HSBC Survey Reveals Extra Income and Improved Quality of Life in the U.S. Drives Expat Job Seekers

17 July 2019 - 11:00PM

Business Wire

Annual Expat Explorer Research Study Shows

Internationals Flock to the U.S. for Career Progression and an

Increase in Income

Expats flock to the U.S. for career opportunities and high

income, according to the new Expat Explorer survey released today

by HSBC Bank USA, N.A., (HSBC), part of HSBC Group, one of the

world’s largest banking and financial services organizations.

Nearly half of those surveyed (49%) say that they chose to come to

the U.S. to progress their career, which is higher than the global

average of 36% and much higher than our neighbor Canada, at only

20%.

In the U.S., almost all expats (92%) said they’ve had the chance

to develop new skills since the move. More than half (57%) report

being more confident at work and nearly two-thirds (61%) say they

are more adaptable.

“Whether through choice or circumstance, moving to a new country

brings a host of exciting and often life-changing opportunities,”

said Paul Mullins, Regional Head of International Banking for HSBC

in the U.S. and Canada. “Our research shows that people don’t just

move to the U.S. for career opportunities — they stay because of

them too.”

The most popular reason that overseas professionals choose to

stay in the U.S. longer than originally planned is to continue to

progress their career (49%). As such, more than half (53%) plan to

be in the U.S. for 11 or more years. This could also be in part due

to 73% being employed full-time, compared to the global average of

64%.

Moving to the U.S. is Paying Off

In the U.S., more than 6 in 10 (64%) of those who relocated here

see their income increase, while just 9% have seen a decrease. Six

percent of those surveyed earn between $300,000-349,999 a year, the

highest percentage of any country in the survey. At $137,826, the

mean annual earnings in the U.S. is the highest of any country or

territory in the survey and far higher than the global mean of

$75,966.

Money Helps

Money can’t buy you happiness. However, according to those who

move to the U.S., it helps. Nearly 7 in 10 (68%) agree that the

country offers fantastic job opportunities, and 69% agree that it

has a vibrant cultural scene with events and exhibitions.

And 63% say their quality of life has improved because they can

now afford nicer things such as cars, a bigger house, more clothes

and devices.

The U.S. beats the global average for several key measures of

home ownership for those who relocate abroad. For example, 43%

agree that property in the U.S. is affordable, compared to a global

average of 35%.

“While real estate may be more affordable in the U.S.,

establishing roots isn’t easy. There’s a lot to consider when

moving to a new country, regardless of if it’s your first time

abroad or you’re a seasoned traveler,” said Mullins. “HSBC’s

professional bankers and advisors thrive on helping expat and

international customers face big challenges associated with living

abroad, such as having financial commitments in both their home and

host countries, juggling finances in different currencies, moving

money to family abroad, having more money to manage and dealing

with complex tax situations.

As the world’s leading international bank, we are committed to

helping these customers better understand their finances and make

planning for a future abroad simple,” Mullins added.

HSBC Bank USA, National Association (HSBC Bank USA, N.A.)

serves customers through retail banking and wealth management,

commercial banking, private banking, and global banking and markets

segments. It operates bank branches in: California; Connecticut;

Washington, D.C.; Florida; Maryland; New Jersey; New York;

Pennsylvania; Virginia; and Washington. HSBC Bank USA, N.A. is the

principal subsidiary of HSBC USA Inc., a wholly-owned subsidiary of

HSBC North America Holdings Inc. HSBC Bank USA, N.A. is a Member of

FDIC. Investment and brokerage services are provided through HSBC

Securities (USA) Inc., (Member NYSE/FINRA/SIPC) and insurance

products are provided through HSBC Insurance Agency (USA) Inc.

HSBC Holdings plc, the parent company of the HSBC Group,

is headquartered in London. The Group serves customers worldwide

across 66 countries and territories in Europe, Asia, North and

Latin America, and the Middle East and North Africa. With assets of

$2,659bn at 31 March 2019, HSBC is one of the world’s largest

banking and financial services organisations.

About Expat Explorer

The Expat Explorer survey was open to adults over 18 years old

currently living away from their country of origin/home country.

The survey was completed by 18,059 expats from 163 countries and

territories through an online questionnaire in February and March

2019, conducted by YouGov and commissioned by HSBC Expat. A minimum

sample of 100 expat respondents is required for a country or

territory to be included in the league table, with 33 qualifying in

2019.

Expat Explorer online:

Report and country comparisons:

https://expatexplorer.hsbc.com/survey/ Twitter: @expatexplorer

Facebook: /hsbcexpat Expats’ ratings of 33 host countries are

available to explore online through the Expat Explorer interactive

tool.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190717005434/en/

Matt Klein Head of Communications Retail Banking and Wealth

Management, HSBC USA 212 525 4644 matt.klein@us.hsbc.com

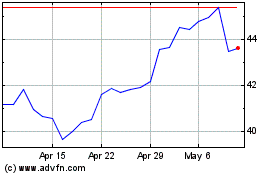

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

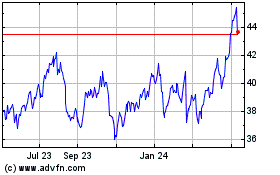

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024