Prudential Pays $32.6 Million to Settle Probe of Mutual-Fund Business

17 September 2019 - 6:43AM

Dow Jones News

By Dave Michaels

WASHINGTON -- Prudential Financial Inc. agreed to pay $32.6

million to settle claims that it didn't disclose how a

reorganization of its mutual-fund business would cost the funds

millions in lost interest income.

The Securities and Exchange Commission on Monday said the 2006

reorganization -- intended to engineer tax benefits for Prudential

-- created a conflict of interest because the company benefited

while the funds lost income from securities lending. They also paid

higher taxes in certain foreign jurisdictions. In addition to

paying the fines, Prudential reimbursed over $155 million to the

funds, the SEC said in a settlement announcement.

Prudential neither admitted nor denied the claims. A company

spokesman didn't immediately respond to a request for comment.

"Investment advisers must be vigilant in monitoring for

conflicts related to actions taken by affiliates, and must act

consistently with their representations to their clients," said

Dabney O'Riordan, co-chief of the SEC's asset-management unit in

its enforcement division. Prudential's subsidiaries "acted to

benefit their parent company despite the costs those acts imposed

on their clients."

Write to Dave Michaels at dave.michaels@wsj.com

(END) Dow Jones Newswires

September 16, 2019 16:28 ET (20:28 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

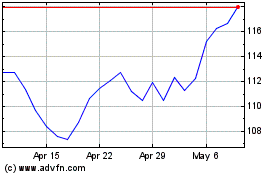

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Mar 2024 to Apr 2024

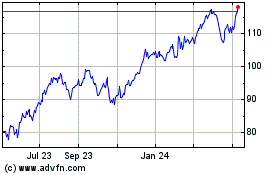

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Apr 2023 to Apr 2024