Google Shuts Out Payday Loans With App Store Ban

13 October 2019 - 12:55AM

Dow Jones News

By Yuka Hayashi

WASHINGTON -- Google has barred high-interest consumer loan

services from its app store, limiting payday lenders' access to

customers.

The tech giant recently prohibited apps from offering personal

loans with an annual percentage rate of 36% or higher on its Google

Play app store. The move inserted the technology giant into a fight

over payday loans, which often carry triple-digit interest rates.

The shift was quietly implemented in August with an update to

Google's app development guidelines for the Android operating

system, prompting an outcry from payday-lending companies.

"Our Google Play developer policies are designed to protect

users and keep them safe," a Google spokesman said. "We expanded

our financial services policy to protect people from deceptive and

exploitative personal loan terms."

Google's decision raises questions about large corporations

influencing markets for legal but controversial products. Retailers

such as Walmart Inc. and Dick's Sporting Goods Inc. have drawn

praise and criticism for decisions to restrict the sale of firearms

and related products in confronting gun violence. Several banks

including Bank of America Corp. and Morgan Stanley have said in

recent months they would cease doing business with companies that

run private prisons and detention centers.

"It hinges on the question of how we feel about a relatively

small number of companies who have achieved very significant market

power," said Brian Knight, director of innovation and governance at

George Mason University's Mercatus Center, a free-market advocacy

group. "And how do we feel about their using that power to try to

nudge or disavow certain legal business models?"

Google, owned by Alphabet Inc., in 2016 implemented a ban on

payday loan ads in its search browser, saying financial services

ads are "core to people's livelihood and well being."

Some states such as California and Ohio have taken new steps to

crack down on high-interest loans, while the Trump administration

has sought to reverse Obama-era policies aimed at reining in these

lenders. In California, Gov. Gavin Newsom on Thursday signed into

law a new 36% interest rate cap on consumer loans of $2,500 to

$10,000.

Payday loans are effectively banned in more than a dozen states

that impose interest rate caps, but are permitted in other

states.

Among the lenders affected by the new restriction are CURO

Financial Technology Corp., Enova International Inc. and MoneyLion.

To remain in Google Play, lenders would have to adjust their

products offered on Android apps to meet Google's requirements.

"What Google is doing is unfair in the commerce world," said

Mary Jackson, chief executive of Online Lenders Alliance, which

represents large online lenders including CURO and Enova. "It harms

legitimate operators and harms consumers looking for legal

loans."

CURO and MoneyLion didn't respond to requests for comment. An

Enova spokeswoman referred the question to the online lenders

group.

Android users could still use web browsers to sign up for and

manage high-interest loans, or download apps from non-Google

sources, though Google discourages such apps for security

reasons.

Consumer advocates praised Google's decision, citing overlap

between payday-loan customers, who tend to have lower incomes, and

users of Android devices, which are generally less expensive than

Apple Inc. products.

Comscore Inc., a data research firm, estimates that among

consumers belonging to households earning less than $25,000 a year,

51.8% own Android phones and 28.9% own iPhones. For those making

$250,000 or more, 30.8% own Android products and 59.7% own iPhones.

The estimates are based on surveys of 30,000 owners of mobile

phones and tablets conducted between June and August this year.

"This policy change effectively cuts off the Google Play store

as a vehicle for predatory loans," says Arisha Hatch, vice

president for Color of Change, an African-American advocacy group

that pressed Google for the app ban.

The group said it plans to push for a similar ban from Apple,

which didn't respond to its request earlier this year. An Apple

spokesman said the company periodically reviews its App Store

guidelines to "address new or emerging issue that affect our

customers," without discussing its policy on payday loan apps.

Write to Yuka Hayashi at yuka.hayashi@wsj.com

(END) Dow Jones Newswires

October 12, 2019 09:40 ET (13:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

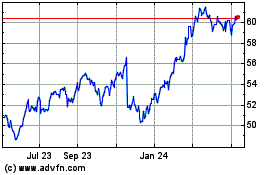

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

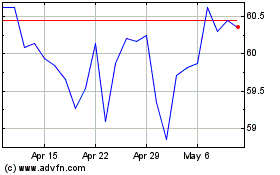

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024