By Benjamin Mullin and Cara Lombardo

CBS Corp. and Viacom Inc. agreed to merge, a deal the media

companies hope will put them on stronger footing to compete with

larger rivals in a business buffeted by cable TV cord-cutting and

increasingly dominated by streaming.

The all-stock deal, if completed, will reunite the media empire

of mogul Sumner Redstone, who had split up CBS and Viacom in 2006.

It will create a major entertainment player valued at roughly $30

billion, combining Viacom properties such as MTV, Nickelodeon,

Comedy Central and the Paramount film and TV studio with CBS's

broadcast network and Showtime premium network.

The companies are betting now that merging back together will

help them battle titans like Walt Disney Co., Comcast Corp.,

AT&T Inc. and Netflix Inc. and remain relevant as consumers

sign up for streaming video services and pay TV distributors look

to cut the fees they pay to programmers.

Shari Redstone, Mr. Redstone's daughter and vice chair of both

companies, will become chair of the combined company. The deal

would cement Ms. Redstone's status as a powerful media mogul.

She controls both CBS and Viacom along with her father, through

their family holding company National Amusements Inc.

Bob Bakish, currently the chief executive of Viacom, would

become CEO of the combined entity, while CBS Acting Chief Executive

Joe Ianniello would get the title of chairman and CEO of CBS,

running its assets.

The deal values Viacom at around $11.8 billion, roughly on par

with its current market valuation. Viacom shareholders will receive

0.59625 CBS share for each share they own. Viacom has been the

weaker of the two media companies over the past several years, and

its stock had risen this year, in part on speculation of a CBS

deal.

Under the terms of the agreement, CBS will receive six seats on

the 13-member board and Viacom will get four. National Amusements

will get two board seats. Mr. Bakish will also get a board

seat.

ViacomCBS would have a diverse stable of programming. Viacom

brings to the table about 20 cable networks, including a handful of

large ones, while CBS has its flagship broadcast network and

premium channel Showtime.

That collection of networks could give the merged company

greater leverage in negotiations with pay-TV providers, many of

which have taken a harder line with TV programmers as cord-cutters

flee the traditional cable bundle. CBS has the rights to air

National Football League games through 2022, giving the combined

entity a valuable bargaining chip since live sports continue to be

one of the major draws of cable TV.

Viacom's biggest rivals have struck major deals over the past

several years. NBCUniversal sold to cable giant Comcast and, more

recently, Time Warner Inc. sold to AT&T, while Disney acquired

the bulk of 21st Century Fox.

ViacomCBS would still be a relative minnow, with a much smaller

market capitalization than big industry players. It would need to

do additional deals to bulk up to the size of its rivals.

The bigger media companies have some major advantages. Disney,

for example, has a fabled trove of intellectual property and a

variety of assets -- from theme parks to cable networks to movie

franchises. Netflix has a seemingly insurmountable lead in

streaming-video subscriptions, with 150 million paying users

globally.

Disney, Comcast and AT&T are all trying to take on Netflix

with plans to launch their own subscription streaming-video

services. CBS has its own service, CBS All Access. But CBS and

Viacom also both are big suppliers to Netflix and other digital

players.

Between their various production outfits and channels, ViacomCBS

would have a combined library of 140,000 episodes of premium TV and

3,600 film titles, the companies said. Some 750 series are ordered

or in production. ViacomCBS would be among the top spenders on

programming, with more than $13 billion spent over the past 12

months.

Beneath Mr. Bakish will be an executive team responsible for

overseeing the company's combined cable-networks group, broadcast

network, television production studios, its direct-to-consumer

streaming services, film studio and advertising sales

divisions.

Christina Spade, the chief financial officer of CBS, will become

CFO of ViacomCBS. Christa D'Alimonte, the general counsel of

Viacom, will be general counsel.

David Nevins, the chief creative officer of CBS, will continue

in his current role. Jim Lanzone, the president and chief executive

of CBS Interactive, will retain that title.

ViacomCBS would seek $500 million in annual synergies, according

to the companies.

The companies may have to navigate some cultural challenges. CBS

is the stronger player, but Viacom's leader will be the CEO.

Directors at CBS and Viacom explored a merger three times in the

past four years.

The first merger attempt, in late 2016, was called off due to a

lack of enthusiasm on the part of both companies. The second

attempt, in 2018, led to a prolonged legal battle between National

Amusements and CBS over the future of the company. CBS, under

then-CEO Leslie Moonves, sought to strip Ms. Redstone of her voting

control of the company by issuing a dividend that would dilute

National Amusements' voting stake.

National Amusements resisted the change and the dispute went to

court. Under a settlement reached last September, Ms. Redstone

emerged with her control intact, and the board of CBS underwent a

significant overhaul; new directors who were friendlier to her

joined the board. Mr. Moonves was forced out after multiple women

accused him of sexual assault and harassment. Mr. Moonves has

denied accusations of nonconsensual sexual relations.

Ms. Redstone is unique among media moguls in the way she

exercises influence over CBS and Viacom. Her power is concentrated

in a holding company that is technically controlled by her ailing

father. The 96-year-old Mr. Redstone owns 80% of the voting shares

of National Amusements, which itself holds controlling stakes in

CBS and Viacom.

In a statement, Ms. Redstone said, "I am really excited to see

these two great companies come together so that they can realize

the incredible power of their combined assets. My father once said

'content is king,' and never has that been more true than

today."

Ms. Redstone has had a complicated relationship with her father

over the years -- at times, she seemed to be the favored heir,

while at other times they feuded. But a few years ago, as his

health deteriorated, she rose to prominence in the empire and took

effective control.

The holding company's bylaws were amended in 2016 to make clear

that Mr. Redstone had a single vote among seven NAI directors in

decisions tied to Viacom and CBS stakes.

The deal reverses the move, made in 2006, to split up CBS and

Viacom. That cleaved Viacom's then-booming cable-networks division

from CBS's more mature TV business. Mr. Redstone, concerned that

the stock of the combined company had stagnated, blessed a move

that created two public companies that one analyst dubbed "ViaGrow"

(referring to Viacom) and "ViaSlow" (a tongue-in-cheek reference to

CBS).

But the narrative flipped over the years as CBS's prospects grew

brighter while Viacom's dimmed. CBS, fueled by hit shows and

subscription-TV revenues, was more resilient as consumers began

cutting the cable TV cord in larger numbers. By contrast, Viacom

suffered major ratings declines at its big networks, leading to

battles with its distributors.

Viacom's weakness relative to CBS was one of the major sticking

points for CBS directors in recent years when the two companies

explored a merger. CBS executives were fearful of being saddled

with fading cable channels that would hamper their ability to

negotiate with pay-TV distributors.

Write to Benjamin Mullin at Benjamin.Mullin@wsj.com and Cara

Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

August 13, 2019 15:55 ET (19:55 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

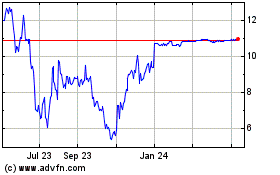

Via Renewables (NASDAQ:VIA)

Historical Stock Chart

From Mar 2024 to Apr 2024

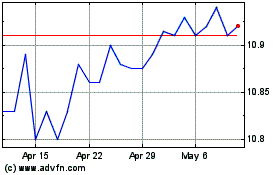

Via Renewables (NASDAQ:VIA)

Historical Stock Chart

From Apr 2023 to Apr 2024