UniCredit to Cut Stake in Turkish Bank Yapi Kredi

02 December 2019 - 6:14PM

Dow Jones News

By Pietro Lombardi

UniCredit SpA (UCG.MI) has reached a deal to cut its stake in

Turkish bank Yapi ve Kredi Bankasi AS (YKBNK.IS) to below 32% in a

further step aimed at simplifying its shareholding structure.

The move, which analysts see as a step to potentially exit

Turkey, comes ahead of the Italian bank's new strategic plan to be

presented Tuesday and follows a string of disposals in recent years

that have helped simplify the bank's structure and boost its

capital.

The Italian bank currently holds roughly 41% of the Turkish bank

through a joint venture, Koc Financial Services. UniCredit will

exit the joint venture and its partner, Turkey's Koc Group, will

take full control of it, the bank said Saturday. The joint venture

currently holds roughly 82% of the Turkish bank.

As part of the deal, Koc Financial Services will sell a 31.93%

stake in Yapi Kredi to UniCredit and 9.02% to Koc.

UniCredit expects to report overall charges of roughly 1 billion

euros ($1.10 billion) related to the deal, whose consideration will

be close to nil in terms of cash, it said. The transaction, which

should be completed in the first half of next year, should improve

the core Tier 1 ratio, a key measure of capital strength, by

mid-single-digit basis points.

"The transaction is part of UniCredit's on-going strategy to

simplify its shareholdings and to optimize its capital allocation,"

it said.

"Stage 1 of exiting [is] Turkey completed," Jefferies said.

The move "supports our case on balance-sheet simplification

driving strategic flexibility and additional capital return to

shareholders."

The bank, which is Italy's largest, has sold a number of assets

in recent years, including Polish lender Bank Pekao SA and asset

manager Pioneer. More recently, it sold its stakes in online lender

FinecoBank SpA (FBK.MI), and Mediobanca SpA (MB.MI). As part of a

strategy it launched to address a number of issues, including a

large pile of bad loans, the bank also cut costs, sold soured loans

and raised EUR13 billion of fresh capital.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

December 02, 2019 01:59 ET (06:59 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

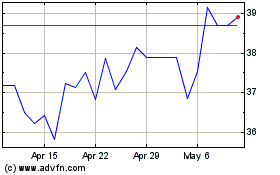

Unicredito (PK) (USOTC:UNCFF)

Historical Stock Chart

From Mar 2024 to Apr 2024

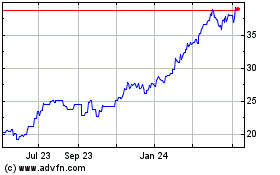

Unicredito (PK) (USOTC:UNCFF)

Historical Stock Chart

From Apr 2023 to Apr 2024