American workers putting more thought into choosing annual benefits, new Prudential survey shows

24 September 2019 - 10:00PM

Business Wire

Almost two-thirds of American workers did not automatically

choose the same benefits as the previous year, indicating they are

putting more thought into their choices during open enrollment,

“Employee Insights on Open Enrollment," a new survey released by

Prudential Financial (NYSE: PRU) today shows.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20190924005358/en/

(Graphic: Business Wire)

The survey of 2,000 employed adults, conducted by Morning

Consult on behalf of Prudential, found that just 35% of working

adults chose the same benefits as the previous year. Further, those

who took on a new job, an elevated role, or received a raise were

even more likely to select new benefits. In most cases, the 65% who

chose new benefits credited their employer for using a variety of

communication methods to keep them informed.

“Now the next big opportunity for employers is to think about

how to tailor those communications for populations most likely to

need them such as new employees, employees in new roles, employees

who received a raise or promotion, and those likely to experience a

life change,” said Leston Welsh, head of products at Prudential

Group Insurance.

Even the 35% who chose the same benefits made an informed

decision rather than simply checking the same boxes for

convenience, according to the survey. Of those choosing the same

benefits, 74% said they did so because they believed those benefits

were still appropriate for them. However, those who selected new

benefits were more likely to say their benefits reduced their

financial stress (79%) than those who selected the same benefits as

the previous year (62%).

American workers comfortable with automatic

enrollment

A majority of American workers (58%) also said that if

auto-enrolled in an insurance policy, they would likely keep it

rather than opt out. Just 5% said they would opt out, and 37% said

they would consider the cost before deciding whether to stick with

it.

While the findings suggest most individuals would be comfortable

with being defaulted into an insurance plan, there are still

misconceptions about insurance benefits that can affect their

decision making, Welsh explained.

“Many individuals assume that non-health insurance benefits cost

more than they actually do (e.g. the average annual premium for

voluntary critical illness insurance is $3251) and they are

hesitant to buy something they don’t think they will use,” Welsh

said.

“But the reality is that a serious illness will set most

Americans back financially much more than $325 if they don’t have

income protection in place. Auto-enrollment is a powerful tool that

can help ease uncertainty and take the pressure off during the

decision-making process.”

When offered by an employer, the non-health insurance benefits

most likely to be selected are life insurance (79%), accidental

death and dismemberment (AD&D) insurance (70%), short-term

disability (69%), long-term disability (65%), accident insurance

(63%), and hospital indemnity insurance (62%).

Methodology:

This poll was conducted by Morning Consult from August 27 - 28,

2019 among a national sample of 2,000 employed adults ages 18+

enrolled in at least 1 insurance benefit through their

employer. The interviews were conducted online and the data

were weighted to approximate a target sample of adults with based

on age, race/ethnicity, gender, educational attainment, and region.

Results from the full survey have a margin of error of plus or

minus 2 percentage points.

About Prudential Group Insurance

Prudential Group Insurance manufactures and distributes a full

range of group life, long-term and short-term disability and

corporate and trust-owned life insurance in the U.S. to

institutional clients primarily for use within employee and

membership benefit plans. The business also sells critical illness,

accidental death and dismemberment and other ancillary coverages.

In addition, the business provides plan and administrative services

in connection with its insurance coverages, and administrative

services for employee paid and unpaid leave, including FMLA, ADA

and PFL.

About Prudential Financial, Inc.

Prudential Financial, Inc. (NYSE: PRU), a financial wellness

leader and premier active global investment manager with more than

$1 trillion in assets under management as of June 30, 2019, has

operations in the United States, Asia, Europe, and Latin America.

Prudential’s diverse and talented employees help to make lives

better by creating financial opportunity for more people.

Prudential’s iconic Rock symbol has stood for strength, stability,

expertise and innovation for more than a century. For more

information, please visit news.prudential.com.

1026897-00001-00

1 “Voluntary Critical Illness Products 2019 Spotlight™ Report,”

Eastbridge Consulting Group, Inc. 2019.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190924005358/en/

MEDIA: Anjelica Sena 973-802-6930

anjelica.sena@prudential.com

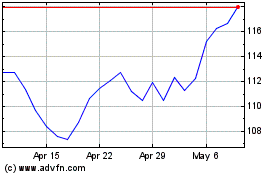

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Mar 2024 to Apr 2024

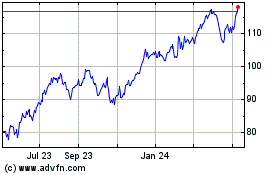

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Apr 2023 to Apr 2024