TIDMTLOU

RNS Number : 0011Q

Tlou Energy Ltd

16 October 2019

16 October 2019

Tlou Energy Limited

("Tlou" or "the Company")

OPERATIONAL REPORT - QUARTERING 30 SEPTEMBER 2019

Tlou Energy Limited is an ASX, AIM and BSE listed company

focused on delivering power in Botswana and southern Africa through

the exploration and development of coal bed methane (CBM) natural

gas.

Key events during the previous quarter:

-- Lesedi 3 and 4 achieved initial sustained gas flows of

approximately 20 thousand standard cubic feet per day (Mcfd) from

each pod;

-- Gas flow rates anticipated to increase steadily as the coals become gas saturated;

-- Core-hole drilling utilising Tlou's own drilling rig

commenced in the Mamba project area, with the objective of

providing valuable data required for the expansion of the Company's

gas Reserves and Contingent Resources.

Dewatering and gas flow testing

During the quarter the Company's operations made excellent

progress with the Lesedi gas production pods having achieved

sustained gas production rates.

Following completion of the first phase of production testing,

including initial dewatering, reaching critical gas desorption

point and commencing gas production, the pods commenced producing

sustained gas flows. The initial rates were approximately 20

thousand standard cubic feet per day (Mcfd) from each pod. This was

an excellent start and the Company is very encouraged by production

data to date.

Gas production is continuing and, as with most new CBM

developments the rate is anticipated to continue increasing

following further reduction of pressure in the coal and additional

dewatering, with the aim to reach a peak and commercial gas flow

rate as soon as possible.

The current stage of production involves maintaining pressure on

the reservoir to further reduce water production, so that the

lateral wells become gas saturated, rather than water saturated.

This is followed by reducing pressure in the wells to the desired

level which, once achieved, is usually expected to significantly

increase the gas flows from the wells. This is a metholodical and

detailed process and takes time to achieve. The Company will update

the market on further progress in due course.

With CBM projects not yet established in this region, Tlou could

pioneer CBM development in the area. Successful results from this

project could potentially facilitate the opening up of a whole new

CBM basin in Botswana and be a significant boost not only for Tlou,

but for the whole region, with the potential for Tlou to supply

power within Botswana and also into neighbouring countries via the

Southern African Power Pool (SAPP).

Core-hole drilling

During the quarter, Tlou commenced core-hole drilling in the

Mamba project area. Operations are being conducted using Tlou's

core drilling rig and Tlou's experienced field-based personnel. As

the Company is not using external drilling contractors the costs of

core drilling are relatively low.

Core-hole drilling and core analysis provides valuable

information regarding coal quality and gas content. This data is

required for the expansion of the Company's gas Reserves and

Contingent Resources and providing information to assess new areas

for potential development.

Gas-to-Power Tender

In 2018 the Company submitted a tender to Botswana's Ministry of

Minerals Resources, Green Technology and Energy Security for the

Development of a CBM-fuelled power plant in Botswana and was

subsequently selected as a preferred bidder for this proposal.

If successful, the negotiations will result in the Company

agreeing a Power Purchase Agreement (PPA) with the Government of

Botswana, whereby Botswana Power Corporation (BPC), the national

electricity utility in Botswana, would purchase the power produced

by Tlou at the Lesedi project.

The tender negotiations are confidential and are being led by

the government of Botswana. The government has confirmed its

commitment to the development of CBM-fuelled pilot power plants and

is in the process of sourcing an advisor to assist them in tender

negotiations. Further information will be provided by the

government in due course, with the next update expected after

Botswana's general election later this month.

Forward plan

3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 Post 4Q20

* Gas flows from Lesedi 3P & 4P * Finalise PPA * Seismic (200km) * Start Poles & Wires * Generators & civils at Central Processing Facility * Target first electricity sales * Expansion to 10MW+

* Mamba Project drilling * Generation Licence Award * Reserve upgrade * Southern African Power Pool (SAPP) application * Boomslang Project EIS approval * SAPP membership approved

* Close development financing from Botswana * Boomslang drilling

------------------------------------------------------------ ----------------------------- ----------------------------------------------------------- --------------------------------------------------------------- ------------------------------------------- --------------------------

The Company's forward plan, subject to financing and operational

results, targets finalising a PPA and development financing as soon

as possible, with first electricity sales potentially in late 2020.

The Company will commit to significant field operations once

development, exploration and working capital funding has been

secured. The Company is listed on three exchanges so continually

monitors all corporate and operational costs with a view to reduce

or cut costs in any area not perceived to be adding value.

