PRESS

RELEASE

Clermont-Ferrand, France - April 24, 2019

COMPAGNIE GÉNÉRALE

DES ÉTABLISSEMENTS MICHELIN

Financial information for the three months ended

March 31, 2019

First-quarter 2019: In difficult markets, Michelin

announces sales of €5.8 billion, an increase of 9.3% at constant

exchange rates, led by a robust price-mix and a strong contribution

from newly acquired businesses.

2019 guidance confirmed

-

A resilient performance by the

Group in difficult markets, with volumes down by just 0.5% in the

first quarter:

-

Passenger car and Light truck

tires: market share maintained in an environment deeply impacted by

declining Original Equipment demand and slightly declining

replacement markets in Europe.

-

Truck tires: volume growth

remained firm in slightly contracting markets, as expected, partly

thanks to the development of new service offers and

solutions.

-

Specialty tires: 2019 growth

ambitions confirmed, despite a first quarter impacted by supply

chain issues in mining tires and the focus on margins in Original

Equipment for Off-Road businesses.

-

A robust 2.0% price-mix effect,

still led by disciplined price management, supported by the

powerful MICHELIN brand and the sustained product mix

enrichment.

-

A strong contribution from the

newly acquired businesses (Fenner and Camso) with their integration

proceeding according to plan.

-

Acquisition of Multistrada, a

major Indonesian tire manufacturer.

-

A favorable currency effect

(2.0%).

Jean-Dominique

Senard, Chief Executive Officer, said: "In difficult markets, we

once again demonstrated the resilience afforded by our Group's

exposure to different economic sectors, allowing us to confirm our

2019 guidance. First-quarter sales also reflect the major

contribution of our recent acquisitions, Camso and

Fenner."

In 2019, the

Passenger Car and Light Truck tire markets are expected to be

mixed, with modest growth in the Replacement segment and a

contraction in the Original Equipment segment. The Truck tire

markets look set to contract slightly, while the Mining, Aircraft

and Two-Wheel tire markets should remain dynamic. Based on April

2019 exchange rates, the currency effect is expected to have a

relatively favorable impact on segment operating income. The impact

of raw materials costs is currently estimated at around a negative

€100 million, mainly affecting first-half results.

In this

environment, Michelin confirms its 2019 targets of volume growth in

line with global market trends, segment operating income exceeding

the 2018 figure at constant exchange rates and before the estimated

€150 million contribution from Camso and Fenner, and structural

free cash flow of more than €1.45 billion*.

* Of which €150 million from the

application of IFRS 16.

First-quarter

sales growth:

Sales

(in € millions) |

First Quarter

2019

|

First Quarter

2018(1)

restated |

% change |

First Quarter

2018

reported |

| SR1: Automotive & related distribution |

2,788 |

2,783 |

+0.2% |

2,772 |

| SR2: Road transportation & related

distribution |

1,550 |

1,472 |

+5.3% |

1,368 |

| SR3: Specialty businesses and related distribution |

1,471 |

963 |

52.8%(2) |

1,078 |

| Group Total |

5,809 |

5,218 |

+11.3% |

5,218 |

-

Following the acquisition of Camso and the

merger of Off-Road businesses, certain minor adjustments have been

made to the composition of the segments.

-

Including the 48.2% positive effect of changes

in the scope of consolidation (first-time consolidation of Camso

and Fenner)

Market

Review

First Quarter

2019/2018

(in number of

tires) |

Europe

including Russia & CIS* |

Europe

excluding Russia & CIS* |

North America |

Central

America |

South America |

Asia

(excluding India) |

Africa/ India/ Middle East |

Total |

Original equipment

Replacement |

-5%

-2% |

-5%

-1% |

-5%**

+5% |

+1% |

-6%

-5% |

-9%

+1% |

-12%

+1% |

-8%

+1% |

* Including Turkey

** Including Central America

The global Original Equipment and

Replacement Passenger Car and Light Truck tire market contracted by

2% in the first quarter of 2019, due to the 8% fall in Original

Equipment demand.

-

Original Equipment

-

In Europe, Original Equipment demand contracted

by 5% in the first quarter, continuing a downtrend that began in

the fourth quarter of 2018. Most of the decline was in Western

Europe, where German carmakers experienced a fall in exports.

