Indexes to Unleash Flood of Money Into Chinese Stocks

16 May 2019 - 9:59PM

Dow Jones News

By Asjylyn Loder

Investors are about to buy billions of dollars in mainland

Chinese stocks even as trade tensions whipsaw markets.

Two of the largest global index providers, MSCI Inc. and FTSE

Russell, will soon begin ratcheting up exposure to companies listed

on China's domestic exchanges. The increases will force asset

managers to purchase shares of Chinese companies to match their

changing benchmark.

MSCI will begin raising the weight of mainland China stocks,

called "A shares," in several of its indexes later this month. It

is the first of three increases that will quadruple the weight of A

shares in the MSCI Emerging Markets Index to 3.3% by the end of the

year. The index is tracked by about $1.9 trillion in assets from

pensions, endowments, passive funds and other investors, meaning

about $50 billion in new money could be chasing China A shares from

that index alone. FTSE Russell will begin adding A shares to its

indexes next month.

As a result of the changes, investors in index mutual funds and

exchange-traded funds will soon have even more of their money

invested in China. The country is already the largest slice of both

FTSE Russell's and MSCI's emerging-markets indexes, accounting for

more than 30% of the portfolios. The exposure is being ramped up

even as the U.S. and China engage in a tit-for-tat trade battle

that has unsettled stock markets in both countries.

The expansion of index investing marks a new phase in China's

decadeslong effort to open up its markets to more foreign

investment. China earned a spot in the benchmarks after regulators

made progress at allaying concerns about market access and ease of

trading.

China A shares are yuan-denominated shares of Chinese companies

listed on mainland Chinese stock exchanges. The indexes already

included other types of Chinese shares, such as Hong Kong-listed

stocks and depositary receipts that trade in U.S. markets.

The A-shares market was opened up to investors beginning in

2003. But it was limited to qualified institutions and subject to

certain rules, including restrictions that made it hard to move

money out of China. These limitations were a concern for mutual

fund and ETF managers, who must be able to meet daily buy and sell

orders from shareholders.

"China has made a lot of concessions and developments in their

market that has made it more transparent and better regulated,"

said Luke Oliver, head of U.S. ETF capital markets for DWS Group,

the asset-management business of Deutsche Bank AG and the first to

offer an A-shares ETF.

But government intervention and limited transparency in China's

markets may limit any future expansion of A-shares investing. One

concern is caps on foreign ownership of Chinese companies, said

Joti Rana, FTSE Russell's head of governance and policy for the

Americas.

MSCI has also identified several problems that will have to be

addressed, said Chin Ping Chia, a Hong Kong-based managing director

of research with MSCI. The barriers include timing differences for

trade settlement, Hong Kong holidays that prevent overseas

investors from accessing mainland markets even when trading is

open, and the inability of non-Chinese investors to take advantage

of derivatives used to hedge their exposure, like stock-index

futures and options.

Critics say the increase of index investing in China leaves

investors increasingly vulnerable to price swings in a single,

volatile market, said Steven Schoenfeld, founder and chief

investment officer of BlueStar indexes, which focuses on Israeli

and other Middle Eastern markets. The benchmark Shanghai Composite

Index tumbled almost 25% in 2018, though it has rebounded this

year.

"When a single country is a third or more of the index, and the

top five countries are two-thirds of the index, you're giving up

the diversification benefit of a broad index, which is part of the

rationale of being in an index strategy in the first place," Mr.

Schoenfeld said.

To receive our Markets newsletter every morning in your inbox,

click here.

Vivian Salama contributed to this article.

Write to Asjylyn Loder at asjylyn.loder@wsj.com

(END) Dow Jones Newswires

May 16, 2019 07:44 ET (11:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

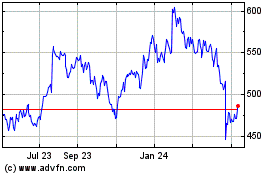

MSCI (NYSE:MSCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

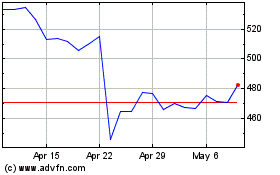

MSCI (NYSE:MSCI)

Historical Stock Chart

From Apr 2023 to Apr 2024