Australian Dollar Slides On Risk Aversion

22 July 2019 - 1:14PM

RTTF2

The Australian dollar weakened against its major counterparts in

the Asian session on Monday, as expectations of an aggressive

interest rate cut by the U.S. Federal Reserve reduced and Middle

East tensions intensified, diminishing the appeal of high-yielding

assets.

Hopes for a smaller cut increased after a Wall Street Journal

report that Fed officials are unlikely to take bolder now and may

pursue further cuts in the future given slowing global growth and

trade uncertainty.

Geopolitical tensions remained after a British-flagged tanker

was seized by Iran in the Gulf.

Traders await reports on new and existing home sales, durable

goods orders and second quarter GDP this week for clues on the

health of the world's largest economy.

The aussie declined to a 4-day low of 0.7031 against the

greenback from Friday's closing value of 0.7039. The next possible

support for the aussie is seen around the 0.69 level.

The aussie that ended last week's trading at 1.5920 against the

euro weakened to 1.5948. The aussie is seen finding support around

the 1.625 region.

The aussie depreciated to 1.0386 against the kiwi for the first

time since March 27. On the downside, 1.02 is possibly seen as the

next support level for the aussie.

The Australian currency fell to a 4-day low of 0.9186 against

the loonie, down from Friday's closing quote of 0.9195. If the

aussie extends decline, 0.90 is possibly seen as its next support

level.

The aussie pared gains to 75.93 against the yen, from a high of

76.07 hit at 9:30 pm ET. The aussie is likely to find support

around the 74.00 area.

Looking ahead, Canada wholesale sales for May are due at 8:30 am

ET.

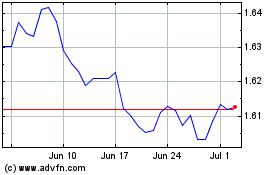

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024