Airbus Cranks Out Strong Profit -- WSJ

01 August 2019 - 5:02PM

Dow Jones News

Jetliner maker tackles production problems as it works through

huge backlog of orders

By Olivia Bugault and Doug Cameron

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 1, 2019).

Airbus SE said its quarterly profit increased more than

fivefold, driven by a rise in jetliner deliveries that positions

the European aircraft maker to overtake Boeing Co. this year as

industry No. 1.

The upbeat results come despite production bottlenecks that have

hobbled Airbus's efforts to deliver on a backlog of almost 7,300

aircraft. Still, the company wants to boost its output of

commercial jetliners after 2021.

The aerospace giant has been struggling to produce more of the

largest version of its A321 single-aisle aircraft, and delays in

deliveries to customers have aggravated airlines' capacity issues

caused by the grounding of the Boeing 737 MAX.

A decadelong order splurge has left Airbus and Boeing with a

combined backlog of 13,000 jets.

Airbus delivered 389 planes in the first half, up 28% from a

year earlier, and needs to deliver about 500 jets in the second

half of 2019 to meet its financial targets.

"While 2019 is another backloaded and challenging year, we are

on track, " Chief Executive Guillaume Faury told analysts.

The larger A321 has outsold similar versions of the 737 MAX by a

wide margin, and Mr. Faury said Airbus is looking at options to

assemble them at its main production facility in Toulouse, France.

The narrow-body planes are currently made in Mobile, Ala., and at a

plant in Hamburg, which has suffered the most production

problems.

With its single-aisle jets sold out through 2024, Airbus has

limited opportunities to capitalize on the uncertainty over when

the 737 MAX will return to service. It continues to be outsold by

Boeing in the market for larger wide-body jets, where orders have

slowed sharply over the past two years.

Mr. Faury said Airbus will maintain output of its A350 and

A330neo wide-body jets at current levels to avoid "price wars."

Boeing recently boosted output of its rival 787.

Airbus is on track to become the largest plane maker by

deliveries this year for the first time since 2011. Its 389

deliveries in the first half topped Boeing's 239. The U.S. company

had originally targeted 900 deliveries in 2019, but pulled the

projection following the MAX's grounding.

The A320 family of single-aisle planes -- which includes the

A321 -- accounted for a majority of Airbus's first-half total. The

company has boosted monthly A320 production to 60 jets and plans to

increase the rate to 63. A further increase after 2021 is under

discussion, though engine makers General Electric Co. and Safran SA

have so far resisted such a move.

Slower growth in airline traffic has triggered caution among

suppliers to both Airbus and Boeing about supporting higher

aircraft production.

Airbus reported net profit of EUR1.16 billion ($1.29 billion) in

the second quarter, up from EUR213 million a year earlier. Sales

climbed 23% to EUR18.32 billion on the increase in jetliner

deliveries, as well as a tailwind from the strong dollar. Aircraft

are generally paid for in U.S. dollars, and the majority of

Airbus's costs are in euros.

Airbus retained its full-year financial guidance based on

delivering 880 to 890 jets this year, 80 more than in 2018 --

though hitting its target of EUR8 billion in free cash flow for the

second half hinges on sorting out problems with the A321. A surge

in free cash flow has helped boost Airbus's share price by about

half this year. The stock rose 0.3% to EUR128.06 on Wednesday.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

August 01, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

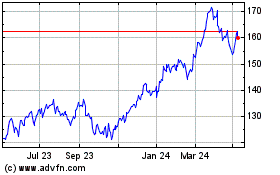

Airbus (EU:AIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

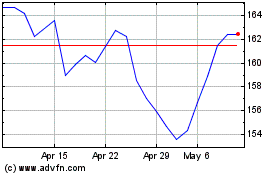

Airbus (EU:AIR)

Historical Stock Chart

From Apr 2023 to Apr 2024