Australian Dollar Extends Gain After China Data

12 July 2019 - 3:56PM

RTTF2

The Australian dollar continued to be higher against its major

counterparts in early European deals on Friday, as China's exports

dropped less than expected in June amid trade standoff with the

U.S.

Data from the General Administration of Customs showed that

China's exports decreased less than expected in June, resulting in

a larger trade surplus from last month.

Exports fell 1.3 percent on a yearly basis in June, slightly

slower than the 1.4 percent drop economists had forecast.

At the same time, imports slid 7.3 percent annually versus the

expected fall of 4.6 percent in June.

As a result, the trade surplus increased to $50.98 billion,

which was bigger than the forecast of $45 billion.

Australia is the largest trading partner of China.

Oil prices rose after falling on Thursday as OPEC cut its 2019

oil production growth forecast for its non-cartel peers.

The currency has been trading higher against its major

counterparts in the Asian session.

The aussie strengthened to a 3-day high of 75.91 against the

yen, from a low of 75.62 hit at 5:15 pm ET. If the aussie rises

further, 77.5 is seen as its next resistance level.

Final data from the Ministry of Economy, Trade and Industry

showed that Japan's industrial production grew at a

less-than-initially-estimated rate in May.

Industrial production rose 2.0 percent month-on-month in May

instead of 2.3 percent estimated previously.

The aussie appreciated to a weekly high of 0.7009 against the

greenback, after having dropped to 0.6971 at 5:15 pm ET. The next

possible resistance for the aussie is seen around the 0.715

mark.

The aussie that closed Thursday's trading at 1.6136 against the

euro firmed to a 3-day high of 1.6078. On the upside, 1.59 is

possibly seen as the next resistance for the aussie.

The Australian currency spiked higher to a 2-day high of 1.0478

against the kiwi, compared to 1.0467 hit late New York Thursday.

The aussie is likely to face resistance around the 1.06 mark.

The latest survey from BusinessNZ showed that New Zealand

manufacturing sector continued to expand in June, and at a faster

rate, with a manufacturing PMI score of 51.3.

That's up from 50.4 in May and it moves further above the

boom-or-bust line of 50 that separates expansion from contraction -

although it remains beneath the long-term survey average of

53.4.

The aussie was trading higher at 0.9121 against the loonie, up

from a low of 0.9107 seen at 5:15 pm ET. Next key resistance for

the aussie is seen around the 0.94 mark.

Looking ahead, U.S. producer prices for June are due in the New

York session.

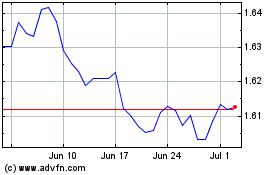

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024