The Company is progressing funding options for the development

of the first 10MW of power generation as well as funding for

further exploration and working capital requirements. Significant

progress has been made with Botswana Development Corporation (BDC)

for financing of the full 10MW project. The total cost for the 10MW

project is estimated at USD$30m including 66kV transmission lines,

central processing facility (CPF), 10MW of generation assets and

additional production wells. The Company expects to complete

negotiations for the first phase of funding by the end of the

year.

Project areas

The Company has three project areas in Botswana:

-- Lesedi Project - Development, Exploration

-- Mamba Project - Exploration

-- Boomslang Project - Exploration

Lesedi CBM Project Area, Botswana

Licences: Mining Licence 2017/18L, Prospecting Licences 001

& 003/2004 and 35 & 37/2000

Ownership: Tlou Energy Limited 100%

The Lesedi project covers an area of approximately 3,800 Km(2)

and consists of four Coal and CBM Prospecting Licences (PL) and a

Mining Licence. The Mining Licence area is currently the focal

point for the Company's operations and includes the gas producing

Lesedi 3 and 4 development wells or 'pods'.

The Lesedi project is the Company's most advanced project, with

plans in place to install gas-fired electricity generators and

connect to the power grid in Botswana. Subject to results, the

first electricity sales could commence in late 2020.

The project has full environmental approval which includes gas

extraction, electricity generation and construction of transmission

lines. In addition, the Company has approval for 20MW of solar

generation. Clean CBM power is ideal for use in conjunction with

solar projects.

Tlou has the only CBM Mining Licence in Botswana. A mining

licence is required by an operator to develop a CBM asset. This

licence spans a large 900 Km(2) area and is valid until 2042 so the

Company has security of tenure over the project.

Tlou has the only independently certified CBM gas reserves in

Botswana, with 252 Billion Cubic Feet (BCF) of 3P gas Reserves

certified in the Lesedi project area. In addition, the 3C

Contingent Gas Resources are approximately 3 Trillion Cubic Feet

(TCF). The potential upside from further successful development of

this area is phenomenal.

The status of the Lesedi area licences is as follows:

Licence Expiry Status

Mining Licence 2017/18L August 2042 Current

--------------- --------

PL 001/2004 March 2021 Current

--------------- --------

PL 003/2004 March 2021 Current

--------------- --------

PL 035/2000 September 2020 Current

--------------- --------

PL 037/2000 September 2020 Current

--------------- --------

Mamba Project Area, Botswana

Licences: Prospecting Licences 237-241/2014

Ownership: Tlou Energy Limited 100%

The Mamba project consists of five Coal and CBM PL's covering an

area of approximately 4,500 Km(2) . The Mamba area is considered to

be highly prospective being situated adjacent to Tlou's Lesedi CBM

Project and being on-trend with the asset that has produced the

encouraging results observed to date. In the event of a gas field

development by Tlou, the Mamba area provides the Company with

considerable flexibility and optionality. Geographically, the Mamba

Project area is approximately 50 km closer to the Orapa Power

station than the Lesedi Project area.

Independently certified 3P Gas Reserves of 175 BCF are already

in place at the Mamba project. Core-hole drilling is ongoing in the

Mamba project which, along with a proposed seismic survey of the

area is aimed at significantly expanding the reserves footprint

across the Mamba project area.

The Mamba area has the potential to become a separate revenue

generating development project in addition to the proposed

development at Lesedi.

The status of the Mamba area licences is as follows:

Licence Expiry Status

PL 237/2014 September 2021 Current

--------------- --------

PL 238/2014 September 2021 Current

--------------- --------

PL 239/2014 September 2021 Current

--------------- --------

PL 240/2014 September 2021 Current

--------------- --------

PL 241/2014 September 2021 Current

--------------- --------

Boomslang Project Area, Botswana

Licence: Prospecting Licence 011/2019

Ownership: Tlou Energy Limited 100%

The Company's most recently acquired Prospecting Licence,

PL011/2019 designated "Boomslang", is valid for an initial term of

3 years. The licence area is approximately 1,000 Km(2) and is

situated adjacent to the Company's existing licences. The Boomslang

area is also located on-trend with the asset that has produced the

encouraging results observed to date at the Lesedi project and

considered to be highly prospective.

The Boomslang licence area provides the Company further

flexibility and optionality for development of different

projects.

The Company is awaiting confirmation of environmental approval

to commence exploration operations in the Boomslang area. This is

expected to be granted in mid-2020, thereafter initial exploration

operations are planned for this area.

