VMware to Buy Pivotal Software and Carbon Black -- 2nd Update

23 August 2019 - 9:47AM

Dow Jones News

By Maria Armental

Software company VMware Inc. has reached deals to buy Pivotal

Software Inc. and cybersecurity provider Carbon Black Inc.,

bolstering its push to allow customers to build, manage and secure

applications across devices and cloud-computing environments.

"These acquisitions address two critical technology priorities

of all businesses today -- building modern, enterprise-grade

applications and protecting enterprise workloads and clients,"

VMware Chief Executive Pat Gelsinger said in a statement.

The proposed deals were disclosed Thursday as VMware reported

results for the quarter ended Aug. 2, including a nearly $5 billion

tax benefit tied to the transfer of some intellectual property

rights to an Irish subsidiary.

VMware, a Silicon Valley company that is majority-owned by Dell

Technologies Inc., holds a roughly 15% stake in Pivotal. The

proposed Pivotal deal, which the companies valued at $3.6 billion,

called for VMware paying a blended price of $11.71 a share for each

Pivotal share held.

Dell and Ford Motor Co., another investor in Pivotal, have

agreed to vote for the Pivotal deal, according to a securities

filing.

The Carbon Black deal offers $26 a share for each share held, a

deal the companies valued at $2.3 billion.

Both transactions are expected to close by Jan. 31, the end of

VMware's business year.

"The security industry is broken," Mr. Gelsinger said during a

conference call with analysts, adding that the "idea of individual

products that are bolted on and patched on is just ineffective for

customers."

Mr. Gelsinger said VMware and Carbon Black had been working

together for the past two years, "so we've really been de-risking

this acquisition."

VMWare on Thursday maintained annual projections of $10.03

billion in revenue, and said that Pivotal and Carbon Black would

boost operating income in the first year after the deal closes and

add to cash flow and earnings in year two.

Overall, second-quarter profit surged to $4.93 billion, or

$11.83 a share, from $644 million, or $1.56 a share, a year

earlier. On an adjusted basis, profit rose to $1.60 a share from

$1.54 a share a year earlier. Revenue rose 12% to $2.44

billion.

Analysts surveyed by FactSet expected $1.05 a share, or $1.55 a

share as adjusted, on $2.43 billion in revenue.

The results included a paper loss of $538 million from its

investment in Pivotal, which went public last year, compared with a

$231 million gain on the investment in the year-ago period.

The so-called fair value of the Pivotal investment is primarily

based on Pivotal's closing stock price on the last trading day of

each fiscal quarter. Pivotal started trading at $16.75 when it went

public but traded around $9 in early August, according to FactSet.

On Thursday, the stock closed at $13.70.

VMware will host its annual conference, VMworld, next week in

San Francisco.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

August 22, 2019 19:32 ET (23:32 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

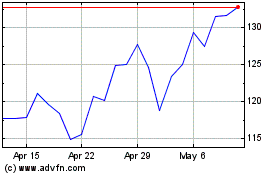

Dell Technologies (NYSE:DELL)

Historical Stock Chart

From Mar 2024 to Apr 2024

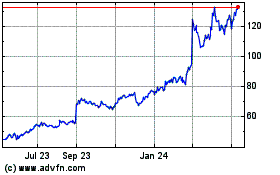

Dell Technologies (NYSE:DELL)

Historical Stock Chart

From Apr 2023 to Apr 2024