TIDMRBS

RNS Number : 1686X

Royal Bank of Scotland Group PLC

26 April 2019

The Royal Bank of Scotland Group plc

Q1 Interim Management Statement

RBS reported an operating profit before tax of GBP1,013 million,

compared with GBP1,213 million in Q1 2018 primarily reflecting

GBP265 million lower income, partially offset by GBP73 million

lower operating expenses.

-- Q1 2019 attributable profit of GBP707 million compared with GBP808

million in Q1 2018.

Supporting our customers:

-- We continue to support our customers through ongoing UK economic

uncertainty. UK Personal Banking (UK PB) gross new mortgage lending

was GBP7.6 billion in the quarter, with net loans to customers of

GBP150.6 billion at Q1 2019. Commercial Banking originated or refinanced

GBP4.6 billion of utilised term lending in the quarter and net loans

to customers were GBP100.8 billion.

-- Across UK PB, Ulster, Commercial and Private Banking net loans to

customers increased by 0.8% on an annualised basis.

Income stable in a competitive market:

-- Excluding notable items, NatWest Markets (NWM) and Central items,

income remained stable compared with Q1 2018.

-- Across the retail and commercial businesses, net interest margin

(NIM) of 2.07% was stable on Q4 2018. Group NIM decreased by 6 basis

points to 1.89% reflecting a reclassification of funding costs in

NWM and an IFRS 9 accounting change for interest in suspense recoveries.

Building a sustainable bank through continued transformation and

increased digitisation:

-- We remain on track to meet our GBP300 million cost reduction target

this year, achieving a GBP45 million reduction in the quarter.

-- We now have 6.6 million regular personal and business users of our

mobile app. In UK PB, 73% of our active current account customers

are regular digital users and total digital sales increased by 17%,

representing 47% of all sales in Q1 2019. In Commercial Banking,

we now have over 2,500 users of the Bankline Mobile app, up 19% compared

with Q4 2018.

Capital generation:

-- CET1 ratio of 16.2%, which excluding the impact of IFRS 16 'Leases'

and a 2p dividend accrual, represents an underlying increase of 30

basis points in the quarter.

-- RWAs increased by GBP2.1 billion compared with Q4 2018 principally

reflecting a GBP1.3 billion increase associated with IFRS 16 'Leases'.

Outlook(1)

While we retain the outlook guidance we provided in the 2018

Annual Results document, we recognise that the ongoing impact of

Brexit uncertainty on the economy, and associated delay in business

borrowing decisions, is likely to make income growth more

challenging in the near term.

Note:

(1) The targets, expectations and trends discussed in this

section represent management's current expectations and are subject

to change, including as a result of the factors described in the

"Risk Factors" section on pages 253 to 263 of the 2018 Annual

Report and Accounts. These statements constitute forward-looking

statements. Refer to Forward-looking statements in this

announcement.

Business performance summary

Quarter ended

=================================

31 March 31 December 31 March

Performance key metrics and ratios 2019 2018 2018

============================================= ========= =========== =========

Operating profit before tax GBP1,013m GBP572m GBP1,213m

Profit attributable to ordinary shareholders GBP707m GBP304m GBP808m

Net interest margin 1.89% 1.95% 2.04%

Net interest margin (excluding NWM) 2.07% 2.07% 2.14%

Average interest earning assets GBP436bn GBP442bn GBP427bn

Cost:income ratio (1) 63.4% 80.5% 60.5%

Earnings per share

- basic 5.9p 2.5p 6.8p

- basic fully diluted 5.8p 2.5p 6.7p

Return on tangible equity 8.3% 3.7% 9.4%

Average tangible equity GBP34bn GBP33bn GBP34bn

Average number of ordinary shares

outstanding during the period (millions)

- basic 12,047 12,040 11,956

- fully diluted (2) 12,087 12,081 12,015

============================================= ========= =========== =========

31 March 31 December 31 March

Balance sheet related key metrics and ratios 2019 2018 2018

================================================ ========== =========== ==========

Total assets GBP719.1bn GBP694.2bn GBP738.5bn

Funded assets GBP585.1bn GBP560.9bn GBP588.7bn

Loans to customers - amortised cost GBP306.4bn GBP305.1bn GBP303.8bn

Impairment provisions GBP3.1bn GBP3.3bn GBP4.2bn

Loan impairment rate (3) 11bps 2bps 10bps

Customer deposits GBP355.2bn GBP360.9bn GBP354.5bn

Liquidity coverage ratio (LCR) 153% 158% 151%

Liquidity portfolio GBP190bn GBP198bn GBP180bn

Net stable funding ratio (NSFR) (4) 137% 141% 137%

Loan:deposit ratio 86% 85% 86%

Total wholesale funding GBP77bn GBP74bn GBP73bn

Short-term wholesale funding GBP19bn GBP15bn GBP17bn

Common Equity Tier (CET1) ratio 16.2% 16.2% 16.4%

Total capital ratio 21.1% 21.8% 21.6%

Pro forma CET 1 ratio, pre dividend accrual (5) 16.3% 16.9%

Risk-weighted assets (RWAs) GBP190.8bn GBP188.7bn GBP202.7bn

CRR leverage ratio 5.2% 5.4% 5.4%

UK leverage ratio 6.0% 6.2% 6.2%

Tangible net asset value (TNAV) per ordinary

share 289p 287p 297p

Tangible net asset value (TNAV) per ordinary

share - fully diluted 288p 286p 295p

Tangible equity GBP34,962m GBP34,566m GBP35,644m

Number of ordinary shares in issue (millions) 12,090 12,049 11,993

Number of ordinary shares in issue (millions)

- fully diluted (2,6) 12,129 12,088 12,075

================================================ ========== =========== ==========

Notes:

(1) Operating lease depreciation included in income for Q1 2019

- GBP34 million; (Q4 2018 - GBP32 million; Q1 2018 - GBP31

million).

(2) Includes the effect of dilutive share options and

convertible securities. Dilutive shares on an average basis for Q1

2019 were 40 million shares; (Q4 2018 - 41 million shares, Q1 2018

- 59 million shares), and as at 31 March 2019 were 39 million

shares (31 December 2018 - 39 million shares; 31 March 2018 - 82

million shares).

(3) Loan impairment rate is calculated as the annualised

impairment charge for the period as a proportion of gross customer

loans.

(4) In November 2016, the European Commission published its

proposal for NSFR rules within the EU as part of its CRR2 package

of regulatory reforms. CRR2 NSFR is expected to become the

regulatory requirement in future within the EU and the UK. RBS has

changed its policy on the NSFR to align with its interpretation of

the CRR2 proposals with effect from 1 January 2018.

(5) The pro forma CET 1 ratio at 31 March 2019 excluded a charge

of GBP242 million (2p per share) for the Q1 2019 foreseeable

dividend. 31 December 2018 excluded a charge of GBP422 million

(3.5p per share) for the final dividend and GBP904 million (7.5p

per share) for the special dividend due to be paid following the

Annual General Meeting held on 25 April 2019.

(6) Includes 24 million treasury shares (31 December 2018 - 8

million shares; 31 March 2018 - 18 million shares).

Re-segmentation

Effective from 1 January 2019, Business Banking has been

transferred from UK Personal and Business Banking (UK PBB) to

Commercial Banking as the nature of the business, including

distribution channels, products and customers, are more closely

aligned to the Commercial Banking business. Concurrent with the

transfer, UK PBB has been renamed UK Personal Banking (UK PB) and

the previous franchise combining UK PBB (now UK PB) and Ulster Bank

RoI has been renamed Personal & Ulster. Comparatives have been

restated.