The status of the Boomslang area licence is as follows:

Licence Expiry Status

PL 011/2019 March 2022 Current

----------- --------

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

****

For further information regarding this announcement please

contact:

Tlou Energy Limited +61 7 3012 9793

Tony Gilby, Managing Director

----------------------

Solomon Rowland, General Manager

----------------------

Grant Thornton (Nominated Adviser) +44 (0)20 7383 5100

----------------------

Samantha Harrison, Colin Aaronson, Harrison

Clarke, Seamus Fricker

----------------------

Shore Capital (Broker) +44 (0) 207 408 4090

----------------------

Jerry Keen, Toby Gibbs, Mark Percy

----------------------

+44 (0) 7891 677

FlowComms Limited (Investor Relations) 441

----------------------

Sasha Sethi

----------------------

Vigo Communications (Financial PR) +44 (0) 20 7390 0230

----------------------

Patrick d'Ancona, Simon Woods

----------------------

Company Information

Tlou Energy is focused on delivering Gas-to-Power solutions in

Botswana and southern Africa to alleviate some of the chronic power

shortage in the region. Tlou is developing projects using coal bed

methane (CBM) natural gas. Botswana has a significant energy

shortage and generally relies on imported power and diesel

generation to fulfil its power requirements. As 100% owner of the

most advanced gas project in the country, the Lesedi CBM Project,

Tlou Energy provides investors with access to a compelling

opportunity using domestic gas to produce power and displace

expensive diesel and imported electricity.

The Company is listed on the Australian Securities Exchange,

London's AIM market and the Botswana Stock Exchange and is led by

an experienced Board, management and advisory team including

individuals with successful track records in the CBM industry.

Since establishment, the Company has significantly de-risked the

project in consideration of its goal to become a significant

gas-to-power producer. The Company flared its first gas in 2014 and

has a 100% interest over its Mining Licence and ten Prospecting

Licences covering an area of 9,300 Km(2) in total. The Lesedi and

Mamba Projects already benefit from significant independently

certified 2P gas Reserves of 41 BCF. In addition, 3P gas Reserves

of 427 BCF and Contingent Gas Resources of 3,043 BCF provide

significant additional potential.

The Company is planning an initial scalable gas-to-power

project. Following successful implementation of this first scalable

project, the Company looks forward to evaluating longer-term

prospects for the delivery of electricity generated from CBM in

Botswana to neighbouring countries.

+Rule 5.5

Appendix 5B

Mining exploration entity and oil and gas exploration entity

quarterly report

Introduced 01/07/96 Origin Appendix 8 Amended 01/07/97,

01/07/98, 30/09/01, 01/06/10, 17/12/10, 01/05/13, 01/09/16

Name of entity

-----------------------------------------------------

Tlou Energy Limited

ABN Quarter ended ("current quarter")

--------------- ----------------------------------

79 136 739 967 30 September 2019

----------------------------------

Consolidated statement of cash Current quarter Year to date

flows $A'000 (3 months)

$A'000

1. Cash flows from operating

activities

1.1 Receipts from customers

1.2 Payments for

(a) exploration & evaluation (587) (587)

(b) development (9) (9)

(c) production

(d) staff costs (389) (389)

(e) administration and corporate

costs (315) (315)

1.3 Dividends received (see note

3)

1.4 Interest received

1.5 Interest and other costs of

finance paid

1.6 Income taxes paid

1.7 Research and development refunds

1.8 Other 254 254

---------------- ----------------

Net cash from / (used in)

1.9 operating activities (1,046) (1,046)

----- ------------------------------------- ---------------- ----------------

2. Cash flows from investing

activities

2.1 Payments to acquire:

(a) property, plant and equipment (21) (21)

(b) tenements (see item 10)

(c) investments

(d) other non-current assets

2.2 Proceeds from the disposal

of:

(a) property, plant and equipment

(b) tenements (see item 10)

(c) investments

(d) other non-current assets

2.3 Cash flows from loans to

other entities

2.4 Dividends received (see note

3)

2.5 Other (provide details if

material)

---------------- ----------------

Net cash from / (used in)

2.6 investing activities (21) (21)

------- ----------------------------------- ---------------- ----------------

3. Cash flows from financing

activities

3.1 Proceeds from issues of shares

3.2 Proceeds from issue of convertible

notes

3.3 Proceeds from exercise of

share options

3.4 Transaction costs related

to issues of shares, convertible

notes or options

3.5 Proceeds from borrowings

3.6 Repayment of borrowings

3.7 Transaction costs related

to loans and borrowings

3.8 Dividends paid

3.9 Other (provide details if

material)

