Factory Orders Point to Slowdown -- WSJ

25 May 2019 - 5:02PM

Dow Jones News

By Paul Kiernan and Patrick McGroarty

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 25, 2019).

WASHINGTON -- The U.S. economic slowdown widely forecast for the

first quarter may be arriving in the second, driven by faltering

industrial activity.

Orders for so-called durable goods -- manufactured products

designed to last at least three years, such as cars, appliances and

commercial aircraft -- tumbled 2.1% from the prior month to a

seasonally adjusted $248.4 billion in April, the Commerce

Department said Friday. The government also said such orders grew

less than previously estimated in March, painting a weaker picture

of U.S. factory demand than anticipated.

Much of the decline owed to the volatile civilian-aircraft

component, which dropped 25% from March following a decision by

global aviation authorities to ground Boeing Co.'s 737 MAX airliner

after a pair of fatal crashes. The company didn't log any

commercial orders for 737 planes in March or April, the first

months without a sale of its best-selling aircraft in seven years.

Boeing in April cut production of the MAX by a fifth, likely

putting it behind Airbus SE this year as the world's biggest plane

maker.

But the aircraft sales were just one piece of a broader picture.

The new data follow others showing recent declines in factory

output and business activity broadly, suggesting the economy is

losing momentum after expanding at a robust 3.2% annual rate

clocked in the first quarter. Research firm Macroeconomic Advisers

lowered its estimate of second-quarter growth to a 1.7% pace from

1.9% in the wake of Friday's report.

Though manufacturing accounts for a small share of gross

domestic product, the sector is highly sensitive to shifts in

demand, making it a bellwether for the broader U.S. economy. Though

the U.S. job market remained strong in April -- with unemployment

falling to a five-decade low of 3.6% -- spending at U.S. retailers

fell, showing some consumer hesitation as the second quarter

began.

Many forecasters had projected economic growth to slow from last

year's pace, which was spurred by a strong labor market, tax cuts

and federal spending increases. They expected some of those effects

to wane, while the lagged impact of the Fed's four interest-rate

increases last year ripple through the economy. The U.S. trade

fight with China is also clouding the economic outlook.

"We've been expecting the economy to slow over the course of

this year for some time, mainly because of domestic factors," says

Andrew Hunter, senior U.S. economist at Capital Economics. "But I

think the downside risks have really increased over the past few

weeks with the escalation of trade tensions."

Boeing isn't the only big manufacturer seeing softer sales.

Harley-Davidson Inc. said on April 23 that U.S. retail sales of its

motorcycles fell 4% in the first quarter, extending a long decline

in its biggest market. And tractor maker Deere & Co. on May 17

said it would cut production by 20% this year to reflect lower

demand from farmers facing the steepest downturn for the

agricultural economy in decades.

The Federal Reserve said last week that industrial production --

the broadest measure of output from factories, mines and utilities

-- fell in three of the first four months of 2019. Factory

production alone is down over the period. A report Thursday showed

activity in U.S. manufacturing and service sectors falling to a

three-year low in May and noted an uptick in uncertainty weighing

on business confidence.

The durable goods report Friday showed a closely watched measure

of business investment -- new orders for nondefense capital goods

excluding aircraft -- slipped 0.9% last month and was revised lower

for March. That left the year-over-year gain in the category at

1.3%, the smallest since January 2017.

Many economists say the outlook for capital investment is

unlikely to improve in the near term given the Trump

administration's decision this month to increase tariffs on goods

imported from China. While the full impact remains unclear,

economists say the levies could disrupt complex business-supply

chains and drive up prices for at least some consumer goods.

"My suspicion is that businesses are holding off on key

investment decisions due to uncertainty surrounding the trade

negotiations," said Stephen Stanley, chief economist at Amherst

Pierpont Securities, in a note to clients. "Now that negotiations

have broken down, there is further reason why firms might be

inclined to sit on their hands for a while."

Corrections & Amplifications The U.S. unemployment rate fell

to a five-decade low of 3.6% in April. An earlier version of this

story incorrectly said it had declined to a half-decade low. (May

24)

Write to Paul Kiernan at paul.kiernan@wsj.com and Patrick

McGroarty at patrick.mcgroarty@wsj.com

(END) Dow Jones Newswires

May 25, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

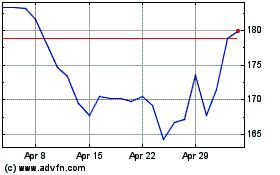

Boeing (NYSE:BA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boeing (NYSE:BA)

Historical Stock Chart

From Apr 2023 to Apr 2024