventories

(http://www.marketwatch.com/story/us-wholesale-inventories-climb-02-in-february-2019-04-17)

in the U.S. rose a mild 0.2% in February, the government said

Wednesday. Sales increased 0.3% in the month. The ratio of

inventories to sales was flat at 1.35.

Philadelphia Fed President Patrick Harker will give a speech on

the economic outlook at 12:30 p.m., while St. Louis Fed President

James Bullard will give a speech at the Hyman Minksy Conference in

New York at 12:45 p.m. Bullard is a voter on the Fed's

interest-rate committee this year, while Harker is not.

At 2 p.m., the Federal Reserve will issue its Beige book, a

collection of anecdotal reports from the central bank's business

districts, reflecting a snapshot of U.S. economic conditions.

How are other markets trading?

Stocks in Asia closed mostly higher on Wednesday

(http://www.marketwatch.com/story/asian-markets-mixed-in-lackluster-trading-2019-04-15),

with China's Shanghai Composite Index and Japan's Nikkei 225 both

rising 0.3%. Hong Kong's Hang Seng Index, meanwhile, ended the day

flat.

In Europe, stocks were edging higher

(http://www.marketwatch.com/story/china-growth-sees-mixed-reaction-in-europe-markets-2019-04-17),

as the Stoxx Europe 600 rose 0.1%, while Germany's DAX and France's

CAC 40 were also up on the day.

In commodities markets, the price of crude oil was on the rise

(http://www.marketwatch.com/story/oil-snaps-back-as-preliminary-data-show-a-dip-in-us-supply-china-growth-surprises-2019-04-17),

while gold prices ticked lower

(http://www.marketwatch.com/story/gold-claws-up-from-lowest-point-of-the-year-but-move-limited-by-continued-stock-strength-2019-04-17)..

The U.S. dollar , meanwhile, edged lower

(http://www.marketwatch.com/story/us-dollar-edges-lower-after-stronger-than-expected-china-gdp-data-2019-04-17).

(END) Dow Jones Newswires

April 17, 2019 11:08 ET (15:08 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

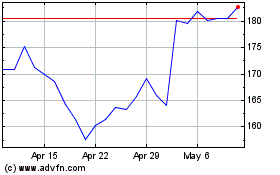

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

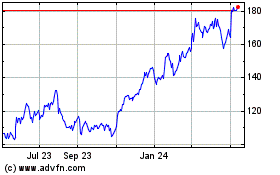

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024