Summary consolidated income statement for the period ended 31 March

2019

Quarter ended

===============================

31 March 31 December 31 March

2019 2018 2018

GBPm GBPm GBPm

======================================================= ======== =========== ========

Net interest income 2,033 2,176 2,146

======================================================= ======== =========== ========

Own credit adjustments (43) 33 21

Other non-interest income 1,047 849 1,135

======================================================= ======== =========== ========

Non-interest income 1,004 882 1,156

======================================================= ======== =========== ========

Total income 3,037 3,058 3,302

======================================================= ======== =========== ========

Litigation and conduct costs (5) (92) (19)

Strategic costs (195) (355) (209)

Other expenses (1,738) (2,022) (1,783)

Operating expenses (1,938) (2,469) (2,011)

======================================================= ======== =========== ========

Profit before impairment losses 1,099 589 1,291

Impairment losses (86) (17) (78)

======================================================= ======== =========== ========

Operating profit before tax 1,013 572 1,213

Tax charge (216) (118) (313)

======================================================= ======== =========== ========

Profit for the period 797 454 900

======================================================= ======== =========== ========

Attributable to:

Ordinary shareholders 707 304 808

Other owners 100 164 85

Non-controlling interests (10) (14) 7

======================================================= ======== =========== ========

Notable items within total income

IFRS volatility in Central items & other (1) (4) (25) (128)

Insurance indemnity in Central items & other - 85 -

UK PB debt sale gain 2 35 26

FX gain/(losses) in Central items & other 20 (39) (15)

Commercial Banking fair value and disposal (loss)/gain (2) (10) 77

NatWest Markets legacy business disposal losses (4) (43) (16)

Note:

(1) IFRS volatility relates to loans which are economically

hedged but for which hedge accounting is not permitted under

IFRS.

Business performance summary

Personal & Ulster

UK Personal Banking

Quarter ended As at

=================================== ======================

31 March 31 December 31 March 31 March 31 December

2019 2018 2018 2019 2018

GBPm GBPm GBPm GBPbn GBPbn

===================== ========= ============= ========= ========================= ======== ============

Total income 1,245 1,246 1,298 Net loans to customers 150.6 148.9

Operating expenses (635) (757) (686) Customer deposits 145.7 145.3

Impairment losses (112) (142) (68) RWAs 35.8 34.3

Loan impairment

Operating profit 498 347 544 rate 30bps 38bps

Return on equity 24.7% 17.2% 29.9%

Net interest margin 2.62% 2.60% 2.73%

Cost:income ratio 51.0% 60.8% 52.9%

===================== ========= ============= ========= ========================= ======== ============

-- UK PB now has 6.1 million regular mobile app users, with 73% of our

active current account customers being regular digital users. Total

digital sales volumes increased by 17% representing 47% of all sales

in Q1 2019. 59% of personal unsecured loan sales were via the digital

channel, 4% higher than Q1 2018. 54% of current accounts opened in

Q1 2019 were via the digital channel, with digital volumes 44% higher.

-- Total income was GBP53 million, or 4.1%, lower than Q1 2018 impacted

by a GBP24 million reduction in debt sale gains, GBP8 million lower

annual insurance profit share and an IFRS 9 accounting change for

interest in suspense recoveries of GBP6 million. Excluding these

items, income was GBP15 million or 1.2% lower than Q1 2018 reflecting

a continued competitive mortgage market. Compared with Q4 2018, net

interest margin was 2 basis points higher due to the impact of an

annual review of mortgage customer behaviour in Q4 2018.

-- Excluding strategic, litigation and conduct costs, operating expenses

were GBP8 million, or 1.3%, lower compared with Q1 2018 as lower

operational costs associated with a 12% reduction in headcount were

largely offset by increased fraud, investment and technology transformation

costs.

-- Impairments were GBP44 million higher than Q1 2018 reflecting lower

provision releases and recoveries and an increase in the stage 1

and 2 charge, reflecting IFRS 9 predictive loss model adjustments

in Q1 2019, following a slight deterioration in default rates.

-- Compared with Q4 2018, net loans to customers increased by GBP1.7

billion as a result of strong gross new mortgage lending and lower

redemptions. Gross new mortgage lending in the quarter was GBP7.6

billion, with market flow share of approximately 13% and mortgage

approval share of around 12%.

-- RWAs increased by GBP1.5 billion compared with Q4 2018, primarily

reflecting an increase in central allocations linked to IFRS 16 changes

and predictive loss model adjustments in Q1 2019.

Ulster Bank RoI

Quarter ended As at

=================================== ======================

31 March 31 December 31 March 31 March 31 December

2019 2018 2018 2019 2018

EURm EURm EURm EURbn EURbn

========================= ========= ============= ========= ======================== ======== ============

Total income 166 165 165 Net loans to customers 21.1 21.0

Operating expenses (156) (184) (145) Customer deposits 20.3 20.1

Impairment

releases/(losses) 13 21 (9) RWAs 16.4 16.4

Loan impairment

Operating profit 23 2 11 rate (24)bps (38)bps

Return on equity 3.8% 0.4% 1.6%

Net interest margin 1.65% 1.73% 1.80%

Cost:income ratio 93.8% 111.6% 87.7%

========================= ========= ============= ========= ======================== ======== ============

-- Ulster Bank RoI continues to deliver digital enhancements that improve

and simplify the everyday banking experience for customers. The successful

launch of paperless processes for everyday banking products has made

it easier and quicker for customers to move from application to drawdown.

70% of active personal current account customers are choosing to

bank through digital channels. Mobile payments and transfers increased

31% compared with Q1 2018.

-- Total income remained stable compared with Q1 2018 as a decrease

in income associated with the non-performing loan portfolio was offset

by an EUR11 million one-off benefit following a restructure of interest

rate swaps on free funds. Compared with Q4 2018, net interest margin

was 8 basis points lower as a continued reduction in funding costs

was more than offset by a decrease in income associated with the

non-performing portfolio.

-- Excluding strategic, litigation and conduct costs, operating expenses

were EUR13 million, or 10.0%, higher than Q1 2018 reflecting the

continued focus on strengthening the risk, compliance and control

environment, investment in technology capabilities and expenditure

on recent mortgage marketing activity.

-- A net impairment release of EUR13 million in the quarter reflects

an improvement in the performance of the non-performing loan portfolio

and an IFRS 9 change in accounting treatment for the recovery of

interest in suspense.

-- Net loans to customers increased by EUR0.1 billion compared with

Q4 2018 primarily driven by growth in the commercial loan portfolio

in the quarter.

Business performance summary

Commercial & Private Banking

Commercial Banking

Quarter ended As at

=============================== =====================

31 March 31 December 31 March 31 March 31 December

2019 2018 2018 2019 2018

GBPm GBPm GBPm GBPbn GBPbn

==================== ======== =========== ======== ====================== ======== ===========

Total income 1,082 1,116 1,158 Net loans to customers 100.8 101.4

Operating expenses (640) (764) (595) Customer deposits 131.8 134.4

Impairment losses (5) (5) (12) RWAs 78.1 78.4

Loan impairment

Operating profit 437 347 551 rate 2bps 2bps

Return on equity 11.5% 8.3% 13.6%

Net interest margin 1.99% 1.96% 1.91%

Cost:income ratio 57.8% 67.5% 50.0%

==================== ======== =========== ======== ====================== ======== ===========

-- The Bankline mobile app was successfully launched in the Apple

app store in Q4 2018 and now has over 2,500 users, up 19% compared

with Q4 2018. The improved lending journey now provides a decision

in principle in under 24 hours for approximately 74% of loans,

compared with 50% in 2018.

