TIDMITV

RNS Number : 0386T

ITV PLC

12 November 2019

ITV plc Q3 Trading Update - 9 months to 30 September 2019

ITV on track to deliver full year guidance

Carolyn McCall, ITV Chief Executive, said:

"ITV's overall performance for the first nine months of 2019 was

as we expected, and although the economic environment continues to

be uncertain, we are making good progress in executing our

strategy. We have successfully launched BritBox and are encouraged

by the positive feedback received on the service so far. We have

also agreed a distribution and marketing deal with BT and EE and a

content partnership with Channel 4. Development of our addressable

advertising platform is on track for a roll out to media agencies

in Q1 2020.

"ITV Studios' performance in 2019 will benefit from a very

strong second half delivery schedule and our Q3 performance

reflects this, with good growth across the business, particularly

from ITV America with Love Island US and the part delivery of

Hell's Kitchen and Snowpiercer. We expect this performance to

continue in Q4, and over the full year we are confident that we

will deliver at least 5% growth in ITV Studios' total revenues at a

margin of 14% to 16%.

"The phasing of deliveries in the second half of 2019 will

adversely impact ITV Studios' performance in 2020 although we

continue to expect that over the medium term ITV Studios revenues

will grow by at least 5% CAGR with a 14% to 16% margin. We continue

to build our creative pipeline and have a strong slate of new and

returning programmes in the UK and internationally for both

broadcasters and OTT platforms, including The Serpent, Zero Zero

Zero, Suburra, Crank Yankers, Queer Eye, Saturday Night Takeaway,

and Love Island globally.

"On screen and online viewing performed well with highlights

including four of the five highest rating new dramas so far this

year and the Rugby World Cup which saw a peak audience of 12.8m

viewers during the final. We have reached our 2021 target of 30m

registered users on ITV Hub ahead of plan. We have an exciting

schedule for the remainder of the year and into next year,

including I'm A Celebrity... Get Me Out of Here!, Sticks and

Stones, England qualifiers for the 2020 European Football

Championships, The Masked Singer, Flesh and Blood, and the return

of Saturday Night Takeaway and Liar.

"Online revenues continue to grow strongly, up 23% for the first

nine months. Total advertising revenue was up 1% in Q3, at the top

end of our guidance. We expect Q4 to be flat to up 1%, and as a

result to be down around 2% across the full year.

"Our cost programme is on track to deliver GBP20m of savings

this year and GBP55m to GBP60m over the four years to 2022. We are

confident in delivering our 2019 full year guidance.

"We remain very focused on building a digitally led media and

entertainment company to create a stronger, more diversified and

structurally sound business. We have a solid balance sheet which

enables us to make the right investment decisions and deliver

returns to shareholders in line with our guidance of at least an 8p

dividend for 2019."

Performance for the 9 months in line with our expectations

-- Total external revenues down 2% at GBP2,209m (2018: GBP2,257m)

-- Total ITV Studios revenue up 1% at GBP1,116m with organic growth flat, at constant currency

-- Broadcast & Online revenue down 3% at GBP1,464m (2018:

GBP1,509m) with ITV total advertising down 3% as guided and online

revenues up 23%

Continued good performance

-- ITV Studios delivered a successful slate of new and returning

programmes in Q3, with a strong Q4 expected, particularly in the

US

-- Continued good viewing onscreen and online, with ITV Family

share of viewing maintained and online viewing up 10% against tough

comparators of the Football World Cup last year

-- Strategy progressing well;

o BritBox successfully launched and we have agreed a

distribution and marketing deal with BT and EE and a content

partnership with C4.

o Currently in the testing phase of the programmatic addressable

advertising platform, Planet V

o ITV Hub has reached its target of 30m registered users two

years early

On track to deliver our full year guidance

-- Confident that ITV Studios will deliver revenue growth of at least 5% at a 14% to 16% margin

-- The phasing of deliveries in the second half of 2019 will

adversely impact ITV Studios' performance in 2020 although we

continue to expect that over the medium term ITV Studios revenues

will grow by at least 5% CAGR with a 14% to 16% margin

-- Total advertising revenue forecast to be down around 2% for the full year

-- Will deliver double-digit revenue growth in Online, and revenue growth in Direct to Consumer

-- Network programme budget (NPB) will be GBP1,090m in 2019,

GBP10m lower than previous guidance due to the timing of European

qualifier games, some of which will broadcast in 2020 and therefore

the NPB in 2020 will be GBP1,110m

-- Cost programme on track to deliver GBP20m of savings in 2019

-- We will maintain a solid balance sheet and deliver on our

full year dividend guidance of at least 8.0p per share

NOTES TO EDITORS

1. Unless otherwise stated, all financial and operating figures

refer to the 9 months ended 30 September 2019, with growth compared

to the same period in 2018.

2.

Revenue for 9 months ended 30 September

(GBPm) 2019 2018 %

======================================== ===== ===== ===========

ITV Broadcast & Online 1,464 1,509 (3)

======================================== ===== ===== ===========

ITV Studios 1,116 1,107 1

======================================== ===== ===== ===========

Total revenue 2,580 2,616 (1)

======================================== ===== ===== ===========

Internal supply (371) (359) (3)

======================================== ===== ===== ===========

Total external revenue 2,209 2,257 (2)

======================================== ===== ===== ===========

Revenue for 9 months ended 30 September

(GBPm) 2019 2018 %

======================================== ===== ===== ===

Total advertising revenue 1,249 1,285 (3)

======================================== ===== ===== ===

Non-advertising revenue 1,331 1,331 -

======================================== ===== ===== ===

Internal supply (371) (359) (3)

======================================== ===== ===== ===

Total external revenue 2,209 2,257 (2)

======================================== ===== ===== ===

3. Total advertising, which includes ITV Family NAR, online VOD

and sponsorship, was down 3% over the 9 months to end of September

and was up 1% in Q3, with July down 5%, August up 3%, and September

up 6%. Total advertising is forecast to be flat to up 1% in Q4 with

October up 5%, November flat to down 1% and December flat to down

3%. Over the full year we expect total advertising to be down

around 2%. Figures for ITV plc are based on ITV estimates and

current forecasts.

