UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

May 1, 2019 (April 30, 2019)

|

JOHNSON CONTROLS INTERNATIONAL PLC

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ireland

|

|

001-13836

|

|

98-0390500

|

|

(State or Other Jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification Number)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One Albert Quay

|

|

|

|

Cork, Ireland

|

|

|

|

(Address of Principal Executive Offices)

|

|

|

|

|

|

|

|

Registrant's Telephone Number, including Area Code:

353-21-423-5000

|

|

|

|

|

|

|

|

Not Applicable

|

|

|

|

(Former name or former address, if changed since last report)

|

|

Securities Registered Pursuant to Section 12(b) of the Exchange Act:

|

|

|

|

|

|

|

Title of Each Class

|

Trading Symbol

|

Name of Each Exchange on Which Registered

|

|

Ordinary Shares, Par Value $0.01

|

JCI

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)

[ X ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

¨

|

|

|

|

|

|

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

¨

|

Item 2.01. Completion of Acquisition or Disposition of Assets.

On April 30, 2019, Johnson Controls International plc (the “

Company

”) completed the previously announced sale of its Power Solutions business (the “

Business

”) to BCP Acquisition LLC, a Delaware limited liability company (“

Purchaser

”), pursuant to the Stock and Asset Purchase Agreement, dated as of November 13, 2018, by and between the Company and Purchaser (as amended or supplemented from time to time, the “

Purchase Agreement

”), for an aggregate purchase price of U.S.$13,244,000,000, subject to certain adjustments as set forth in the Purchase Agreement.

The foregoing description of the Purchase Agreement, and the transactions contemplated thereby, including the sale of the Business, is included to provide you with information regarding its terms. It does not purport to be a complete description and is qualified in its entirety by reference to the full text of the Purchase Agreement, a copy of which was filed by the Company as Exhibit 2.1 to the Company’s Current Report on Form 8-K filed on November 13, 2018, the full text of which is incorporated herein by reference.

Item 2.02. Results of Operations and Financial Condition.

On May 1, 2019, the Company issued a press release containing information about the Company’s results of operations for the three and six months ended March 31, 2019. A copy of this press release is furnished as Exhibit 99.1 and incorporated by reference in this Item 2.02.

Item 8.01. Other Events.

Debt Tender Offers

On May 1, 2019, the Company issued a press release announcing the commencement of cash tender offers (each, a “

Debt Tender Offer

,” and collectively, the “

Debt Tender Offers

”) to purchase up to $1.5 billion in aggregate principal amount (as such amount may be increased by the Company pursuant to the terms of the Debt Tender Offers, the “

Aggregate Maximum Purchase Amount

”) of certain of its senior notes (the “

Notes

”). The Debt Tender Offers are each being made upon the terms and subject to the conditions set forth in the Offer to Purchase, dated May 1, 2019 (the “

Offer to Purchase

”). The Debt Tender Offers are not conditioned on any minimum amount of Notes being tendered or the consummation of the other Debt Tender Offers, or on the receipt of financing. The Company will fund the purchase of Notes in the Debt Tender Offers with a portion of the proceeds from the sale of the Business.

The Debt Tender Offers will expire at 11:59 p.m., New York City time, on May 29, 2019, unless extended or earlier terminated (such time and date, as the same may be extended with respect to one or more Debt Tender Offers, the “

Expiration Date

”). Holders of Notes must validly tender and not validly withdraw their Notes at or prior to 5:00 p.m., New York City time, on May 14, 2019 (such time and date, as the same may be extended with respect to one or more Debt Tender Offers, the “

Early Tender Deadline

”) in order to be eligible to receive the applicable Total Consideration (as set forth in the Offer to Purchase), which includes the Early Tender Premium (as set forth in the Offer to Purchase). Holders who validly tender their Notes after the Early Tender Deadline and at or prior to the Expiration Date will be eligible to receive only the applicable Tender Consideration (as set forth in the Offer to Purchase), which does not include the Early Tender Premium. Tendered Notes may be withdrawn at or prior to 5:00 p.m., New York City time, on May 14, 2019, by following the procedures described in the Offer to Purchase, but may not thereafter be validly withdrawn, except as provided for in the Offer to Purchase or required by applicable law.