-- Total income was GBP76 million, or 6.6%, lower than Q1 2018 reflecting

a GBP79 million reduction in fair value and disposal gains and

lower fee income, partially offset by higher deposit income.

Compared with Q4 2018, net interest margin increased by 3 basis

points to 1.99% due to lower liquidity portfolio costs and deposit

funding benefits, partially offset by lower volumes.

-- Excluding strategic, litigation and conduct costs, operating

expenses were GBP28 million, or 5.1% higher, primarily reflecting

an GBP11 million one-off item in Q1 2018, increased remediation

spend and higher innovation and technology costs.

-- Impairments were GBP7 million lower than Q1 2018 reflecting lower

single name charges.

-- Compared with Q4 2018, net loans to customers decreased by GBP0.6

billion, or 0.6%, to GBP100.8 billion. Commercial Banking originated

or refinanced GBP4.6 billion of utilised term lending in the

quarter.

-- Compared with Q4 2018, RWAs were GBP0.3 billion lower as a result

of the transfer of GBP1.0 billion to Central Items in relation

to the 2011 investment in the Business Growth Fund and GBP0.2

billion to NatWest Markets related to the transition of Western

European Corporate clients, partially offset by model changes

and the impact of IFRS 16 'Leases'.

Private Banking

Quarter ended As at

=============================== =====================

31 March 31 December 31 March 31 March 31 December

2019 2018 2018 2019 2018

GBPm GBPm GBPm GBPbn GBPbn

============================= ======== =========== ======== ====================== ======== ===========

Total income 193 198 184 Net loans to customers 14.4 14.3

Operating expenses (117) (143) (121) Customer deposits 26.9 28.4

Impairment releases/(losses) 4 8 (1) RWAs 9.6 9.4

Operating profit 80 63 62 AUM 27.8 26.4

Return on equity 17.1% 12.3% 12.5%

Net interest margin 2.52% 2.49% 2.51%

Cost:income ratio 60.6% 72.2% 65.8%

============================= ======== =========== ======== ====================== ======== ===========

Note:

(1) Private Banking manages assets under management portfolios

on behalf of UK Personal Banking and RBS International (Q4 2018 -

GBP6.6 billion and Q1 2019 - GBP6.8 billion). Prior to Q4 2018, the

assets under management portfolios from Personal and RBSI were not

included. Private Banking receives a management fee from UK

Personal Banking and clients of RBS International in respect of

providing this service.

-- Private Banking offers a service-led, digitally enabled experience

for its clients, with 73% banking digitally, and 94% of clients positively

rate the Coutts24 telephony service. Coutts Connect, the social platform

which allows clients to network and build working relationships with

one another, now has over 1,500 users with more than half of conversations

client to client.

-- Total income was GBP9 million, or 4.9%, higher than Q1 2018 reflecting

increased deposit income and higher lending balances. Compared with

Q4 2018, net interest margin increased by 3 basis points due to deposit

funding benefits and lower liquidity portfolio costs, partially offset

by ongoing asset margin pressure.

-- Excluding strategic, litigation and conduct costs, operating expenses

were GBP2 million, or 1.8%, lower primarily reflecting lower back

office operations costs.

-- Net loans to customers increased by GBP0.1 billion compared with Q4

2018, driven by mortgage lending.

-- Assets under management (AUM) increased by GBP1.4 billion compared

with Q4 2018 to GBP27.8 billion driven by new business inflows of

GBP0.1 billion and investment performance.

Business performance summary

RBS International

Quarter ended As at

================================== ======================

31 March 31 December 31 March 31 March 31 December

2019 2018 2018 2019 2018

GBPm GBPm GBPm GBPbn GBPbn

===================== ========= ============ ========= ======================== ========= ===========

Total income 151 155 137 Net loans to customers 13.3 13.3

Operating expenses (59) (86) (59) Customer deposits 27.6 27.5

Impairment releases 1 2 - RWAs 7.0 6.9

Operating profit 93 71 78

Return on equity 28.6% 20.0% 23.2%

Net interest margin 1.70% 1.81% 1.57%

Cost:income ratio 39.1% 55.5% 43.1%

===================== ========= ============ ========= ======================== ========= ===========

-- The RBS International mobile app now has 69,000 users, an increase

of 24% year on year. 90% of wholesale customer payments are now processed

using the newly introduced international banking platform, making

the payments process simpler for customers.

-- Total income was GBP14 million, or 10.2%, higher than Q1 2018 driven

by deposit margin benefits. Compared with Q4 2018, net interest margin

decreased by 11 basis points due to a one-off benefit in Q4 2018 and

ongoing higher funding costs associated with becoming a non ring-fenced

bank.

-- Excluding strategic, litigation and conduct costs, operating expenses

were GBP4 million, or 6.8%, lower reflecting decreased remediation

spend and lower back office operations costs.

-- Net loans to customers remained stable compared with Q4 2018. Customer

deposits increased by GBP0.1 billion compared with Q4 2018 primarily

due to customer activity in Institutional Banking.

-- In the quarter, RBS International continued to diversify its liquidity

portfolio, increasing the position in sovereign bonds with this portfolio

expected to modestly increase in scale over future quarters.

NatWest Markets(1)

Quarter ended As at

=============================== =====================

31 March 31 December 31 March 31 March 31 December

2019 2018 2018 2019 2018

GBPm GBPm GBPm GBPbn GBPbn

======================== ======== =========== ======== ============= ======== ===========

Total income 256 152 437 Funded assets 138.8 111.4

Operating expenses (334) (455) (349) RWAs 44.6 44.9

Impairment releases 16 100 9

Operating (loss)/profit (62) (203) 97

Return on equity (2.4%) (9.2%) 2.0%

Net interest margin

(2) (0.39%) 0.39% 0.54%

Cost:income ratio 130.5% 299.3% 79.9%

======================== ======== =========== ======== ============= ======== ===========

Notes:

(1) The NatWest Markets operating segment should not be assumed

to be the same as the NatWest Markets Plc legal entity or group.

NatWest Markets Plc entity includes the Central items & other

segment but excludes NatWest Markets N.V. for statutory reporting.

For the quarter ended 31 March 2019, NatWest Markets Plc's

(consolidated legal entity) results are estimated as: total income

of GBP276 million, operating expenses of GBP231 million, impairment

releases of GBP20 million, operating profit before tax of GBP65

million, funded assets(excluding intra-group assets) of GBP130.8

billion and total assets of GBP273.6 billion. The key difference

between the NWM segment and NWM legal entity operating profit for

the quarter ended 31 March 2019 largely relates to expense items,

including one-off recoveries, that form part of Central items and

other. The remaining difference relates primarily to NatWest

Markets N.V.

(2) From 1 January 2019, funding costs of the trading book have

been reclassified from trading income to net interest income.

-- NatWest Markets is increasingly using technology to enhance the

way it provides innovative financial solutions to customers.

For example, through our automated pricing tool FXmicropay we

make it simpler for businesses operating globally to accept payments

in multiple currencies. We have now made FXmicropay available

on an e-commerce web platform, SAP Commerce Cloud, helping online

businesses easily integrate the tool and capture foreign exchange

margins via their platform.

-- Total income was GBP181 million, or 41.4%, lower than Q1 2018

reflecting a GBP35 million reduction in the core business, an

GBP83 million decrease in legacy income and a GBP63 million deterioration

in own credit adjustments. Income in the core business fell by

8.5% to GBP377 million as customer activity fell in uncertain

market conditions. Legacy income reduced as funding costs associated

with former RBS plc debt are now reported wholly in NatWest Markets

rather than being partially allocated to other segments. The

larger part of this former RBS plc debt is due to mature by early

2020. Income from own credit adjustments deteriorated due to

a substantial reduction in funding spreads.