---------------- ----------------

3.10 Net cash from / (used in) - -

financing activities

------- ----------------------------------- ---------------- ----------------

4. Net increase / (decrease)

in cash and cash equivalents

for the period

Cash and cash equivalents

4.1 at beginning of period 5,205 5,205

Net cash from / (used in)

operating activities (item

4.2 1.9 above) (1,046) (1,046)

Net cash from / (used in)

investing activities (item

4.3 2.6 above) (21) (21)

4.4 Net cash from / (used in) - -

financing activities (item

3.10 above)

Effect of movement in exchange

4.5 rates on cash held (19) (19)

---------------- ----------------

Cash and cash equivalents

4.6 at end of period 4,119 4,119

------- ----------------------------------- ---------------- ----------------

5. Reconciliation of cash and Current quarter Previous quarter

cash equivalents $A'000 $A'000

at the end of the quarter

(as shown in the consolidated

statement of cash flows) to

the related items in the accounts

5.1 Bank balances 4,119 5,205

5.2 Call deposits

5.3 Bank overdrafts

5.4 Other (provide details)

---------------- -----------------

Cash and cash equivalents

at end of quarter (should

5.5 equal item 4.6 above) 4,119 5,205

---- ----------------------------------- ---------------- -----------------

6. Payments to directors of the entity and Current quarter

their associates $A'000

Aggregate amount of payments to these parties

6.1 included in item 1.2 256

----------------

6.2 Aggregate amount of cash flow from loans

to these parties included in item 2.3

----------------

6.3 Include below any explanation necessary to understand

the transactions included in items 6.1 and 6.2

----- -----------------------------------------------------------------

Office rent, Directors fees and salaries

7. Payments to related entities of the entity Current quarter

and their associates $A'000

7.1 Aggregate amount of payments to these parties

included in item 1.2

----------------

7.2 Aggregate amount of cash flow from loans

to these parties included in item 2.3

----------------

7.3 Include below any explanation necessary to understand

the transactions included in items 7.1 and 7.2

---- ----------------------------------------------------------------

8. Financing facilities available Total facility Amount drawn

Add notes as necessary for amount at quarter at quarter end

an understanding of the position end $A'000

$A'000

8.1 Loan facilities

------------------- ----------------

8.2 Credit standby arrangements

------------------- ----------------

8.3 Other (please specify)

------------------- ----------------

8.4 Include below a description of each facility above, including

the lender, interest rate and whether it is secured or

unsecured. If any additional facilities have been entered

into or are proposed to be entered into after quarter

end, include details of those facilities as well.

---- -------------------------------------------------------------------------

9. Estimated cash outflows for next $A'000

quarter

9.1 Exploration and evaluation 296

9.2 Development

9.3 Production

9.4 Staff costs 408

9.5 Administration and corporate costs 286

9.6 Other (Equipment)

-------

9.7 Total estimated cash outflows 990

---- ----------------------------------- -------

10. Changes in tenements Tenement Nature of interest Interest Interest

(items 2.1(b) reference at beginning at end

and 2.2(b) above) and location of quarter of quarter

10.1 Interests in

mining tenements

and petroleum

tenements lapsed,

relinquished

or reduced

----- --------------------- -------------- ------------------- -------------- ------------

10.2 Interests in

mining tenements

and petroleum

tenements acquired

or increased

----- --------------------- -------------- ------------------- -------------- ------------

Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Sign here: .....Solomon Rowland.................. Date: .....16

October 2019.....

(Director/Company secretary)

Print name: ......Solomon Rowland................

Notes

1. The quarterly report provides a basis for informing the

market how the entity's activities have been financed for the past

quarter and the effect on its cash position. An entity that wishes

to disclose additional information is encouraged to do so, in a

note or notes included in or attached to this report.

2. If this quarterly report has been prepared in accordance with

Australian Accounting Standards, the definitions in, and provisions

of, AASB 6: Exploration for and Evaluation of Mineral Resources and

AASB 107: Statement of Cash Flows apply to this report. If this

quarterly report has been prepared in accordance with other

accounting standards agreed by ASX pursuant to Listing Rule 19.11A,

the corresponding equivalent standards apply to this report.

3. Dividends received may be classified either as cash flows

from operating activities or cash flows from investing activities,

depending on the accounting policy of the entity.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCXELLFKBFLFBD

(END) Dow Jones Newswires

October 16, 2019 02:00 ET (06:00 GMT)

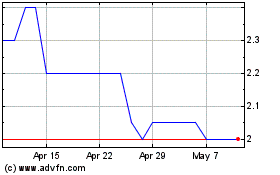

Tlou Energy (LSE:TLOU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tlou Energy (LSE:TLOU)

Historical Stock Chart

From Apr 2023 to Apr 2024