A copy of the press release announcing the Debt Tender Offers is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

Intention to Commence an Equity Tender Offer

On May 1, 2019, the Company also announced its intention to commence a “modified Dutch auction” tender offer in the coming days (the “

Equity Tender Offer

”) under its share repurchase program. The Company also announced that it intends to launch a “modified Dutch auction” tender offer to purchase its ordinary shares for cash up to an aggregate purchase price of $4,000,000,000, at a per share purchase price not greater than $40.00 and not

less than $36.00 in the Equity Tender Offer. The Company will fund the purchase of shares in the Equity Tender Offer with a portion of the proceeds from the sale of the Business.

Neither this report nor the exhibits hereto is a recommendation to buy or sell any of the Company’s securities and shall not constitute an offer to purchase or the solicitation of an offer to sell any securities of the Company. The Debt Tender Offers are being made exclusively pursuant to the Offer to Purchase, which sets forth the terms and conditions of the Debt Tender Offers.

The Equity Tender Offer has not yet commenced, and there can be no assurances that the Company will commence the Equity Tender Offer on the terms described in this report or at all. On the commencement date of the Equity Tender Offer, the Company will file a tender offer statement on Schedule TO, including an offer to purchase, letter of transmittal and related materials, with the United States Securities and Exchange Commission (the “SEC”). The Equity Tender Offer will be made only pursuant to the offer to purchase, the related letter of transmittal and other related materials filed as part of the Schedule TO with the SEC upon commencement of the Equity Tender Offer. When available, shareholders should read carefully the offer to purchase, letter of transmittal and related materials because they will contain important information, including the various terms of, and conditions to, the Equity Tender Offer. Once the Equity Tender Offer is commenced, shareholders will be able to obtain a free copy of the tender offer statement on Schedule TO, the offer to purchase, letter of transmittal and other documents that the Company will be filing with the SEC at the SEC’s website at www.sec.gov or from the Company’s information agent in connection with the Equity Tender Offer.

Item 9.01. Financial Statements and Exhibits.

(b) Pro Forma Financial Information

The unaudited pro forma consolidated financial statements of the Company as of December 31, 2018, for the three months ended December 31, 2018, and for each of the years ended September 30, 2018, 2017 and 2016 and notes thereto are filed as Exhibit 99.3 hereto and are incorporated herein by reference.

(d) Exhibits.

|

|

|

|

99.1

|

Press release issued by Johnson Controls International plc, dated May 1, 2019, relating to the Company's results of operations.

|

|

|

|

|

99.2

|

Press release issued by Johnson Controls International plc, dated May 1, 2019, relating to the Debt Tender Offers.

|

|

|

|

|

99.3

|

Unaudited pro forma consolidated financial statements of Johnson Controls International plc.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

JOHNSON CONTROLS INTERNATIONAL PLC

|

|

|

|

|

|

|

|

|

|

May 1, 2019

|

|

By:

|

/s/ Michael R. Peterson

|

|

|

|

|

Name:

|

Michael R. Peterson

|

|

|

|

|

Title:

|

Vice President and Corporate Secretary

|

EXHIBIT INDEX

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

|

|

|

99.1

|

|

|

99.2

|

|

|

99.3

|

|

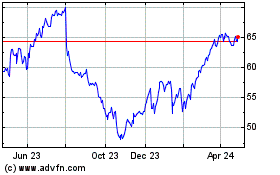

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

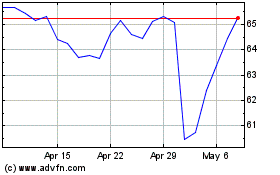

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024