-- Excluding strategic, litigation and conduct costs, operating

expenses reduced by GBP10 million, or 3.1%, compared with Q1

2018 reflecting lower support costs.

-- RWAs decreased by GBP0.3 billion compared with Q4 2018 driven

by legacy reductions partially offset by a GBP0.2 billion transfer

of Western European Corporate clients from Commercial Banking.

Legacy RWAs are now GBP12.9 billion including Alawwal Bank RWAs

of GBP5.6 billion.

Central items & other

-- Central items not allocated represented a charge of GBP53 million

in the quarter, principally reflecting GBP61 million of strategic

costs.

Business performance summary

Capital and leverage ratios

End-point CRR basis

(1)

======================

31 March 31 December

2019 2018

Risk asset ratios % %

============================================ ========= ===========

CET1 16.2 16.2

Tier 1 18.3 18.4

Total 21.1 21.8

============================================ ========= ===========

Capital GBPm GBPm

============================================ ========= ===========

Tangible equity 34,962 34,566

============================================ ========= ===========

Expected loss less impairment provisions (682) (654)

Prudential valuation adjustment (448) (494)

Deferred tax assets (720) (740)

Own credit adjustments (311) (405)

Pension fund assets (389) (394)

Cash flow hedging reserve 49 191

Foreseeable ordinary dividends (1,568) (1,326)

Other deductions (4) (105)

============================================ ========= ===========

Total deductions (4,073) (3,927)

CET1 capital 30,889 30,639

AT1 capital 4,051 4,051

============================================ ========= ===========

Tier 1 capital 34,940 34,690

Tier 2 capital 5,242 6,483

============================================ ========= ===========

Total regulatory capital 40,182 41,173

============================================ ========= ===========

Risk-weighted assets

============================================ ========= ===========

Credit risk

- non-counterparty 139,300 137,900

- counterparty 14,700 13,600

Market risk 14,200 14,800

Operational risk 22,600 22,400

============================================ ========= ===========

Total RWAs 190,800 188,700

============================================ ========= ===========

Leverage

============================================ ========= ===========

Cash and balances at central banks 83,800 88,900

Trading assets 89,100 75,100

Derivatives 134,100 133,300

Loans 319,400 318,000

Other assets 92,700 78,900

============================================ ========= ===========

Total assets 719,100 694,200

Derivatives

- netting and variation margin (143,000) (141,300)

- potential future exposures 43,100 42,100

Securities financing transactions gross up 1,900 2,100

Undrawn commitments 48,900 50,300

Regulatory deductions and other adjustments (3,200) (2,900)

============================================ ========= ===========

CRR leverage exposure 666,800 644,500

============================================ ========= ===========

CRR leverage ratio % 5.2 5.4

============================================ ========= ===========

UK leverage exposure (2) 586,700 559,500

============================================ ========= ===========

UK leverage ratio % (2) 6.0 6.2

============================================ ========= ===========

Notes:

(1) Based on end-point CRR Tier 1 capital and leverage exposure under the CRR Delegated Act.

(2) Based on end-point CRR Tier 1 capital and UK leverage

exposures reflecting the post EU referendum measures announced by

the Bank of England in the third quarter of 2016.

Segment performance

Quarter ended 31 March 2019

==================================================================================

Personal & Ulster Commercial & Private Central

================== ====================

UK

Personal Ulster Commercial Private RBS NatWest items & Total

other

Banking Bank RoI Banking Banking International Markets (1) RBS

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

================================== ======== ======== ========== ======== ============= ======= ======= =======

Income statement

Net interest income 1,052 98 708 132 117 (31) (43) 2,033

Other non-interest income 193 47 374 61 34 329 9 1,047

Own credit adjustments - - - - - (42) (1) (43)

Total income 1,245 145 1,082 193 151 256 (35) 3,037

================================== ======== ======== ========== ======== ============= ======= ======= =======

Direct expenses - staff costs (158) (52) (190) (41) (28) (173) (294) (936)

- other costs (74) (26) (75) (18) (13) (48) (548) (802)

Indirect expenses (378) (47) (309) (51) (14) (89) 888 -

Strategic costs - direct - (5) (20) - (2) (18) (150) (195)

-

indirect (26) (5) (36) (7) (2) (13) 89 -

Litigation and conduct costs 1 (1) (10) - - 7 (2) (5)

Operating expenses (635) (136) (640) (117) (59) (334) (17) (1,938)

================================== ======== ======== ========== ======== ============= ======= ======= =======

Operating profit/(loss) before

impairment

(losses)/releases 610 9 442 76 92 (78) (52) 1,099

Impairment (losses)/releases (112) 11 (5) 4 1 16 (1) (86)

================================== ======== ======== ========== ======== ============= ======= ======= =======

Operating profit/(loss) 498 20 437 80 93 (62) (53) 1,013

================================== ======== ======== ========== ======== ============= ======= ======= =======

Additional information

Return on equity (2) 24.7% 3.8% 11.5% 17.1% 28.6% (2.4%) nm 8.3%

Cost:income ratio (3) 51.0% 93.8% 57.8% 60.6% 39.1% 130.5% nm 63.4%

Loan impairment rate (4) 30bps (23)bps 2bps nm nm nm nm 11bps

Impairment provisions (GBPbn) (1.2) (0.7) (1.0) - - (0.1) (0.1) (3.1)

Impairment provisions - stage 3

(GBPbn) (0.6) (0.6) (0.8) - - (0.1) - (2.1)

Net interest margin 2.62% 1.65% 1.99% 2.52% 1.70% (0.39%) nm 1.89%

Third party customer asset rate 3.31% 2.32% 3.22% 3.01% 1.72% nm nm nm

Third party customer funding rate (0.37%) (0.19%) (0.47%) (0.42%) (0.15%) nm nm nm

Average interest earning assets

(GBPbn) 162.9 24.1 144.6 21.2 27.8 32.1 23.1 435.8

Total assets (GBPbn) 172.2 24.8 165.4 21.7 28.9 272.8 33.3 719.1

Funded assets (GBPbn) 172.2 24.8 165.4 21.7 28.9 138.8 33.3 585.1

Net loans to customers - amortised

cost (GBPbn) 150.6 18.2 100.8 14.4 13.3 9.1 - 306.4

Customer deposits (GBPbn) 145.7 17.5 131.8 26.9 27.6 2.7 3.0 355.2

Risk-weighted assets (RWAs)

(GBPbn) 35.8 14.2 78.1 9.6 7.0 44.6 1.5 190.8

RWA equivalent (RWAes) (GBPbn) 36.8 14.2 79.9 9.6 7.1 49.1 2.0 198.7

Employee numbers (FTEs -

thousands) 21.6 3.1 10.3 1.9 1.7 5.0 23.3 66.9

================================== ======== ======== ========== ======== ============= ======= ======= =======

For the notes to this table, refer to page

10. nm

= not meaningful

Segment performance

Quarter ended 31 December 2018

==================================================================================

Personal & Ulster Commercial & Private Central

================== ====================

UK

Personal Ulster Commercial Private RBS NatWest items & Total

other

Banking Bank RoI Banking Banking International Markets (1) RBS

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

================================= ======== ======== ========== ======== ============= ======= ======= =======

Income statement

Net interest income 1,061 110 724 133 123 30 (5) 2,176

Other non-interest income 185 37 392 65 32 89 49 849

Own credit adjustments - - - - - 33 - 33

================================= ======== ======== ========== ======== ============= ======= ======= =======

Total income 1,246 147 1,116 198 155 152 44 3,058

================================= ======== ======== ========== ======== ============= ======= ======= =======

