RBS 1Q Profit Beat Expectations; Brexit Weighs on Revenue Outlook

26 April 2019 - 4:53PM

Dow Jones News

By Adam Clark

Royal Bank of Scotland Group PLC (RBS.LN) beat market

expectations for its first-quarter profit but warned Brexit

uncertainty is likely to weigh on short-term revenue growth.

The U.K. bank said Friday that it made a quarterly pretax profit

of 1.01 billion pounds ($1.30 billion), down from GBP1.21 billion

in the year-earlier quarter. Net profit fell to GBP707 million from

GBP808 million.

RBS said the profit fall was largely due to lower income but the

results were ahead of market expectations. Analysts had forecast an

operating profit of GBP900 million and a net profit of GBP546

million, according to company-compiled consensus.

Revenue dropped to GBP3.04 billion from GBP3.30 billion, driven

by lower net interest income. RBS's net interest margin --the

difference between what it earns on lending and pays for funding--

declined to 1.89% from 1.95% in the preceding quarter.

"While we retain the outlook guidance we provided in the 2018

Annual Results document, we recognize that the ongoing impact of

Brexit uncertainty on the economy, and associated delay in business

borrowing decisions, is likely to make income growth more

challenging in the near term," RBS said.

The bank's Common Equity Tier 1 ratio--a key measure of

balance-sheet strength--remained stable at 16.2%.

Write to Adam Clark at adam.clark@dowjones.com

(END) Dow Jones Newswires

April 26, 2019 02:38 ET (06:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

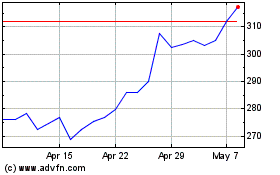

Natwest (LSE:NWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Natwest (LSE:NWG)

Historical Stock Chart

From Apr 2023 to Apr 2024