Amazon Rents More Jets to Expand Next-Day Delivery

19 June 2019 - 7:00AM

Dow Jones News

By Doug Cameron

Amazon.com Inc. is expanding its domestic air-cargo operation,

adding smaller jets to its rented fleet in order to link its

distribution centers and extend the reach of its next-day delivery

service.

Amazon is experimenting with local collection centers, its own

delivery vans, on-demand taxis and even its own employees to speed

deliveries to consumers at a lower cost. The e-commerce giant's

experimentation is bringing it into direct competition, in some

cases, with companies that also deliver its packages. FedEx Corp.

said earlier this month that it would end its air-shipping

agreement with Amazon to concentrate on rapid delivery for other

retailers that are making more sales online.

Amazon said Tuesday that it will rent 15 Boeing Co. 737-800 jets

converted to carry cargo, in addition to a fleet of 40 larger

planes it uses to ship packages around the U.S. Amazon expects to

have a rented fleet of about 70 planes by 2021.

Earlier this year, Amazon said it would invest $800 million into

making the next-day option the free standard for its Prime members.

Amazon this month said it had made free next-day delivery available

on about 10 million products. The company is in a race with Walmart

Inc. and other big-box retailers to satisfy ever-demanding online

shoppers.

"These new aircraft create additional capacity for Amazon Air,

building on the investment in our Prime Free One-Day program," said

Dave Clark, Amazon's senior vice president of world-wide

operations.

The 737s, which will be purchased by the aircraft-leasing arm of

General Electric Co., will link 20 Amazon facilities to smaller

cities, while larger Boeing 767s take packages to bigger markets.

Amazon is opening three more air cargo centers this year, in Fort

Worth, Texas, Wilmington, Ohio and Rockford, Ill. A new hub at

Cincinnati/Northern Kentucky International Airport that can handle

100 planes is due to open in 2021.

Amazon's rapid growth has helped temper a broader slowdown in

air cargo traffic caused by simmering trade tensions. Global

e-commerce airfreight volumes are growing by 20% or more a year,

according to Atlas Air Worldwide Holdings Inc., one of two

specialist cargo companies that operate 767 freighters for Amazon.

Atlas Air suffered a fatal crash of a Boeing 767 operated for

Amazon near Houston in February, killing all three people on board.

The other is Air Transport Services Group Inc., which flies 20

Boeing 767s and plans to add at least five more this year.

Amazon's airfreight expansion has created logjams at facilities

that convert passenger planes to cargo use and pushed up the value

of secondhand planes such as the Boeing 767.

"All roads lead to Amazon," said Steve Rimmer, chief executive

of Altavair Aviation Leasing, who has been involved in the air

cargo market for 30 years.

Analysts expect Amazon to continue outsourcing its flying rather

than start an in-house carrier. The domestic industry is highly

regulated and has a history of turbulent labor relations, creating

high barriers to entry. Amazon decided in 2015 to outsource some

flying to contractors rather than rely solely on bigger players,

such as FedEx, that also carry cargo for Amazon's competitors.

The latest expansion plan carries risks for Amazon, though,

including the potential inflammation of tensions with pilots who

fly that cargo.

Pilot unions representing flight crew at Atlas Air have said

increased flying for Amazon has contributed to a personnel shortage

and deteriorating working conditions.

A strike by pilots flying for a unit of Air Transport Services

Group in 2016 delayed holiday shipments that year. Atlas has been

in contract talks with its pilots for three years, with an

arbitrator recently ordering the two sides to sit down for fresh

talks.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

June 18, 2019 16:45 ET (20:45 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

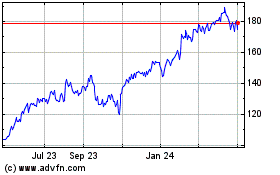

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

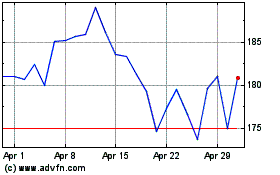

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024