-

In North America (including Central America),

demand was down 5% in the first quarter.

-

In Asia (excluding India), total demand fell by

9% during the quarter, due to a 15% drop in the Chinese market and

a modest decline in the region's other markets.

-

In South America, demand contracted by 6% at

end-March, due to the crisis in Argentina and the uncertain

economic environment in Brazil.

-

In Africa/India/Middle East, the market narrowed

by 12% in the first quarter.

-

Replacement

-

In Europe, the market declined by 2% in the

first quarter, due mainly to the crisis in Turkey, which led to a

13% fall in demand, and to a 10% drop in the German market. The

Replacement markets in Italy and Spain expanded slightly, while the

French and Nordic markets contracted by 3% and 4%, respectively.

Concerns about the future consequences of Brexit drove a 7%

increase in the United Kingdom market.

-

In North America, demand grew by 5% overall. The

United States market expanded by 5%, reflecting a sharp increase in

the non pool market (with imports rising ahead of the possible

introduction of new import duties), while the market in Canada

declined by 2% due to lower demand for winter tires.

-

In Asia (excluding India), the market rose by a

modest 1% in the first quarter. After declining in the third and

fourth quarters of 2018, the Chinese market returned to growth (up

2%) at end-March. The dip in the Japanese market (down 2%) was

partly offset by vibrant demand in South Korea (up 6%) and

Indonesia (up 2%).

-

In Central America, the market expanded by a

slight 1% in the first quarter, led by Mexico.

-

In South America, demand contracted by 5% during

the period, heavily impacted by the crisis in Argentina (down 23%)

and lower demand in Brazil (down 2%).

-

In Africa/India/Middle East, the market grew by

1% in the first quarter, with strong growth in the Indian market

(up 7%) offsetting declines in the rest of the region.

First-quarter

2019/2018

(in number of

tires) |

Europe

including Russia & CIS* |

Europe

excluding Russia & CIS* |

North America |

Central

America |

South America |

Asia

(excluding India) |

Africa/ India/ Middle East |

Total |

Original equipment

Replacement |

-1%

-5% |

-1%

-3% |

+12%

-7% |

-32%

-7% |

+27%

-0% |

+0%

+0% |

+9%

-0% |

+4%

-2% |

* Including Turkey

The number of new Truck tires sold

worldwide was stable in the first quarter of 2019, as continued

growth in Original Equipment demand (up 4%) offset lower

Replacement demand (down 2%).

-

Original Equipment

-

In Europe, Original Equipment demand dipped 1%.

The effects of the crisis in Turkey (down 11%) and falling markets

in Spain (down 22%) and the United Kingdom (down 29%) were partly

offset by growth in the French and Italian markets (up 4% and 7%

respectively) and vibrant demand in Poland (up 22%).

-

In North America, the market expanded by a

strong 12% on the back of 19% growth in 2018.

-

In Asia (excluding India), the market was stable

in the first quarter. In China, after dropping 18% in the second

half of 2018 against the backdrop of the trade war with the United

States, Original Equipment demand stabilized in the first quarter

(down 1%). Demand in the other countries of the region grew

strongly, with increases of 5% in Japan, 10% in Indonesia and 6% in

South Korea.

-

In South America, the market continued to

recover, growing 27% in the first quarter on the back of strong

demand in Brazil.

-

The Africa/India/Middle East market rose by 9%,

reflecting the 12% gain in Indian demand in a buoyant economic

environment.

-

Replacement

-

In Europe, the market contracted by 5% as a

result of weaker demand in Poland (down 10%) and Eastern Europe

(down 10%) and the crisis in Turkey (down 23%). The region's other

markets expanded by a slight 1% overall.

-

Demand in North America retreated by 7%,

primarily due to a drop in the non pool market. After significantly

increasing their Chinese tire imports in late 2018, ahead of the

possible introduction of new import duties, dealers focused on

reducing their inventories in the first quarter.

-

In Asia (excluding India), the Replacement

markets were stable in the first quarter. After falling by 10% in

the second half of 2018, the Chinese market was also stable during

the period, while demand in the other countries expanded by 1%

overall.

-

In Central America, the market narrowed by 7%

due to a 10% fall in Mexican demand.