Direct expenses - staff costs (166) (53) (185) (39) (25) (128) (263) (859)

- other costs (80) (27) (77) (22) (22) (65) (870) (1,163)

Indirect expenses (414) (52) (403) (72) (35) (123) 1,099 -

Strategic costs - direct (27) (3) (5) - (1) (89) (230) (355)

-

indirect (63) (12) (57) (10) (2) (22) 166 -

Litigation and conduct costs (7) (17) (37) - (1) (28) (2) (92)

Operating expenses (757) (164) (764) (143) (86) (455) (100) (2,469)

================================= ======== ======== ========== ======== ============= ======= ======= =======

Operating profit/(loss) before

impairment

(losses)/releases 489 (17) 352 55 69 (303) (56) 589

Impairment (losses)/releases (142) 19 (5) 8 2 100 1 (17)

================================= ======== ======== ========== ======== ============= ======= ======= =======

Operating profit/(loss) 347 2 347 63 71 (203) (55) 572

================================= ======== ======== ========== ======== ============= ======= ======= =======

Additional information

Return on equity (2) 17.2% 0.4% 8.3% 12.3% 20.0% (9.2%) nm 3.7%

Cost:income ratio (3) 60.8% 111.6% 67.5% 72.2% 55.5% 299.3% nm 80.5%

Loan impairment rate (4) 38bps (39)bps 2bps nm nm nm nm 2bps

Impairment provisions (GBPbn) (1.1) (0.8) (1.3) - - (0.1) - (3.3)

Impairment provisions - stage 3

(GBPbn) (0.6) (0.6) (1.0) - - (0.1) - (2.3)

Net interest margin 2.60% 1.73% 1.96% 2.49% 1.81% 0.39% nm 1.95%

Third party customer asset rate 3.33% 2.43% 3.19% 2.94% 1.73% nm nm nm

Third party customer funding rate (0.36%) (0.18%) (0.44%) (0.38%) (0.08%) nm nm nm

Average interest earning assets

(GBPbn) 161.7 25.2 146.7 21.2 26.9 30.4 30.0 442.1

Total assets (GBPbn) 171.0 25.2 166.4 22.0 28.4 244.5 36.7 694.2

Funded assets (GBPbn) 171.0 25.2 166.4 22.0 28.4 111.4 36.5 560.9

Net loans to customers -

amortised cost (GBPbn) 148.9 18.8 101.4 14.3 13.3 8.4 - 305.1

Customer deposits (GBPbn) 145.3 18.0 134.4 28.4 27.5 2.6 4.7 360.9

Risk-weighted assets (RWAs)

(GBPbn) 34.3 14.7 78.4 9.4 6.9 44.9 0.1 188.7

RWA equivalent (RWAes) (GBPbn) 35.5 14.7 79.7 9.5 6.9 50.0 0.2 196.5

Employee numbers (FTEs -

thousands) 21.7 3.1 10.3 1.9 1.7 4.8 23.6 67.1

================================= ======== ======== ========== ======== ============= ======= ======= =======

For the notes to this table, refer to page

10. nm

= not meaningful

Segment performance

Quarter ended 31 March 2018

==================================================================================

Personal & Ulster Commercial & Private Central

================== ====================

UK

Personal Ulster Commercial Private RBS NatWest items & Total

other

Banking Bank RoI Banking Banking International Markets (1) RBS

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

================================= ======== ======== ========== ======== ============= ======= ======= =======

Income statement

Net interest income 1,068 106 683 123 104 36 26 2,146

Other non-interest income 230 40 475 61 33 380 (84) 1,135

Own credit adjustments - - - - - 21 - 21

================================= ======== ======== ========== ======== ============= ======= ======= =======

Total income 1,298 146 1,158 184 137 437 (58) 3,302

================================= ======== ======== ========== ======== ============= ======= ======= =======

Direct expenses - staff costs (178) (49) (188) (43) (24) (165) (317) (964)

-

other

costs (65) (19) (47) (14) (15) (53) (606) (819)

Indirect expenses (374) (47) (311) (55) (20) (102) 909 -

Strategic costs - direct (7) (1) (6) (1) - (17) (177) (209)

-

indirect (61) (3) (42) (8) (1) (6) 121 -

Litigation and conduct costs (1) (9) (1) - 1 (6) (3) (19)

================================= ======== ======== ========== ======== ============= ======= ======= =======

Operating expenses (686) (128) (595) (121) (59) (349) (73) (2,011)

================================= ======== ======== ========== ======== ============= ======= ======= =======

Operating profit/(loss) before

impairment (losses)/releases 612 18 563 63 78 88 (131) 1,291

Impairment (losses)/releases (68) (8) (12) (1) - 9 2 (78)

Operating profit/(loss) 544 10 551 62 78 97 (129) 1,213

================================= ======== ======== ========== ======== ============= ======= ======= =======

Additional information

Return on equity (2) 29.9% 1.6% 13.6% 12.5% 23.2% 2.0% nm 9.4%

Cost:income ratio (3) 52.9% 87.7% 50.0% 65.8% 43.1% 79.9% nm 60.5%

Loan impairment rate (4) 18bps 16bps 5bps nm nm nm nm 10bps

Impairment provisions (GBPbn) (1.3) (1.2) (1.5) (0.1) - (0.2) 0.1 (4.2)

Impairment provisions - stage 3

(GBPbn) (0.8) (1.0) (1.4) - - (0.1) - (3.3)

Net interest margin 2.73% 1.80% 1.91% 2.51% 1.57% 0.54% nm 2.04%

Third party customer asset rate 3.41% 2.39% 2.90% 2.89% 2.57% nm nm nm

Third party customer funding rate (0.29%) (0.21%) (0.26%) (0.19%) (0.07%) nm nm nm

Average interest earning assets

(GBPbn) 158.4 23.9 144.8 19.8 26.9 27.3 26.3 427.4

Total assets (GBPbn) 166.3 23.4 165.6 20.4 28.0 283.8 51.0 738.5

Funded assets (GBPbn) 166.3 23.3 165.5 20.4 28.0 135.2 50.0 588.7

Net loans to customers -

amortised cost (GBPbn) 145.9 19.0 102.9 13.7 13.1 9.4 (0.2) 303.8

Customer deposits (GBPbn) 142.9 16.4 131.1 25.3 26.9 3.8 8.1 354.5

Risk-weighted assets (RWAs)

(GBPbn) 31.5 16.9 84.3 9.4 7.0 53.1 0.5 202.7

RWA equivalent (RWAes) (GBPbn) 32.2 17.4 88.9 9.4 7.0 56.5 0.9 212.3

Employee numbers (FTEs -

thousands) 24.5 3.0 10.7 1.9 1.7 5.7 23.4 70.9

================================= ======== ======== ========== ======== ============= ======= ======= =======

nm = not meaningful

Notes:

(1) Central items include unallocated transactions which

principally comprise volatile items under IFRS and RMBS related

charges.

(2) RBS's CET 1 target is around 14% but for the purposes of

computing segmental return on equity (ROE), to better reflect the

differential drivers of capital usage, segmental operating profit

after tax and adjusted for preference dividends is divided by

notional equity allocated at different rates of 15% (Ulster Bank

RoI, 14% prior to Q1 2019), 12% (Commercial Banking), 13% (Private

Banking, 13.5% prior to Q1 2019), 16% (RBS International - 12%

prior to Q4 2017)) and 15% for all other segments, of the monthly

average of segmental risk-weighted assets incorporating the effect

of capital deductions (RWAes). RBS return on equity is calculated

using profit for the period attributable to ordinary

shareholders.

