Kroger Seeks Patience As It Works to Reshape Business --Update

21 June 2019 - 5:55AM

Dow Jones News

By Micah Maidenberg

Kroger Co. executives are seeking patience from investors as

they continue to oversee efforts to transform the business while

facing heightened competition from a range of food retailers and

shifting shopping patterns.

The nation's biggest supermarket operator on Thursday reported

same-store sales excluding fuel rose 1.5% in the latest quarter, a

weaker performance compared to last year and below what analysts

predicted for the period.

Kroger faces competition from growing discount chains like

Walmart Inc. as well as from Amazon.com Inc., which is working to

bring customers into its Whole Foods Market unit and plans to

launch a separate grocery business.

Chief Executive Rodney McMullen said on a conference call that

Kroger must "step up our game." Kroger shares are down 12% over the

past 12 months, compared with a 6.5% gain in the S&P 500.

"What we find is there's a lag between when you make those

improvements and when the customer starts rewarding you with their

checkbook," he said, referring to efforts to upgrade the experience

for shoppers.

The company has been investing in its e-commerce operation and

said on Thursday that home-delivery services or

online-order-and-pickup at stores is now available at 93% of its

locations. Digital sales grew 42% in the first quarter, which ended

May 25.

Kroger has also been developing new businesses, such as selling

consumer data and targeted advertising. The company said those

efforts would yield $100 million incremental operating profit in

its current fiscal year compared with the prior one.

Shares were down about 2.5% in early afternoon trading. Kroger

shares have fallen 12% over the past 12 months, compared with a

6.5% gain in the S&P 500.

The Cincinnati-based grocer reported $37.25 billion in revenue

in the first quarter, down 1% from a year earlier but better than

what analysts polled by FactSet had forecast.

The company attributed the most recent decline to the sale of

its convenience-store business. Kroger has now reported

year-over-year total sales declines for three consecutive

quarters.

Pet products, natural foods and several beverage categories were

strong performers in the latest period, executives said. Kroger

also added 219 of new private-label products during the quarter.

Sales of such brands grew faster than total sales, driven in part

by products like pork-belly bites.

The profit margin for private-label products exceed those Kroger

gets from selling national brands. But overall gross profit margin

fell in the quarter, primarily due to the performance from its

pharmacy business, according to the company.

Kroger reported a profit of $772 million, or 95 cents a share,

compared with $2.03 billion, or $2.37 a share, a year earlier, when

the grocer recorded a gain on the sale of its convenience-store

business.

After adjustments, Kroger reported a profit of 72 cents a share

for the most recent period, beating Wall Street targets by a

penny.

The grocer has been slimming down its operation and hunting for

investment opportunities. In April, it sold a company that makes

ice cream, ice teas and other products. Kroger said in May it

formed a new venture with a private-equity firm to make investments

in consumer brands.

Kroger recently struck new labor contracts with unions in

Indianapolis, Denver and Louisville, and is working on deals with

employees in several other cities, finance chief Gary Millerchip

told analysts.

Like other companies, Kroger has been raising wages amid the

tight labor market. The new contract covering Indianapolis workers

increased starting pay from $8 to $10 per hour for most clerks, the

company said in a statement Monday.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

June 20, 2019 15:40 ET (19:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

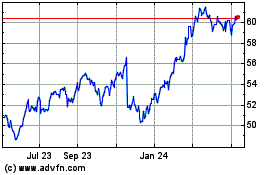

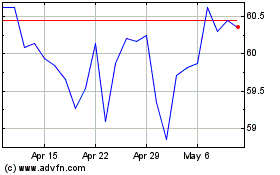

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024