EUROPE MARKETS: Europe Stocks Hammered By U.S.-China Trade Tensions

05 August 2019 - 10:13PM

Dow Jones News

By Steve Goldstein, MarketWatch

Europe stocks dropped sharply on Monday on concerns about being

caught up in escalating U.S.-China trade tensions.

The Stoxx Europe 600 index slumped 2.06% to 370.37, in broad-based selling.

The U.K. FTSE 100 index slumped 2.24% to 7241.13, the German DAX

skidded 1.81% to 11657.52 and the French CAC 40 slumped 2.18% to

5241.94.

What's moving markets

Asian stocks were hit hard as the dollar rose about the key 7

level vs. the Chinese yuan

(http://www.marketwatch.com/story/chinas-yuan-falls-below-key-level-with-us-dollar-2019-08-04),

and as protests continued in Hong Kong.

"Today's decision by China's central bank to allow the yuan to

breach the watershed 7 per dollar mark is a result of the threat by

President Trump to impose further U.S. tariffs on imports from

China. But it is also consistent with China's policy increasingly

to allow the currency to move in line with currency market

pressures," said analysts at Oxford Economics.

Markets are still reacting to the news that the U.S. plans to

impose 10% tariffs on $300 billion of Chinese goods that, unlike

past tariff rounds, would focus on consumer products. China has

said it would retaliate.

"German manufacturing continues to weaken. Driven by China

weakness and autos, a swift turnaround seems unlikely. This is

Europe's weak spot," said Ruben Segura-Cayuela, an economist at

Bank of America Merrill Lynch.

Related:Recession will come in 9 months if Trump takes this one

step, Morgan Stanley argues

(http://www.marketwatch.com/story/global-recession-will-come-in-9-months-if-trump-takes-this-one-step-morgan-stanley-argues-2019-08-05)

The yield on the key 10-year Treasury dropped as traders priced

in the possibility of more Fed rate cuts. "The fact that the Fed

bases its interest rate policy on US-China trade tensions rather

than the economic data raises the suspicion that Donald Trump may

be adding fuel to the flames on the Chinese side to increase

pressure for lower rates," said Ipek Ozkardeskaya, senior market

analyst at London Capital Group. U.S. stock futures pointed to a

sizeable decline at the open.

Focus stocks

HSBC Holdings shares (HSBA.LN) (HSBA.LN) dropped 2.1% after the

bank ousted its chief executive

(http://www.marketwatch.com/story/hsbc-ceo-john-flint-ousted-after-just-18-months-2019-08-04),

John Flint, and announced a rise in second-quarter profit. The bank

also announced it is going to cut thousands of jobs

(http://www.marketwatch.com/story/hsbc-to-cut-thousands-of-jobs-after-ceo-ouster-2019-08-05).

Shares of Linde PLC (LIN) rose 1.8% in Frankfurt, after the

industrial gases company reported a second-quarter profit and sales

that topped expectations and provided an upbeat full-year

outlook.

Scout24 (G24.XE) shares edged up 0.9% as the activist investor

Elliott

(http://www.marketwatch.com/story/elliott-advisors-pressures-scout24-2019-08-05)

pushed the German classifieds firm to sell its car-listings

business and ramp up a share buyback.

(END) Dow Jones Newswires

August 05, 2019 07:58 ET (11:58 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

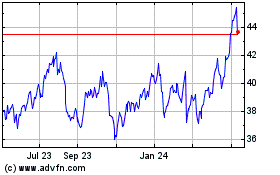

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

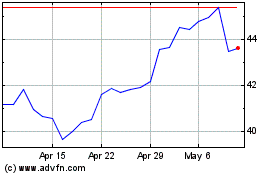

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024