(3) Operating lease depreciation included in income (Q1 2019 -

GBP34 million; Q4 2018 - GBP32 million; Q1 2018 - GBP31

million).

(4) Loan impairment rate is calculated as the annualised charge

for the period as a proportion of gross customer loans.

Condensed consolidated income statement for the period ended 31

March 2019 (unaudited)

Quarter ended

===============================

31 March 31 December 31 March

2019 2018 2018

GBPm GBPm GBPm

-------------------------------------------- -------- ----------- --------

Interest receivable 2,747 2,825 2,702

Interest payable (714) (649) (556)

============================================ ======== =========== ========

Net interest income (1) 2,033 2,176 2,146

============================================ ======== =========== ========

Fees and commissions receivable 905 785 813

Fees and commissions payable (244) (190) (207)

Income from trading activities 224 161 465

Other operating income 119 126 85

============================================ ======== =========== ========

Non-interest income 1,004 882 1,156

============================================ ======== =========== ========

Total income 3,037 3,058 3,302

============================================ ======== =========== ========

Staff costs (1,011) (1,014) (1,055)

Premises and equipment (265) (411) (370)

Other administrative expenses (418) (851) (399)

Depreciation and amortisation (244) (187) (163)

Write down of other intangible assets - (6) (24)

============================================ ======== =========== ========

Operating expenses (1,938) (2,469) (2,011)

============================================ ======== =========== ========

Profit before impairment losses 1,099 589 1,291

Impairment losses (86) (17) (78)

============================================ ======== =========== ========

Operating profit before tax 1,013 572 1,213

Tax charge (216) (118) (313)

============================================ ======== =========== ========

Profit for the period 797 454 900

============================================ ======== =========== ========

Attributable to:

Ordinary shareholders 707 304 808

Other owners 100 164 85

Non-controlling interests (10) (14) 7

============================================ ======== =========== ========

Earnings per ordinary share 5.9p 2.5p 6.8p

Earnings per ordinary share - fully diluted 5.8p 2.5p 6.7p

============================================ ======== =========== ========

Note:

(1) Negative interest on loans is reported as interest payable.

Negative interest on customer deposits is reported as interest

receivable.

Condensed consolidated statement of comprehensive income for the

period ended 31 March 2019 (unaudited)

Quarter ended

===============================

31 March 31 December 31 March

2019 2018 2018

GBPm GBPm GBPm

=================================================== ======== =========== ========

Profit for the period 797 454 900

=================================================== ======== =========== ========

Items that do not qualify for reclassification

Remeasurement of retirement benefit schemes

- contributions in preparation for ring-fencing

(1) - (53) -

- other movements (42) 14 -

(Loss)/profit on fair value of credit in financial

liabilities designated at FVTPL due to

own credit risk (46) 91 61

Fair value through other comprehensive income

(FVOCI) financial assets 42 (13) -

Tax 32 15 (13)

=================================================== ======== =========== ========

(14) 54 48

=================================================== ======== =========== ========

Items that do qualify for reclassification

Fair value through other comprehensive income

(FVOCI) financial assets 41 (24) 131

Cash flow hedges 188 241 (584)

Currency translation (350) 190 (73)

Tax (40) (35) 126

=================================================== ======== =========== ========

(161) 372 (400)

=================================================== ======== =========== ========

Other comprehensive (loss)/income after tax (175) 426 (352)

=================================================== ======== =========== ========

Total comprehensive income for the period 622 880 548

=================================================== ======== =========== ========

Total comprehensive income/(loss) is attributable

to:

Ordinary shareholders 558 727 474

Preference shareholders 10 88 18

Paid-in equity holders 90 76 67

Non-controlling interests (36) (11) (11)

=================================================== ======== =========== ========

622 880 548

=================================================== ======== =========== ========

Note:

(1) On 17 April 2018 RBS agreed a Memorandum of Understanding (MoU)

with the Trustees of the RBS Group Pension Fund in connection

with the requirements of ring-fencing. NatWest Markets Plc could

not continue to be a participant in the Main section and separate

arrangements have been made for its employees. Under the MoU,

on 9 October 2018, NatWest Bank Plc made a contribution of GBP2

billion to strengthen funding of the Main section relating to

the ring-fenced bank. In Q1 2019 NatWest Markets Plc paid a contribution

of GBP53 million to the new NatWest Markets section relating

to the non-ring fenced bank.

Condensed consolidated balance sheet as at 31 March 2019

(unaudited)

31 March 31 December

2019 2018

GBPm GBPm

==================================== ======== ===========

Assets

Cash and balances at central banks 83,800 88,897

Trading assets 89,101 75,119

Derivatives 134,079 133,349

Settlement balances 13,556 2,928

Loans to banks - amortised costs 13,042 12,947

Loans to customers - amortised cost 306,400 305,089

Other financial assets 62,058 59,485

Intangible assets 6,616 6,616

Other assets 10,484 9,805

==================================== ======== ===========

Total assets 719,136 694,235

==================================== ======== ===========

Liabilities

Bank deposits 25,188 23,297

Customer deposits 355,186 360,914

Settlement balances 12,981 3,066

Trading liabilities 86,554 72,350

Derivatives 130,606 128,897

Other financial liabilities 42,404 39,732

Subordinated liabilities 9,651 10,535

Other liabilities 9,716 8,954

==================================== ======== ===========

Total liabilities 672,286 647,745

Equity

Ordinary shareholders' interests 41,578 41,182

Other owners' interests 4,554 4,554

==================================== ======== ===========

Owners' equity 46,132 45,736

Non-controlling interests 718 754

==================================== ======== ===========

Total equity 46,850 46,490

==================================== ======== ===========

Total liabilities and equity 719,136 694,235

==================================== ======== ===========

Condensed consolidated statement of changes in equity for the

period ended 31 March 2019 (unaudited)

Share

capital

and Total Non

statutory Paid-in Retained Other owners' controlling Total

reserves equity earnings reserves* equity interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

======================================= ========= ======= ======== ========= ======= =========== ========

At 1 January 2019 13,055 4,058 14,312 14,311 45,736 754 46,490

Implementation of IFRS 16 on

1 January 2019 (1) - - (187) - (187) - (187)

Profit attributable to ordinary

shareholders

and other equity owners - - 807 - 807 (10) 797

Other comprehensive income

- Remeasurement of retirement

benefit schemes

- other movements - - (42) - (42) - (42)

- Changes in fair value of

credit in financial liabilities

at

fair value through profit

or loss - - (46) - (46) - (46)

- Other amounts recognised

in equity - - - 28 28 (26) 2

- Amount transferred from

equity to earnings - - - (81) (81) - (81)

- Tax - - 18 (26) (8) - (8)

Preference share dividends

paid - - (100) - (100) - (100)

Shares and securities issued

during the period 100 - - - 100 - 100

Share-based payments - gross - - (35) - (35) - (35)

Movement in own shares held (40) - - - (40) - (40)

======================================= ========= ======= ======== ========= ======= =========== ========

At 31 March 2019 13,115 4,058 14,727 14,232 46,132 718 46,850

======================================= ========= ======= ======== ========= ======= =========== ========

31 March

2019

Total equity is attributable to: GBPm

======== ========= ======= =========== ========

Ordinary shareholders 41,578

Preference shareholders 496

Paid-in equity holders 4,058

Non-controlling interests 718

======================================= ========= ======= ======== ========= ======= =========== ========

46,850

========

*Other reserves consist of:

======= ======== ========= ======= =========== ========

Merger reserve 10,881

Fair value through other comprehensive

income reserve 436

Cash flow hedging reserve (49)

Foreign exchange reserve 2,964

======================================= ========= ======= ======== ========= ======= =========== ========

14,232

========

Note:

(1) Refer to Note 1 for further information.