-

In South America, the market was stable in the

first quarter, with growth in Brazil (up 2%) and Colombia (up 11%)

offsetting the effects of the Argentine crisis on local demand

(down 26%).

-

In Africa/India/Middle East, demand for new

tires held firm.

-

Specialty tires

-

Mining tires: the mining

tire market continued to enjoy robust growth in demand from

international and regional mining companies.

-

Off-road tires: in the

agricultural segment, the Original Equipment markets continued to

grow rapidly in North America; however, growth in Europe was held

back by weaker Turkish demand. Replacement demand rose slightly in

Europe but declined in North America, due to unfavorable weather

conditions and declining farming incomes. In Infrastructure, demand

continued to trend upwards in both the Original Equipment and

Replacement segments, except in Turkey.

-

Two-wheel tires: growth

slowed in the European and North American motorcycle tire markets,

as seasonal fluctuations became less pronounced. Demand in the

Commuting segment remained very strong in the new markets.

-

Aircraft tires: led by the

sustained increase in passenger traffic, the commercial aircraft

tire market continued to expand, with more pronounced gains in the

radial segment.

| (in € millions) |

First-quarter 2019 |

|

sales |

5,809 |

| Q1 2019

vs. Q1 2018 |

|

|

| Total

change |

+591 |

+11.3% |

| Of

which Volumes * |

-25 |

-0.5% |

|

Price-mix |

+104 |

+2.0% |

| Currency

effect |

+103 |

+2.0% |

| Changes

in scope of consolidation |

+409 |

+7.8% |

* In tonnes

Sales for the first quarter of

2019 totaled €5,809 million, an increase of 11.3% from the

year-earlier period that was attributable to the following

factors:

- A 0.5% or €25 million decrease

due to lower volumes, especially in the Passenger Car and Light

Truck tires market (2% negative effect).

- A 2.0% increase from the

favorable price-mix effect. Prices added 1.3%, reflecting the

Group's disciplined price management, and the mix effect added

another 0.7% as the up-market shift in the product mix

continued.

- A 2% increase from the

favorable currency effect, primarily stemming from US dollar/euro

rates.

- A strong 7.8% increase from

changes in the scope of consolidation, with the contributions of

recently acquired companies (Fenner and Camso) partially offsetting

the deconsolidation of TCi.

Sales stood at €2,788 million for

the first quarter of 2019, largely unchanged from the year-earlier

period.

In narrower markets hit by an 8%

drop in Original Equipment demand, the Group succeeded in limiting

the fall in volumes to 1.6% and consolidated its market share. The

price-mix effect was favorable, reflecting disciplined price

management, supported by the powerful MICHELIN brand, and the

continued up-market shift in the product mix. The effect of changes

in the scope of consolidation was negative, due to the

deconsolidation of TCi.

Sales

for the first quarter amounted to €1,550 million, up 5.3% year on

year.

In slightly cooler markets, the

Group continued to grow its sales, reporting an increase of 0.9%

thanks in part to the development of new service offers and

solutions. The robust price-mix effect reflected the segment's

selective approach, designed to create value.

First-quarter sales totaled €1,471

million, a gain of 53% over the same period of 2018 that was

primarily attributable to the contributions of newly acquired

businesses (Camso and Fenner).

Excluding these acquisitions, the

segment's underlying sales growth was 4.6%, with a robust price-mix

effect along with stable volumes and favorable currency effect.

-

Mining tires: sales continued to grow, thanks to

sustained volumes growth and despite some logistics problems, an

assertive pricing policy and unfavorable exchange rates.

-

Off-Road tires: sales were stable, with the

impact of lower volumes - notably due to the Original Equipment

business's focus on margins - offset by favorable price-mix and

currency effects.

-

Two-Wheel tires: sales contracted slightly

although volumes increased, especially in the Commuting segment.

The Group pursued the integration of Levorin, which reported

significantly higher volumes in a very competitive market.

-

Aircraft tires: sales continued to grow, led by

higher volumes, an effective pricing strategy and favorable

exchange rates.

-

MICHELIN Guide 2019 - France

published, featuring 632 starred restaurants, including 75 new

establishments gaining either one, two or three stars and an

unprecedented number of new star studded restaurants led by women.

