Schwab, in Bid for Younger Clients, to Allow Investors to Buy and Sell Fractions of Stocks -- Update

18 October 2019 - 8:05AM

Dow Jones News

By Lisa Beilfuss

Charles Schwab Corp. will let investors buy and sell fractions

of shares in coming months as part of an effort to attract younger

clients to its online brokerage platform.

Founder and Chairman Charles R. Schwab told The Wall Street

Journal Thursday that fractional share trading would soon be

introduced, along with several other new programs, as the online

brokerage looks ahead after it eliminated trading commissions

earlier this month. Mr. Schwab discussed the firm's future after

speaking about his new book, "Invested, " in New York.

"I wanted to take commissions out of the formula," Mr. Schwab

said. "We've been on that path for 40 years," he said, reflecting

back on the company's start as one of the first discount

brokerages.

Now, Mr. Schwab said the company is focusing on efforts to

expand access to investing, particularly to young people.

Schwab's decision to scrap trading commissions followed a

similar move by Interactive Brokers Group Inc., and it prompted

rivals TD Ameritrade Holding Corp. and E*Trade Financial Corp. to

swiftly match.

With commission-free trading now the norm, e-brokers must find

new ways to attract clients who might boost other parts of the

business -- such as banking or financial advice -- and who could

become more lucrative as their investments grow.

Schwab's move would be the first by a major online brokerage to

allow investors to buy and sell fractions of stocks. Some of the

most well-known and popular companies have high price tags, making

owning a share impossible for some would-be investors. A share of

Amazon.com Inc., for example, costs around $1,794.

In addition, fractional shares can help younger and less-wealthy

investors diversify their investment portfolios by spreading

relatively small pots of money over a broader range of stocks.

"It's about widening the net," said Richard Repetto, a brokerage

analyst at Sandler O'Neill + Partners LP. Allowing clients to own

slivers of companies reflects Schwab's emphasis on bringing in new

customers that can develop into more profitable accounts over time,

Mr. Repetto said.

When Schwab said this month that it would forgo trading

commissions, it acknowledged competitive pressure from new

entrants. Digital upstarts such as Robinhood Markets Inc. helped

popularize the zero-commission model in the online-brokerage

business, attracting millions of young clients through trading

apps.

Fractional trading is already offered by a handful of newer

online brokerages. One such company is M1 Finance LLC, a

Chicago-based company that splits every share of stock into

1/100,000 of a share. Brian Barnes, M1's chief executive, said

clients trade about 250,000 fractional shares a day. In comparison,

E*Trade's clients trade an average of 268,000 shares a day.

Financial-technology startup Social Finance Inc. has also waded

into fractional share trading. It launched its fractional trading

program in July, after noticing some clients delayed investing and

chose companies based on share price, rather than fundamentals, it

said.

Schwab didn't specify when the program would launch or elaborate

on plans for other new programs meant to woo young clients. "We're

constantly working on new services designed to appeal to our

evolving client base," a spokeswoman said.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

October 17, 2019 16:50 ET (20:50 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

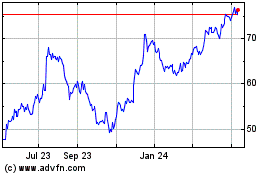

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

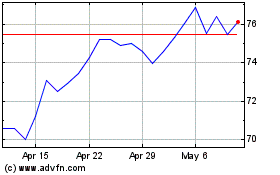

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024