FedEx to Deliver Packages 7 Days a Week -- Update

31 May 2019 - 5:43AM

Dow Jones News

By Paul Ziobro

FedEx Corp. will deliver packages seven days a week starting

next year, adding an extra operating day to accommodate America's

online shopping habits.

The delivery giant also plans to bring to customers' doorsteps

many of the packages it currently drops at local post offices. The

shift will seek to lower costs by building density along FedEx

Ground routes, while also shifting some two million packages daily

out of the U.S. Postal Service's network.

The changes aim to serve an e-commerce shopping market where

consumer habits don't mesh with working schedules, because many

deliveries arrive at homes while shoppers are at work. It also adds

capacity to FedEx's network by using existing facilities an extra

day to handle what the company expects will be a doubling of small

package shipments in the U.S. by 2026.

"Online shopping is seven days a week," FedEx President and

Chief Operating Officer Raj Subramaniam said in an interview. "So

there is increasing demand from online shoppers and e-commerce

shippers for seven-day service."

FedEx and rival United Parcel Service Inc. have invested heavily

in recent years to manage the surge in e-commerce packages moving

through their sorting facilities and long-haul networks. Until

recently, the companies have taken steps to outsource the so-called

last-mile delivery to the Postal Service or others, worried that

home deliveries would be less profitable than shipments between

businesses. But as the volumes climb -- to an estimated 50 million

domestic packages a day -- the companies are adjusting their

operations to capture market share and handle weekend

deliveries.

At the same time, FedEx's traditional Express business of

rushing deliveries by jet across the country or globe has slowed.

Amazon.com Inc., Walmart Inc. and many other retailers have

expanded their warehouse networks, adding locations near more U.S.

cities where they can store goods and ship them shorter

distances.

Retailers are also building out their own local delivery efforts

or pushing shoppers to pick up web purchases at their stores.

Target Corp. acquired Shipt, a service that uses contractors to

bring orders from stores, and Amazon has been recruiting people to

start local firms that would carry packages the last mile from its

warehouses to homes.

"FedEx could have been on the cusp of just being ignored, not

having delivery options for Sundays," said Charles Dimov, vice

president of marketing at OrderDynamics Corp., which sells

order-management software.

FedEx plans to shift to seven-day-a-week operations in January

for a majority of the U.S. population, following the holiday

shopping season -- when it typically delivers packages every day to

handle the seasonal surge.

The added day wasn't made with any one retailer in mind, Mr.

Subramaniam said, as FedEx expects to deliver packages on Sundays

for everyone from smaller shippers to the largest retailers.

"E-commerce is much larger than any one company," he said.

The company didn't disclose the financial impact of its plan.

FedEx said it won't charge extra fees for Sunday delivery. It

currently provides Saturday delivery for no additional charge.

Mr. Subramaniam declined to say whether FedEx plans to add staff

to run Sunday operations. The company uses independent contractors

to handle Ground deliveries in the U.S.

FedEx this year shifted to six-day-a-week delivery operations

after the recent holiday season, an expansion that has added

significant costs. In March, the company cut its profit outlook for

the year, citing declining revenue in its Express unit and higher

costs in the Ground operations. It has switched CEOs at the Express

unit twice in the past year.

Rival UPS in recent years has shifted to six-day-a-week

delivery. During last year's contract bargaining with unionized

workers, UPS added lower-tier pay for delivery drivers to work on

weekends, although it doesn't currently deliver on Sundays.

UPS spokesman Glenn Zaccara said the company is "constantly

assessing when it makes sense to expand current capabilities and

operations."

The U.S. Postal Service, meanwhile, is considering expanding

package delivery to seven days a week. It currently delivers

packages on Sundays for Amazon year round and for other shippers

during the holidays.

A USPS spokesman declined to comment.

To build density along routes, FedEx will keep more of the FedEx

SmartPost packages it gives to the Postal Service. In recent years,

FedEx has used technology to keep such packages in its network if a

FedEx driver was headed to a nearby address.

Currently, about 20% of SmartPost packages are delivered by

FedEx instead of the Postal Service. By the end of 2020, FedEx

expects the vast majority of these packages to be integrated into

its network.

UPS, which has a similar service called SurePost, has been

redirecting packages from the Postal Service for about five years

to try to find the most cost-effective way to deliver packages. "We

are constantly optimizing based on the most efficient delivery

method," Mr. Zaccara said.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

May 30, 2019 15:28 ET (19:28 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

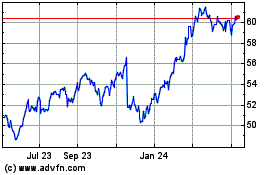

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

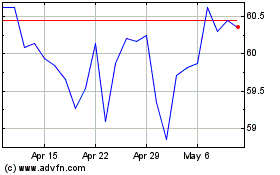

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024