(January 21, 2019)

-

The two latest additions to the

MICHELIN Pilot Sport family presented at the Geneva International

Motor Show, the MICHELIN Pilot Sport 4 SUV and MICHELIN Pilot Sport

Cup2 R developed in partnership with the most demanding carmakers.

(March 5, 2019)

-

Acquisition of an 88% stake in

tire manufacturer PT Multistrada Arah Sarana TBK, a leading player

in the fast-growing Indonesian market (March 8, 2019) and launch of

a public tender offer (April 16, 2019) for all or some of

the remaining shares.

-

Michelin named "Tire

Manufacturer of the Year" during the 2019 Tire Technology Expo in

Germany, in recognition of several achievements, notably the

Group's environmental initiatives, product innovation and its work

into worn tire performance. (March 8, 2019)

-

Alliance between Faurecia and

Michelin to create a future world leader in hydrogen fuel cell

systems. (March 11, 2019)

-

The new MICHELIN Anakee

Adventure motorcycle tire introduced in one of the most dynamic,

competitive and innovative markets. (March 21, 2019)

-

Changes to the Michelin

Executive Committee, to create a tight structure focused on

strategic choices. (March 25, 2019)

-

Investor Day held in Almeria

and €500 million share buyback program announced, to be implemented

between 2019 and 2023. (April 4, 2019).

A full

description of 2019 highlights

may be found on the Michelin website:

https://www.michelin.com/en

PRESENTATION AND

CONFERENCE CALL

The quarterly information for the

period ended March 31, 2019 will be reviewed during a conference

call in English later today (Wednesday, April 24, 2019) at

6:30 pm CET. Practical information concerning the call may be

found at http://www.michelin.com/eng.

You may follow the presentation

with slideshow synchronization at http://www.michelin.com/eng

If you have any questions, please

phone one of the following numbers:

· In

France

+33 (0)1 72 72 74 03 + pin code 33159787#

· In the

United Kingdom

+44 (0)207 194 3759 + pin code 33159787#

· In North

America

+1 (646) 722 49 16 + pin code 33159787#

· From

anywhere

else

+44 (0)207 194 3759 + pin code 33159787#

INVESTOR

CALENDAR

Thursday, July 25, 2019 after close

of trading

Thursday, October 24, 2019 after

close of trading

Investor Relations

Edouard de Peufeilhoux

+33 (0) 4 73 32 74 47

+33 (0) 6 89 71 93 73 (mobile)

edouard.de-peufeilhoux@michelin.com

Humbert de Feydeau

+33 (0) 4 73 32 68 39

+33 (0) 6 82 22 39 78 (mobile)

humbert.de-feydeau@michelin.com

|

Media Relations

Corinne Meutey

+33 (0) 1 78 76 45 27

+33 (0) 6 08 00 13 85 (mobile)

corinne.meutey@michelin.com

Individual Shareholders

Isabelle Maizaud-Aucouturier

+33 (0) 4 73 98 59 27

isabelle.maizaud-aucouturier@michelin.com

Clémence Rodriguez

+33 (0) 4 73 98 59 25

clemence.daturi-rodriguez@michelin.com

|

DISCLAIMER

This press release is not an offer to purchase or a

solicitation to recommend the purchase of Michelin shares. To

obtain more detailed information on Michelin, please consult the

documents filed in France with Autorité des marchés financiers,

which are also available from the Michelin website

https://www.michelin.com/en.

This press release may contain a

number of forward-looking statements. Although the Company believes

that these statements are based on reasonable assumptions as at the

time of publishing this document, they are by nature subject to

risks and contingencies liable to translate into a difference

between actual data and the forecasts made or inferred by these

statements.

20190424_PR_Michelin_Q1 Sales

2019

This

announcement is distributed by West Corporation on behalf of West

Corporation clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Michelin via Globenewswire

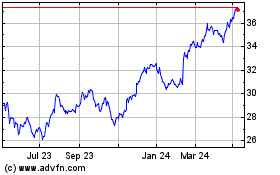

Michelin (EU:ML)

Historical Stock Chart

From Mar 2024 to Apr 2024

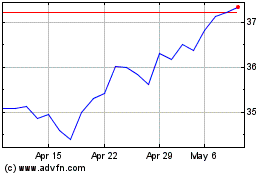

Michelin (EU:ML)

Historical Stock Chart

From Apr 2023 to Apr 2024