Notes

1. Basis of preparation

The condensed consolidated financial statements should be read

in conjunction with RBS's 2018 Annual Report and Accounts which

were prepared in accordance with International Financial Reporting

Standards issued by the International Accounting Standards Board

(IASB) and interpretations issued by the IFRS Interpretations

Committee of the IASB as adopted by the European Union (EU)

(together IFRS).

Accounting policies

The Group's principal accounting policies are as set out on

pages 182 to 186 of the 2018 Annual Report and Accounts and are

unchanged other than as presented below.

Changes in reporting standards

IAS 12 'Income taxes' was revised with effect from 1 January

2019. The income statement is now required to include any tax

relief on the servicing cost of instruments classified as equity.

Relief of GBP67 million was recognised in the statement of changes

in equity for the year ended 31 December 2018; this and prior

periods have been restated.

Presentation of interest on suspense recoveries

Until 1 January 2019, interest on suspense recoveries was

presented as a component of interest receivable within Net interest

income. It amounted to GBP11 million for the period ended 31 March

2019. From 1 January 2019 interest on suspense recoveries is

presented within impairment charges; prior periods were presented

as income. It is unpredictable by nature but is not expected to be

material. Comparatives have not been restated.

Revised Accounting policy 10 - Leases

The Group has adopted IFRS 16 'Leases' with effect from 1

January 2019, replacing IAS 17 'Leases'. The Group has applied IFRS

16 on a modified retrospective basis without restating prior years.

Accounting policy note 10 presented in the 2018 Annual Report and

Accounts has been updated as follows:

As lessor

Finance lease contracts are those which transfer substantially

all the risks and rewards of ownership of an asset to a customer.

All other contracts with customers to lease assets are classified

as operating leases.

Loans to customers include finance lease receivables measured at

the net investment in the lease, comprising the minimum lease

payments and any unguaranteed residual value discounted at the

interest rate implicit in the lease. Interest receivable includes

finance lease income recognised at a constant periodic rate of

return before tax on the net investment. Unguaranteed residual

values are subject to regular review; if there is a reduction in

their value, income allocation is revised and any reduction in

respect of amounts accrued is recognised immediately.

Rental income from operating leases is recognised in other

operating income on a straight-line basis over the lease term

unless another systematic basis better represents the time pattern

of the asset's use. Operating lease assets are included within

Property, plant and equipment and depreciated over their useful

lives.

As lessee

On entering a new lease contract, the Group recognises a right

of use asset and a liability to pay future rentals. The liability

is measured at the present value of future lease payments

discounted at the applicable incremental borrowing rate. The right

of use asset is depreciated over the shorter of the term of the

lease and the useful economic life, subject to review for

impairment. Short term and low value leased assets are expensed on

a systematic basis.

Notes

1. Basis of preparation continued

For further details see page 186 of RBS's 2018 Annual Report and

Accounts. The impact on RBS's balance sheet at 1 January 2019 is as

follows:

GBPbn

======================================= =====

Retained earnings at 31 December 2018 14.3

Loans to customers - Finance leases 0.2

Other assets - Net right use of assets 1.3

--------------------------------------- -----

- Recognition of lease liabilities (1.9)

- Provision for onerous leases 0.2

======================================= -----

Other liabilities (1.7)

-----

Net impact on retained earnings (0.2)

======================================= =====

Retained earnings at 1 January 2019 14.1

=====

Operating lease commitments reported under IAS 17 were GBP2.7

billion which resulted in lease liabilities recognised under IFRS

16 of GBP1.9 billion. The difference is primarily because of the

different treatment of termination and extension options; and

discounting the contractual lease payments under IFRS 16.

Critical accounting policies and key sources of estimation

uncertainty

The judgements and assumptions that are considered to be the

most important to the portrayal of the Group's financial condition

are those relating to goodwill, provisions for liabilities,

deferred tax, loan impairment provisions and fair value of

financial instruments. These critical accounting policies and

judgements are described on page 186 of RBS's 2018 Annual Report

and Accounts.

Going concern

Having reviewed RBS's forecasts, projections and other relevant

evidence, the directors have a reasonable expectation that RBS will

continue in operational existence for the foreseeable future.

Accordingly, the results for the period ended 31 March 2019 have

been prepared on a going concern basis.

2. Provisions for liabilities and charges

Litigation

Payment Other and

protection customer other regulatory

insurance redress (incl. RMBS) Other (1) Total

GBPm GBPm GBPm GBPm GBPm

=============================== ========== ========= ================ ========= =====

At 1 January 2019 695 536 783 990 3,004

Implementation of IFRS 16 on 1

January 2019 - - - (170) (170)

IFRS 9 - Impairment charges -

Movements on ECL - - - (3) (3)

Transfer to accruals and other

liabilities - (4) - 1 (3)

Currency translation and other

movements - (7) (6) (16) (29)

Charge to income statement - 17 5 33 55

Releases to income statement - (12) (9) (16) (37)

Provisions utilised (136) (81) (6) (114) (337)

=============================== ========== ========= ================ ========= =====

At 31 March 2019 559 449 767 705 2,480

=============================== ========== ========= ================ ========= =====

Note:

(1) Materially comprises provisions relating to property closures and restructuring costs.

On 5 February 2019 the Official Receiver appointed Deloitte to

assist in the identification of potential claimants in respect of

PPI. The extent of the Group's share of any obligation in respect

of ensuing claims cannot be ascertained with sufficient reliability

for inclusion in the provision at 31 March 2019.

There are uncertainties as to the eventual cost of redress in

relation to certain of the provisions contained in the table above.

Assumptions relating to these are inherently uncertain and the

ultimate financial impact may be different from the amount

provided.

Notes

3. Litigation, investigations and reviews

RBS's 2018 Annual Report and Accounts, issued on 15 February

2019, included comprehensive disclosures about RBS's litigation,

investigations and reviews in Note 27 on the accounts. Set out

below are the material developments in these matters since the 2018

Annual Report and Accounts were published. RBS generally does not

disclose information about the establishment or existence of a

provision for a particular matter where disclosure of the

information can be expected to prejudice seriously RBS's position

in the matter.

Litigation

Government securities antitrust litigation

In March 2019, class action antitrust claims were filed in the

United States District Courts for the District of Connecticut and

the Southern District of New York against Bank of America and

NatWest Markets Plc, as well as NatWest Markets Securities Inc. and

(in the Connecticut case) NatWest Plc. The complaints allege a

conspiracy among dealers of Euro-denominated bonds issued by

European central banks (EGBs), to widen the bid-ask spreads they

quoted to customers, thereby increasing the prices customers paid

for the EGBs or decreasing the prices at which customers sold the

bonds. The class consists of those who purchased or sold EGBs in

the US between 2007 and 2012.

US Anti-Terrorism Act litigation

On 31 March 2019, the United States District Court for the

Eastern District of New York granted summary judgment in favour of

NatWest Plc in the Anti-Terrorism Act case relating to accounts

previously maintained for the Palestine Relief & Development

Fund, an organisation which plaintiffs allege solicited funds for

Hamas, the alleged perpetrator of the terrorist attacks in Israel

which harmed the plaintiffs. The plaintiffs have commenced an

appeal of the judgment to the United States Court of Appeals for

the Second Circuit.

On 28 March 2019, the United States District Court for the

Southern District of New York granted defendants' motion to dismiss

one of the Anti-Terrorism Act cases pending against NatWest Markets

N.V., NatWest Markets Plc, and other financial institutions,

relating to terrorist attacks in Iraq allegedly perpetrated by

Hezbollah and certain Iraqi terror cells. The dismissal is subject

to re-pleading by the plaintiffs or appeal. Similar Anti-Terrorism

Act claims against NatWest Markets N.V. remain subject to a pending

motion to dismiss in the United States District Court for the

Eastern District of New York.

