Purchase of Array BioPharma for $10.64 billion shows strategic

focus on segment

By Jared S. Hopkins and Kimberly Chin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 18, 2019).

Pfizer Inc. agreed to buy Array BioPharma Inc. for $10.64

billion in cash, as one of the world's biggest pharmaceutical

companies seeks to expand its cancer lineup with targeted

therapies.

Monday's deal for Array, which garnered a 62% premium to its

closing price Friday, suggests just how important the market for

cancer drugs is for the world's biggest pharmaceutical

companies.

Pfizer has been trying to expand its offerings through a

combination of deals as well as by ramping up its own

drug-discovery efforts. The deal for Array includes two drugs in an

increasingly important segment of the market: for agents that

target genetic changes driving the cancers of certain patients.

Array's two drugs, Braftovi and Mektovi, are currently approved

to treat skin-cancer patients with certain genetic alterations. The

drugs could also play a role in treating some colon and rectal

cancer patients, if studies pan out.

Like a lot of big drugmakers, Pfizer has been trying to beef up

its portfolio of cancer drugs to tap into a market projected to

reach $237 billion in 2024 world-wide sales, up from $138 billion

this year, according to research firm EvaluatePharma.

Also appealing to the big companies is the ability to command

high prices and the opportunities to find new treatments furnished

by advances understanding the disease.

For Pfizer, the shift has meant moving away from the widely used

pills like cholesterol fighter Lipitor and male-impotence treatment

Viagra that the company had long been known for. Pfizer's 18 cancer

drugs include three less-expensive copies of biotech drugs known as

biosimilars.

Pfizer's cancer drugs are projected to generate $8.3 billion in

sales this year, according to EvaluatePharma.

Big company interest in cancer has driven many recent

acquisitions -- and high premiums. Last month, Merck & Co.

agreed to acquire Peloton Therapeutics Inc. for about $1 billion,

while Bristol-Myers Squibb Co. in January announced a $74 billion

deal for Celgene Corp.

Targeted cancer treatments are a special area of focus, fueling

takeouts like Eli Lilly & Co.'s roughly $8 billion deal for

Loxo Oncology. Lilly paid a 68% premium for Loxo and its drugs

based on tumors' genetic traits.

Braftovi and Mektovi, which are taken together, each carry a

monthly list price of approximately $11,000. In May, the

combination showed positive results in a late-stage study of

patients with advanced colon cancer.

Andy Schmeltz, who heads Pfizer's cancer business, expressed

hope that the two drugs would play a major role in improving

treatment for colon cancer, a leading cause of cancer-related

deaths in the U.S.

An estimated 145,600 patients in the U.S. will be diagnosed with

cancer of the colon and rectum this year, according to the American

Cancer Society, and more than 51,000 people are expected to die

from the diseases.

Analysts expect Array's annual product sales will reach $1

billion by 2023, according to FactSet. The company also has several

drugs in clinical development that are being tested in

patients.

Targeted cancer drugs like those from Array are among those that

Pfizer has prioritized in recent years, especially as the company

looks forward to the increasing use of the therapies in combination

with other cancer treatments.

"The future of cancer medicines are combinations," Chris

Boshoff, who leads Pfizer's cancer drug development, said in an

interview. "A big part of that will be targeted cancer

medicines."

Boulder, Colo.-based Array was founded in 1998 by three former

scientists at Amgen Inc. -- Kevin Koch, Anthony Piscopio and David

Snitman -- as well as chemistry professor K.C. Nicolaou, now at

Rice University in Houston.

Pfizer Chief Financial Officer Frank D'Amelio told analysts on a

conference call the company will continue to search for small and

midsize deals, and isn't dependent on larger acquisitions for

growth.

Under the terms, Pfizer said it would pay Array shareholders $48

for each of its shares outstanding, a 62% premium to the closing

price Friday. Pfizer said it would fund the transaction with debt

and existing cash, and expects it to close by year's end.

Shares of Array climbed 57% to $46.50 in early afternoon trading

Monday, while Pfizer slipped 5 cents to $42.71.

Pfizer said it expects the transaction to hit adjusted per-share

earnings by 4 cents to 5 cents in 2019 and 4 cents to 5 cents in

2020. Pfizer expects the deal to add to earnings at the beginning

of 2022.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

June 18, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

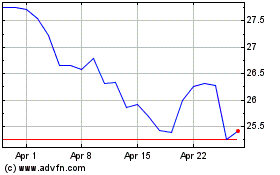

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024