By Harriet Torry

WASHINGTON -- The U.S. economic expansion remained on solid

ground as it entered the fourth quarter, although some signs

pointed to weaker consumer spending this holiday season.

An initial snapshot of the year-end trends emerged Wednesday

when the Commerce Department, in separate reports, said household

spending picked up in October and orders for long-lasting factory

goods rose -- both positive signs for growth.

The department also said the U.S. economy expanded at a slightly

better pace than initially estimated in the third quarter, despite

a continuing slump in business investment.

"Growth is still on track" despite recent challenges including a

40-day strike at General Motors Co. and the grounding of Boeing

Co.'s 737 MAX airliner, said Brian Bethune, an economist at Tufts

University.

Investors cheered both the economic data and optimistic comments

Tuesday from President Trump on progress in the trade talks between

China and the U.S., which drove the S&P 500 higher.

Gross domestic product -- the value of all goods and services

produced across the economy -- rose at a 2.1% annual rate in the

third quarter, adjusted for seasonality and inflation, the

department said. That was up from the previous estimate of a 1.9%

pace of growth, mainly due to stronger inventory investment.

The latest reading "indicates the economy is not about to fall

off a cliff," Oxford Economics said in a note to clients. "However,

the lingering global industrial slump, persistent trade policy

uncertainty and cooling income growth all point to weaker activity

in the coming months," economists Gregory Daco and Lydia Boussour

said.

Growth in the fourth quarter, now in its ninth week, is shaping

up to be a bit below the roughly 2% pace seen in the prior two

quarters. Forecasting firm Macroeconomic Advisers on Wednesday

projected GDP would expand at a 1.8% rate in the fourth

quarter.

U.S. shoppers have been the economy's driving force over the

past two quarters as business investment declined. But there are

signs that consumer momentum could be fading. The Commerce

Department said households increased spending a seasonally adjusted

0.3% in October from September, but much of that rise was due to

higher outlays on electricity and gas.

Spending on long-lasting items like vehicles declined in

October, and household incomes were flat overall.

Weakening consumer confidence could also be a cause for concern

as the fourth quarter gets under way. On Tuesday, the Conference

Board reported its consumer confidence index fell in November for

the fourth consecutive month.

Consumer spending accounts for more than two-thirds of total

economic output, and Wednesday's data showed Americans' outlays

grew at a solid, though slower, pace in the July-to-September

period compared with April to June. Personal-consumption

expenditures rose at an unrevised 2.9% annual rate in the third

quarter, compared with 4.6% in the second quarter.

Retailers reporting quarterly sales thus far provide conflicting

views on the health of the American consumer heading into the

pivotal holiday season.

Department-store chains Kohl's Corp., Macy's Inc., Nordstrom

Inc. and J.C. Penney Co. have reported weak sales, but Target

Corp., Amazon.com Inc., Walmart Inc., Best Buy Co. and TJX Co s.

have logged strong gains.

Jamie Lanza, co-founder of Tampa, Fla.-based fitness studio Camp

Tampa, said the back-to-school months of September and October are

typically slower than the earlier months of the year, but

merchandise sales have increased headed into the holidays. "People

are prioritizing things that feel good" like exercise classes, she

said.

Business investment, though, remains a weak spot for the

economy. Nonresidential fixed investment -- which reflects business

spending on software, research and development, equipment and

structures -- fell at a 2.7% annual rate in the third quarter

following a 1% pace of decline in the prior quarter.

U.S. corporate profits also fell in the third quarter, according

to the government's first broad estimate, due in part to legal

settlements with Facebook Inc. and Google parent Alphabet Inc.

A key measure of business earnings -- profit after tax without

inventory valuation and capital-consumption adjustments -- fell

0.6% from the prior quarter after rising 3.3% in the second

quarter. Compared with the third quarter a year earlier, after-tax

profits were down 0.4%.

Paul Miller, vice president of Park Hills, Missouri-based

plastic and rubber product manufacturer MOCAP LLC, said business

has slowed this year, particularly since June. He attributes that

to uncertainty surrounding the U.K.'s exit from the European Union

and the trade dispute with China.

The company's U.S. operation "is kind of holding steady, but

it's just not in growth mode," he said. Still, the company is

planning to build a new factory in Missouri due to savings the

company made from the 2017 tax overhaul, which cut corporate tax

rates and allowed immediate deductions for capital investment.

"For us, the tariffs, yeah they're negative, but the tax savings

were so substantial that it's more of a nuisance, it wasn't

devastating," Mr. Miller said.

One concern posed by weakness in corporate profits is that the

labor market could deteriorate if boardrooms slow hiring or lay off

workers to cut costs, which would likely hit consumer spending.

Still, for now the labor market remains strong. The number of

Americans applying for first-time unemployment benefits fell last

week, the Labor Department said Wednesday. More broadly, the

unemployment rate was a low 3.6% in October and the labor market

continued to add jobs, albeit at a slower pace than in the previous

two months.

Wednesday's reports are unlikely to sway U.S. central-bank

officials from their current wait-and-see stance on monetary

policy.

The Federal Reserve has cut interest rates three times this

year, most recently in October, on worries that weakness in

manufacturing, trade and business investment could threaten the

economic expansion by triggering cutbacks in hiring and consumer

spending.

Officials meet in Washington in two weeks' time for the last

scheduled policy gathering of 2019.

Speaking in Providence, R.I., on Monday, Fed Chairman Jerome

Powell said that "as this expansion continues into its 11th year,

the longest in U.S. history, economic conditions are generally

good."

"If the outlook changes materially, policy will change as well,"

he said.

Write to Harriet Torry at harriet.torry@wsj.com

(END) Dow Jones Newswires

November 27, 2019 14:27 ET (19:27 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

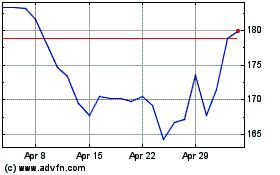

Boeing (NYSE:BA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boeing (NYSE:BA)

Historical Stock Chart

From Apr 2023 to Apr 2024