By Suzanne Kapner and Aisha Al-Muslim

Macy's Inc. posted stronger-than-expected growth in a key sales

metric in the latest period as the retailer said it benefited from

more customers making purchases through digital channels.

Sales at stores open at least a year grew 0.6% for the period

ended May 4, above the FactSet estimate of a 0.6% decrease.

Including licensed departments, same-store sales rose 0.7%.

Overall, the Cincinnati-based company reported Wednesday that

net sales for the first quarter fell less than 1% to $5.5

billion.

"The consumer is still healthy," Macy's Chief Executive Jeff

Gennette said on a conference call. But he added that challenges

loom, including the U.S. trade war with China.

Mr. Gennette said the three tranches of tariffs enacted last

year had no meaningful impact on Macy's business. But the increase

last week to a 25% tariff on the third tranche of goods from 10%

will affect its furniture business. He added that the real concern

is whether the fourth tranche covering all Chinese imports goes

into effect.

In that event, it would be "hard to find a path where the

customer isn't impacted," Mr. Gennette said.

He said Macy's was working with suppliers to determine which

products could withstand a price increase and which couldn't. For

those that couldn't, discussions centered on who would absorb the

additional costs, Macy's or its vendors. For its private-label

brands that it sources directly, Macy's is working on moving

production out of China, Mr. Gennette said.

Macy's better-than-expected results bucked an overall trend in

which retail sales declined in April from a month earlier,

according to the Commerce Department. In a reversal of recent

trends, spending at department stores increased slightly, but

nonstore retailers, a category that includes e-commerce companies

such as Amazon.com Inc., posted a decline.

The company posted a profit of $136 million, or 44 cents a

share, down from $139 million, or 45 cents a share, a year earlier.

Excluding impairment and other costs, adjusted earnings were 44

cents a share, higher than the 33 cents a share that analysts

polled by FactSet were looking for.

Analysts were concerned about rising inventory levels, which

were up 2.4% on a comparable basis compared with a year ago. Mr.

Gennette said Macy's also had more goods in transit than it did a

year ago in case additional tariffs go into effect. The company

expects inventory levels to be down by year-end.

Like other retailers, Macy's is grappling with higher delivery

costs for online orders. One way it is looking to cover those costs

is by doing a better job of managing its markdowns, which eat into

profits. Rather than marking down goods by one of its six zones as

it currently does, it has been testing a program that marks down

goods locally, based on the inventory of a particular store.

If a store in Boston has 10 pairs of khaki pants left, but a

store in Houston only has one pair, the Boston store will mark down

those goods, while the Houston store might not. The new pricing

strategy affects markdowns only, not the original price or pricing

during promotional sales.

Macy's is also exploring options for its flagship store on

Manhattan's 34th Street, including building an office tower atop

the building. Mr. Gennette said in an interview that the company

was in talks with city officials about the project, which wouldn't

include downsizing the store.

"We'll continue to operate the full store and then build on

top," he said.

In April, Macy's said it would bring its Story concept shop to

36 stores in 15 states. Macy's acquired Story in May 2018, which at

the time had one store in New York City that rotated its

merchandise and store layout every four-to-eight weeks.

Mr. Gennette said on the conference call that Story was

performing well and helping to draw new customers into its stores.

But perhaps more important, it was helping Macy's shrug off its

reputation as a fusty department store, he said.

"This is breaking that paradigm and opening us to new

partnerships," Mr. Gennette said, adding that the company has been

getting calls from potential partners who normally wouldn't have

reached out in the past.

Macy's also affirmed its sales and earnings guidance for the

current fiscal year. The company expects net sales to be roughly

flat from the last fiscal year, with comparable sales to be flat to

up 1%. Excluding settlement charges, impairment and other costs,

the company forecasts adjusted earnings per share of $3.05 to

$3.25.

Its shares were mainly unchanged, trading around $21.81

Wednesday.

In February, Macy's signaled 2019 would be a challenging year,

predicting sales wouldn't grow and announcing another round of cost

cuts. The company said it would streamline senior management as

part of a plan to save $100 million a year, resulting in the

elimination of 100 jobs.

The retailer operates about 680 department stores under the

Macy's and Bloomingdale's names, and nearly 190 specialty stores

that include Bloomingdale's The Outlet, Bluemercury, Macy's

Backstage and Story.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com and Aisha

Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

May 15, 2019 13:00 ET (17:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

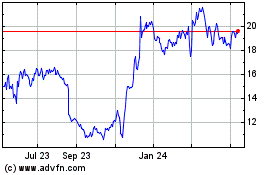

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

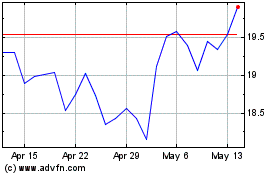

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024