Nestlé Is Halfway to Cost-Savings Goal -- WSJ

25 May 2019 - 5:02PM

Dow Jones News

By Nina Trentmann

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 25, 2019).

Nestlé SA has achieved about half of the savings it hopes to

implement by 2020 in a cost-cutting effort focused on boosting

efficiency and centralizing procurement.

The Swiss consumer-goods giant is scrutinizing its manufacturing

footprint, consolidating procurement and simplifying its recipes to

cut billions in costs by next year, Chief Financial Officer

François-Xavier Roger told CFO Journal.

"My priority is to make sure that we deliver on our commitment

for 2020," Mr. Roger said.

Nestlé, which produces Kit Kat chocolate bars and Nescafé

coffee, plans to generate savings of 2.0 billion to 2.5 billion

Swiss Francs ($1.99 billion to $2.49 billion) as part of an

initiative that began in 2016.

About CHF1.2 billion in cuts have already been achieved.

"The focus to date has been on procurement and back-office

rationalization," said Martin Deboo, a consumer goods analyst at

Jefferies International Ltd. "We sense that Nestlé sees major

potential from manufacturing cost savings."

While the procurement operations have already generated 65% of

planned savings, manufacturing so far only has managed 35%, Mr.

Roger said.

Nestlé is currently closing one plant a month, the CFO said. It

also is repurposing some of its facilities, and transferring

manufacturing functions between plants.

The cost cuts have had a measurable effect on the company's

financial results, improving its margins, capital expenditures and

working capital, according to the CFO.

Capital expenditures as a percentage of sales fell to 4.2% last

year from 5.9% in 2012, according to a recent investor

presentation. Working capital, measured as a percentage of sales,

declined to 1.4% from 8.5% in 2012, according to the presentation.

Return on invested capital has increased to 12.1% from 10.8% in

2014, according to the presentation.

Changing consumer tastes are playing a role in the effort.

Nestlé anticipates growing demand for single-serve coffee, for

instance, but experiences less demand for congee, a rice porridge

consumed in China.

Last year, the company opened and closed plants, resulting in a

stable factory count of 413 at the end of 2018.

Mr. Roger declined to give a forecast for 2019, and he said the

company doesn't have a fixed target for job cuts.

Mr. Roger also sees potential for sourcing a larger share of the

company's procurement orders from one of three centers in Europe,

Central America and Asia. About 60% of what Nestlé buys is routed

through these procurement centers, he said.

Write to Nina Trentmann at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

May 25, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

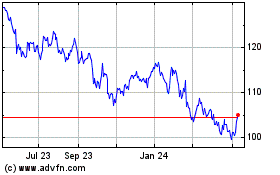

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

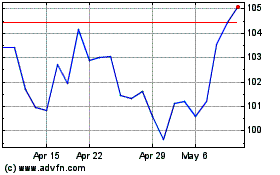

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024