Australian Dollar Climbs As RBA Leaves Key Rate Unchanged

06 August 2019 - 2:01PM

RTTF2

The Australian dollar firmed against its major counterparts in

the Asian session on Tuesday, erasing its early losses, after the

Reserve Bank of Australia kept its key interest rate unchanged

after trimming it for two straight months.

The board of the Reserve Bank of Australia, governed by Philip

Lowe, maintained the cash rate at a record low 1.00 percent, in

line with forecasts.

"The Board will continue to monitor developments in the labour

market closely and ease monetary policy further if needed to

support sustainable growth in the economy and the achievement of

the inflation target over time," the bank said in a statement.

Policymakers said it is reasonable to expect that an extended

period of low interest rates will be required in Australia to make

progress in reducing unemployment and achieve more assured progress

towards the inflation target.

Data from the Australian Bureau of Statistics showed that

Australia recorded a merchandise trade surplus of A$8.036 billion

in June. That beat expectations for a surplus of A$6.0 billion and

was up from the upwardly revised A$6.173 billion surplus in

May.

The currency weakened in early Asian trading, as Asian shares

followed Wall Street lower after the U.S. Treasury Department

designated China a currency manipulator, paving way for possible

additional sanctions.

Meanwhile, China halted purchases of U.S. farm goods as a weapon

in the ongoing trade war and also indicated it may slap tariffs on

U.S. farm goods purchased after August 3.

On Monday, the currency fell as the escalating U.S.-China trade

war triggered concerns about global economic slowdown. Further,

China's central bank let its yuan to fall below the politically

sensitive level of seven to the U.S. dollar to counter President

Donald Trump's latest tariff threat.

The aussie lost 1.2 percent against the yen, 0.6 percent against

the greenback, 1.5 percent against the euro and 0.5 percent against

the kiwi for the day.

The aussie remained near a 4-day high of 72.71 against the yen,

up by almost 2 percent from more than a 7-month low of 71.23 hit at

6:00 pm ET. The pair was valued at 71.58 at yesterday's close. Next

immediate resistance for the aussie is possibly seen around the

75.5 level.

Data from the Ministry of Communications and Internal Affairs

showed that Japan household spending rose 2.7 percent on year in

June, coming in at 276,882 yen. That beat expectations for an

increase of 1.2 percent following the 4.0 percent gain in May.

The aussie was up by 0.6 percent at 1.6534 against the euro,

following near a 10-year low of 1.6626 it touched at 8:00 pm ET. At

Monday's close, the pair was quoted at 1.6580. Further uptrend may

take the aussie to a resistance around the 1.63 region.

The Australian currency gained 0.6 percent against the

greenback, rising to 0.6795 after the RBA decision. The

aussie-greenback pair had ended Monday's deals at 0.6756.

Continuation of the aussie's uptrend may see it challenging

resistance around the 0.70 region.

After depreciating to more than a 7-month low of 1.0265 at 6:45

pm ET, the aussie bounced off 1.2 percent to 1.0390 against the

kiwi. The aussie was trading at 1.0345 per kiwi when it finished

deals on Monday. The aussie is seen facing resistance around the

1.05 level.

Data from Statistics New Zealand showed that New Zealand

unemployment rate came in at a seasonally adjusted 3.9 percent in

the second quarter of 2019. That was shy of expectations for 4.3

percent and down from 4.2 percent in the three months prior.

The aussie was 0.5 percent higher at 0.8963 versus the loonie,

gaining from over a 9-year low of 0.8915 recorded at 5:45 pm ET. At

yesterday's New York session close, the aussie-loonie pair was

worth 0.8921. The aussie is likely to find resistance around the

0.93 level.

In today's events, Federal Reserve Bank of Chicago President

Charles Evans is scheduled to speak at a media breakfast event

hosted by the central bank at 9:30 am ET.

Federal Reserve Bank of St. Louis President James Bullard will

give a speech about the economy and monetary policy at the National

Economists Club Signature Luncheon in Washington DC at 12:00 pm

ET.

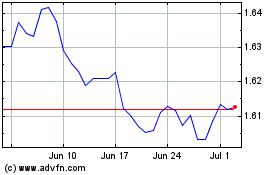

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024