Investigations and reviews

RMBS and other securitised products investigations

In October 2017, NatWest Markets Securities Inc. entered into a

non-prosecution agreement (NPA) with the United States Attorney for

the District of Connecticut (USAO) in connection with alleged

misrepresentations to counterparties relating to secondary trading

in various form of asset-backed securities. In the NPA, the USAO

agreed not to file criminal charges relating to certain conduct and

information described in the NPA if NatWest Markets Securities Inc.

complies with the NPA during its term. In April 2019, NatWest

Markets Securities Inc. agreed to a second six-month extension of

the NPA while the USAO reviews the circumstances of an unrelated

matter reported during the course of the NPA.

Response to reports concerning certain historic Russian and

Lithuanian transactions

Media coverage in March 2019 highlighted an alleged money

laundering scheme involving Russian and Lithuanian entities between

2006 and 2013. Allegedly certain European banks and at least one US

bank, were involved in processing certain transactions associated

with this scheme. The reports allege that ABN AMRO and Coutts were

amongst those institutions. RBS is investigating these reports, and

in particular whether the relevant business unit of ABN AMRO was

part of the business acquired by RBS in 2007. RBS is responding to

regulatory requests for information.

4. Post balance sheet events

Other than as disclosed there have been no other significant

events between 31 March 2019 and the date of approval of these

accounts which would require a change to or additional disclosure

in the accounts.

Additional information

Presentation of information

In this document, 'RBSG plc' or the 'parent company' refers to

The Royal Bank of Scotland Group plc, and 'RBS' or the 'Group'

refers to RBSG plc and its subsidiaries.

Financial information contained in this document does not

constitute statutory accounts within the meaning of section 434 of

the Companies Act 2006 ('the Act'). The statutory accounts for the

year ended 31 December 2017 have been filed with the Registrar of

Companies and those for the year ended 31 December 2018 will be

filed with the register of companies following the Annual General

Meeting. The report of the auditor on those statutory accounts was

unqualified, did not draw attention to any matters by way of

emphasis and did not contain a statement under section 498(2) or

(3) of the Act.

Key operating indicators

As described in Note 1 on page 15, RBS prepares its financial

statements in accordance with IFRS as issued by the IASB which

constitutes a body of generally accepted accounting principles

(GAAP). This document contains a number of adjusted or alternative

performance measures, also known as non-GAAP financial measures.

These measures exclude certain items which management believe are

not representative of the underlying performance of the business

and which distort period-on-period comparison. These measures

include:

-- Performance, funding and credit metrics such as 'return on

tangible equity', and related RWA equivalents incorporating the

effect of capital deductions (RWAes), total assets excluding

derivatives (funded assets), net interest margin (NIM) adjusted for

items designated at fair value through profit or loss

(non-statutory NIM), NIM excluding NatWest Markets, cost:income

ratio and loan:deposit ratio. These are internal metrics used to

measure business performance;

-- Personal & Ulster franchise results combining the

reportable segments of UK Personal Banking and Ulster Bank RoI and

the Commercial & Private Banking franchise results, combining

the reportable segments of Commercial Banking and Private

Banking.

-- The Group also presents a pro forma CET1 ratio which is on an

adjusted basis, this has not been prepared in accordance with

Regulation S-X and should be read in conjunction with the notes

provided as well as the section "Forward-looking statements"

below.

Q1 2019 segmental re-organisation

Effective from 1 January 2019, Business Banking has been

transferred from UK Personal and Business Bank (UK PBB) to

Commercial Banking as the nature of the business, including

distribution channels, products and customers, are more closely

aligned to the Commercial Business. Following the transfer, UK PBB

has been renamed UK Personal Banking (UK PB) and the previous

franchise combining UK PBB (now UK PB) and Ulster Bank RoI has been

renamed Personal & Ulster. Comparatives have been represented

in this document. Refer to the re-segmentation document published

on 16 April 2019 for further details.

Contacts

Analyst enquiries: Alexander Holcroft Investor Relations +44 (0) 2076721982

Media enquiries: RBS Press Office +44 (0) 131 523 4205

Analyst and investor call Webcast and dial in details

Date: Friday 26 April 2019 www.rbs.com/results

Time: 9am UK time International: +44 (0) 203 057 6566

Conference ID: 6858277 UK Free Call: 0800 279 5995

US Local Dial-In, New York: +1 646 741 2115

========================= ============================================

Available on www.rbs.com/results

-- Q1 2019 Interim Management Statement and background slides.

-- A financial supplement containing income statement, balance

sheet and segment performance for the nine quarters ended 31 March

2019.

-- Pillar 3 supplement at 31 March 2019.

-- Q1 2019 re-segmentation document.

-- GSIB template as of and for the year ended 31 December 2018.

Forward looking statements

This document contains forward-looking statements within the

meaning of the United States Private Securities Litigation Reform

Act of 1995, such as statements that include, without limitation,

the words 'expect', 'estimate', 'project', 'anticipate', 'commit',

'believe', 'should', 'intend', 'plan', 'could', 'probability',

'risk', 'Value-at-Risk (VaR)', 'target', 'goal', 'objective',

'may', 'endeavour', 'outlook', 'optimistic', 'prospects' and

similar expressions or variations on these expressions. These

statements concern or may affect future matters, such as RBSG's

future economic results, business plans and current strategies. In

particular, this document includes forward-looking statements

relating to RBSG in respect of, but not limited to: its regulatory

capital position and related requirements, its financial position,

profitability and financial performance (including financial,

capital and operational targets), its access to adequate sources of

liquidity and funding, increasing competition from new incumbents

and disruptive technologies, its impairment losses and credit

exposures under certain specified scenarios, substantial regulation

and oversight, ongoing legal, regulatory and governmental actions

and investigations, LIBOR, EURIBOR and other benchmark reform and

RBSG's exposure to economic and political risks (including with

respect to Brexit and climate change), operational risk, conduct

risk, cyber and IT risk and credit rating risk. Forward-looking

statements are subject to a number of risks and uncertainties that

might cause actual results and performance to differ materially

from any expected future results or performance expressed or

implied by the forward-looking statements. Factors that could cause

or contribute to differences in current expectations include, but

are not limited to, legislative, political, fiscal and regulatory

developments, accounting standards, competitive conditions,

technological developments, interest and exchange rate

fluctuations and general economic conditions. These and other

factors, risks and uncertainties that may impact any

forward-looking statement or RBSG's actual results are discussed in

RBSG's UK 2018 Annual Report and Accounts (ARA) and materials filed

with, or furnished to, the US Securities and Exchange Commission,

including, but not limited to, RBSG's most recent Annual Report on

Form 20-F and Reports on Form 6-K. The forward-looking statements

contained in this document speak only as of the date of this

document and RBSG does not assume or undertake any obligation or

responsibility to update any of the forward-looking statements

contained in this document, whether as a result of new information,

future events or otherwise, except to the extent legally

required.

Legal Entity Identifier: 2138005O9XJIJN4JPN90

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTEANLSALNNEFF

(END) Dow Jones Newswires

April 26, 2019 02:01 ET (06:01 GMT)

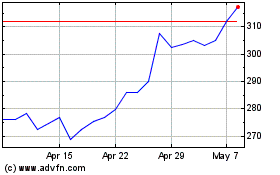

Natwest (LSE:NWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Natwest (LSE:NWG)

Historical Stock Chart

From Apr 2023 to Apr 2024