By Alexandra Bruell

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 18, 2019).

Accenture LLC's acquisition of hot creative agency Droga5

earlier this year was just the latest and most dramatic salvo in

consulting firms' steady encroachment into marketing services.

Accenture, Deloitte LLP and PricewaterhouseCoopers LLP for years

have been investing in marketing services, acquiring ad agencies

and hiring executives in droves in a bid to add some of the $70

billion-plus advertising-agency business to their established

professional-services revenue.

These investments come as marketers are under pressure to

modernize their operations and rethink the way they interact with

today's consumers, a task that requires business and strategy

support that goes beyond traditional advertising.

"We believe the marketers' agenda has been evolving to focusing

on creating superior experiences," says Tom Puthiyamadam, digital

services leader at PwC. "That's the business we built and continue

to invest in."

The pitch is resonating with some marketers.

Deloitte, Accenture and PwC have all seen exponential growth in

the groups that house their marketing services. At Accenture

Interactive, revenue has ballooned to $8.5 billion in 2018 from

$1.9 billion in 2014, according to the company, which has acquired

a number of creative shops, including Fjord and Karmarama as well

as Droga5.

PwC Digital, meanwhile, says its revenue has jumped to $5.4

billion in 2018 from $737 million in 2014, in part from

acquisitions including Pond, Outbox Group and BGT Partners.

And Deloitte Digital had $16 billion in revenue in 2018, up from

$6 billion in 2014.

Revenue in these groups is not necessarily comparable to revenue

at a traditional ad-agency holding company, because the business

units also include products and services that aren't tied directly

to traditional marketing.

To get a better idea how marketers are using the new services

offered by consulting firms, consider the experience of Aspen

Dental Management Inc. In 2017, before it switched to a new agency,

the company ran an ad in which a dentist foils a bank robbery but

provokes even greater financial fear in the teller and bank

customers. The dentist wins everyone over only when he says Aspen

Dental offers low prices.

The ad, created by storied creative agency Crispin Porter &

Bogusky LLC, was meant to help Aspen Dental's hundreds of offices

recruit new dentists and attract new patients as it continues to

expand across the U.S.

But Aspen Dental's new marketing chief, William Setliff, wasn't

pleased with the ad or the results. Using humor to paint a picture

of an industry that gouges patients was "tone deaf," Mr. Setliff

says.

Crispin, which resigned the business in early 2018, declines to

comment.

Deloitte's core consulting group did an analysis that showed

patients would respond well to empathy, and a team from

Deloitte-owned Heat joined the effort to create a more emotive

campaign featuring patient testimonials.

The pitch resonated at Aspen Dental. "We needed to modernize our

approach to marketing," says Mr. Setliff. "We needed a broader view

to make decisions, from advertising to store design."

The company has seen a significant boost in new patient

appointments and a 16% increase in revenue this year up to early

June, compared with the same period last year.

The new structure with Deloitte is 5% to 8% more expensive for

Aspen Dental than working with an agency and consulting firm

separately, says Mr. Setliff. But it's worth it, he says.

Scenes like this are playing out across marketing. Accenture

Interactive has handled marketing work for clients such as Subway

and Carnival Corp., while PwC Digital has designed a new

application to crowdsource donations for the Make-A-Wish

Foundation.

The picture emerging strongly suggests that consultancies that

buy ad agencies can do what the big agencies do, and then some --

at least, that's the promise -- thanks to broad consulting and

technology resources, and the relationships with the CEOs and

CFOs.

The model is far from perfect, however. The consulting firms are

still struggling to win over some marketers. And firms that have

grown quickly, sometimes as a result of acquiring creative shops,

are struggling to bring together contrasting cultures of

advertising and consulting. They are not always in tune with

advertisers' needs.

Consulting firms pursuing advertising and marketing business

"don't know quite how to position themselves as an agency

resource," says Tom Denford, partner at ID Comms Inc., an

agency-search consulting firm. Mr. Denford helped Puma with its

agency review.

Hermann Hassenstein, head of marketing planning at Puma, tells a

story that reflects how consulting firms trying to break into the

ad business can still sometimes be perceived by prospective clients

as out of their depth. When Puma reviewed its global

media-planning-and-buying business last spring, he says, a mix of

companies were invited to compete for the account. Invitees

included large media-buying firms owned by advertising holding

companies, and more integrated marketing shops with media

capabilities.

A large international consulting firm's team arrived at Puma's

Boston office wearing suits and Puma shoes and proceeded to give a

long presentation about "digital transformation," Mr. Hassenstein

says. The presentation looked very similar to one the consulting

firm had given previously to another business unit within Puma, he

adds.

"There were 80 slides full of prophecies and bubbles," Mr.

Hassenstein says. "I was confused, and it was a very deterring

experience."

By contrast, he says, most of the agency executives who met with

Puma wore more casual attire. They assured the company they could

handle the job, be it developing a content strategy, building a

data plan or handling brand and performance marketing, he says.

Puma ultimately hired Havas Media, an agency that was more relaxed

in its presentation and helped provide a data and media offering in

line with Puma's needs, Mr. Hassenstein says.

But one big factor that helps the consulting firms is their

relationships with business leaders such as CEOs and CFOs. Through

these contacts, they have gotten to know marketers newly assigned

to such important and challenging tasks as unifying a brand

presence in stores and online, for example, or building

digital-loyalty programs and using data from those programs to

rethink their marketing mix. These types of issues, involving

technology and data, play to the consulting firms' strengths.

"We've had pressures from other parts of the [corporate]

enterprise to look at Deloitte for marketing," says Greg Paull,

principal at agency-search consulting firm R3. "That's going to be

a common trend."

Ms. Bruell is a reporter for The Wall Street Journal in New

York. Email her at alexandra.bruell@wsj.com.

(END) Dow Jones Newswires

June 18, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

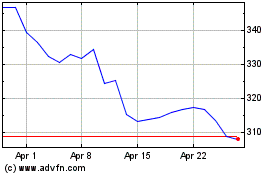

Accenture (NYSE:ACN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Accenture (NYSE:ACN)

Historical Stock Chart

From Apr 2023 to Apr 2024