Airbus Profit Leaps Amid Woes at Rival Boeing -- Update

31 July 2019 - 7:54PM

Dow Jones News

By Olivia Bugault

Airbus SE said its quarterly net profit rose more than fivefold,

driven by an increase in deliveries that positions the European

aircraft maker to overtake Boeing Co. as the industry No. 1.

Boeing's best-selling 737 MAX was grounded world-wide following

two fatal crashes, one in Ethiopia earlier this year and one off

the coast of Indonesia last year. Deliveries of the plane have been

halted since April, with the U.S. company slowing production and

taking a multibillion-dollar hit.

Airbus is on track to become the largest plane maker by

deliveries this year for the first time since 2011. It already

overtook Boeing in the first half, with 389 planes shipped compared

with the U.S. company's 239. Its top-selling A320 family planes

accounted for a majority of the deliveries.

Airbus's second-quarter net profit surged to EUR1.16 billion

($1.29 billion), from EUR213 million a year earlier. Sales were up

23% at EUR18.32 billion after Airbus delivered 227 jetliners during

the period. According to a FactSet consensus forecast, analysts

expected a net profit of EUR1.11 billion and sales of EUR17.62

billion.

The company stuck to its 2019 guidance, which includes the

delivery of 880 to 890 commercial aircraft this year.

On a conference call, Airbus Chief Executive Guillaume Faury

said the production of its A321 jets -- including the newly

launched A321XLR unveiled during the Paris Air Show in June --

wasn't increasing as fast as it had hoped. During the show, Airbus

racked up a total of more than 120 orders and commitments for the

single-aisle A321XLR, which is a long-range version of the A321.

The company is currently studying options to increase the share of

the A321 in its current A320 family production capacity.

Meanwhile, Airbus's A350 long-haul jets program is on track to

reach break-even for the year after 53 handovers during the first

half, the company said.

The strong performance has boosted Airbus's stock by 50% so far

this year, while Boeing's has risen less than 8%. Boeing reported a

loss of $2.94 billion in the June quarter, its biggest-ever

quarterly loss, with sales down 35%.

Still, it isn't an entirely smooth ride at Airbus, which warned

that deliveries would be challenging for the rest of the year.

The company has been struggling with delays due partly to issues

at its Hamburg plant, which slowed production. JetBlue Airways

Corp. flagged a four-month delay in the handover of its first

A321neo, while International Consolidated Airlines Group SA CEO

Willie Walsh recently said in an interview that his airline's order

for 200 Boeing 737 MAXs was because of Airbus delivery delays.

During the second quarter, Airbus posted EUR75 million of new

charges related to the shutdown of its A380 superjumbo program

announced earlier this year.

(END) Dow Jones Newswires

July 31, 2019 05:39 ET (09:39 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

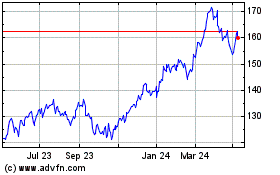

Airbus (EU:AIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

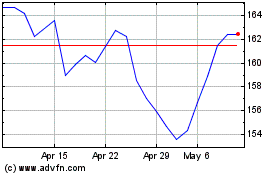

Airbus (EU:AIR)

Historical Stock Chart

From Apr 2023 to Apr 2024