4. Operational summary

Broadcast & Online performance indicators

- 9 months ended 30 September 2019 2018 %

========================================== ====== ====== ===

ITV Total viewing (hrs) 12.0bn 12.7bn (6)

========================================== ====== ====== ===

ITV Family SOV 23.2% 23.3% -

========================================== ====== ====== ===

Long form online viewing (hrs) 378m 346m 10

========================================== ====== ====== ===

ITV Hub registered users 30.1m 26.9m 12

------------------------------------------ ====== ====== ===

-- Total viewing is the total number of hours spent watching ITV

channels live, recorded broadcast channels within 28 days, third

party VOD platforms, ITV Hub on owned and operated ad funded

platforms, and managed YouTube channels.

-- SOV data based on BARB/AdvantEdge. SOV data is for

individuals and is based on 7 days (C7). ITV Family includes: ITV,

ITV2, ITV3, ITV4, ITV Encore, ITVBe, CITV, ITV Breakfast, CITV

Breakfast and associated "HD" and "+1" channels. All viewing on TV

set, therefore includes catch up and Hub on television.

-- Long form online viewing is the total number of hours ITV VOD

content is viewed on owned and operated ad funded platforms, and

Hub+ viewing on owned and operated platforms, based on data from

Crocus.

-- A registered user is an individual viewer who has signed up

to the ITV Hub. The individual has to have been active within the

last 3 years to remain a registered user.

-- % change for performance indicators is calculated on

unrounded numbers.

5. Total external ITV Studios revenues were flat at GBP747m

(2018: GBP749m]. Total Studios organic revenue at constant currency

was flat at GBP1,099m for the first 9 months of 2019 (2018:

GBP1,103m). The favourable translation impact of foreign exchange

on revenue was GBP10m over that period. Our definition of constant

currency assumes exchange rates remain consistent with 2018. The

translation impact of foreign exchange, assuming rates remain at

current levels, could favourably impact revenues by around GBP15m

to GBP20m and adjusted EBITA by around GBP2m over the full

year.

6. Net debt at 30 September 2019 was GBP1,167m (30 June 2019:

GBP1,082m). In September ITV issued a new EUR600m 7 year Eurobond

at a coupon of 1.375% which was swapped into sterling using a

number of cross currency swaps. The net sterling interest rate

payable on these swaps is 2.94%. The proceeds of the bond were used

to partly refinance the existing notes which expire in 2022 and

2023 to extend ITV's debt maturity, and to pay down part of the

Revolving Credit Facility.

7. The net pension deficit of the defined benefit schemes at 30

September 2019 was GBP2m (30 June 2019: GBP105m). The decrease in

the deficit was driven by our deficit funding contribution and an

increase in asset values more than offsetting the increase in

liabilities arising from a fall in corporate bond yields.

8. On 8 November 2019, ITV exchanged contracts for the sale of

the London Television Centre on the South Bank to Mitsubishi Estate

London Limited in an all-cash transaction for GBP145.6m. Completion

is expected to occur by the end of November. In 2014, ITV

established a Pension Funding Partnership with the Trustees backed

by The London Television Centre which resulted in the assets of

Section A of the defined benefit pension scheme being increased by

GBP50m. Part of proceeds of the sale of the South Bank site, net of

tax and fees, will be used to replace the asset security, and the

remaining sale proceeds used to reduce ITV's net debt. The

accounting profit on the sale of the South Bank will be treated as

exceptional.

9. Figures presented in this Trading Statement are not audited.

This announcement contains certain statements that are or may be

forward looking with respect to the financial condition, results or

operations and business of ITV. By their nature forward looking

statements involve risk and uncertainty because they relate to

events and depend on circumstances that will occur in the future.

There are a number of factors that could cause actual results and

developments to differ materially from those expressed or implied

by such forward looking statements. These factors include, but are

not limited to (i) significant change in regulation or legislation,

(ii) the impact of a financial crisis or macroeconomic change,

(iii) a faster than expected shift towards non-linear viewing, (iv)

a major deterioration in the current outlook for UK advertising and

consumer demand, (v) failure to identify and obtain, or significant

loss of, optimal programme rights.

Undue reliance should not be placed on forward looking

statements which speak only as of the date of this document. The

Group accepts no obligation to revise publicly or update these

forward looking statements or adjust them to future events or

developments, whether as a result of new information, future events

or otherwise, except to the extent legally required.

For further enquiries please contact:

Investor Relations

Pippa Foulds +44 20 7157 6555 or +44 7778 031097

Faye Dipnarine +44 20 7157 6581

Media Relations

Paul Moore +44 7860 794444

Grant Cunningham +44 20 7157 3023 or +44 7764 210742

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTKFLFFKFFFFBQ

(END) Dow Jones Newswires

November 12, 2019 02:00 ET (07:00 GMT)

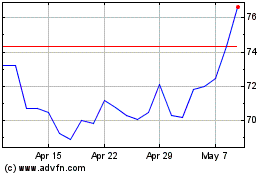

Itv (LSE:ITV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Itv (LSE:ITV)

Historical Stock Chart

From Apr 2023 to Apr 2024