Royal Bank of Scotland Group PLC Directorate Change (0605X)

25 April 2019 - 4:01PM

UK Regulatory

TIDMRBS TIDMNATN

RNS Number : 0605X

Royal Bank of Scotland Group PLC

25 April 2019

The Royal Bank of Scotland Group plc

Director Change

RBS announces that Ross McEwan has resigned from his role as

Chief Executive Officer (CEO) and Executive Director.

Ross has a 12 month notice period and will remain in his

position until a successor has been appointed and an orderly

handover has taken place. The effective date of his departure will

be confirmed in due course.

Chairman Howard Davies said:

"For the past five and a half years Ross has worked tirelessly

to make the bank stronger and safer and played the central role in

delivering a return to profitability and dividend payments to

shareholders. The Board and I are grateful for the huge

contribution Ross has made in one of the toughest jobs in banking.

His successful execution of the strategy to refocus the bank back

on its core markets here in the UK and Ireland has helped to

deliver one of the biggest UK corporate turnarounds in history. RBS

is now well positioned to succeed in the future in what is a

rapidly evolving landscape for the banking sector. We will be

conducting an internal and external search for his successor, which

will start immediately."

CEO Ross McEwan added:

"After over five and a half very rewarding years, and with the

bank in a much stronger financial position it is time for me to

step down as CEO. It has been a privilege to lead this great bank

and to have worked with some really outstanding people in the

process. It is never easy to leave somewhere like RBS. However with

much of the restructuring done and the bank on a strong and

profitable footing, I have delivered the strategy that I set out in

2013 and now feels like the right time for me to step aside and for

a new CEO to lead the bank. I'd like to thank the Board,

shareholders and UKGI for the support they have shown me during my

time at the bank and our colleagues for the remarkable job in

turning this bank around".

Investor Relations

Alexander Holcroft

Head of Investor Relations

+44 (0) 207 672 1758

RBS Media Relations

+44 (0) 131 523 4205

Forward-looking statements

This document contains forward-looking statements within the

meaning of the United States Private Securities Litigation Reform

Act of 1995, including (but not limited to) those related to RBS

and its subsidiaries' regulatory capital position and requirements,

financial position, future pension funding and contribution

requirements, ongoing litigation and regulatory investigations,

profitability and financial performance (including financial

performance targets), structural reform and the implementation of

the UK ring-fencing regime, the implementation of RBS's

restructuring and transformation programme, impairment losses and

credit exposures under certain specified scenarios, increasing

competition from new incumbents and disruptive technologies and

RBS's exposure to political risks, operational risk, conduct risk,

cyber and IT risk and credit rating risk. In addition,

forward-looking statements may include, without limitation, the

words 'expect', 'estimate', 'project', 'anticipate', 'commit',

'believe', 'should', 'intend', 'plan', 'could', 'probability',

'risk', 'Value-at-Risk (VaR)', 'target', 'goal', 'objective',

'may', 'endeavour', 'outlook', 'optimistic', 'prospects' and

similar expressions or variations on these expressions. These

statements concern or may affect future matters, such as RBS's

future economic results, business plans and current strategies.

Forward-looking statements are subject to a number of risks and

uncertainties that might cause actual results and performance to

differ materially from any expected future results or performance

expressed or implied by the forward-looking statements. Factors

that could cause or contribute to differences in current

expectations include, but are not limited to, legislative,

political, fiscal and regulatory developments, accounting

standards, competitive conditions, technological developments,

interest and exchange rate fluctuations and general economic

conditions. These and other factors, risks and uncertainties that

may impact any forward-looking statement or RBS's actual results

are discussed in RBS's UK 2018 Annual Report and Accounts (ARA).

The forward-looking statements contained in this document speak

only as of the date of this document and RBS does not assume or

undertake any obligation or responsibility to update any of the

forward-looking statements contained in this document, whether as a

result of new information, future events or otherwise, except to

the extent legally required.

MAR - Inside Information

This announcement contains information that qualified or may

have qualified as inside information for the purposes of Article 7

of the Market Abuse Regulation (EU) 596/2014 (MAR). For the

purposes of MAR and Article 2 of Commission Implementing Regulation

(EU) 2016/1055, this announcement is made by Alexander Holcroft,

Head of Investor Relations for The Royal Bank of Scotland

Group.

Legal Entity Identifier

The Royal Bank of Scotland Group 2138005O9XJIJN4JPN90

plc

The Royal Bank of Scotland plc 549300WHU4EIHRP28H10

National Westminster Bank Plc 213800IBT39XQ9C4CP71

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

BOAGUGDSRUDBGCU

(END) Dow Jones Newswires

April 25, 2019 02:01 ET (06:01 GMT)

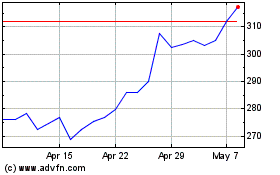

Natwest (LSE:NWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Natwest (LSE:NWG)

Historical Stock Chart

From Apr 2023 to Apr 2024