Dollar Mixed After U.S. Consumer Inflation Data

14 January 2020 - 8:22PM

RTTF2

The U.S. dollar showed mixed trading against its major

counterparts in European trading on Tuesday, after the release of

consumer inflation data that improved less than forecast for

December.

While the greenback rose against the euro, it showed little

reaction against other major opponents.

Data from the Labor Department showed that consumer prices

increased slightly less than anticipated in December.

The Labor Department said its consumer price index rose by 0.2

percent in December after climbing by 0.3 percent in November.

Economists had been expecting another 0.3 percent increase.

Excluding food and energy prices, core consumer prices inched up

by 0.1 percent in December after rising by 0.2 percent in November.

Core prices had been expected to rise by another 0.2 percent.

Investors awaited the signing of a Phase I trade deal between

the United States and China on Wednesday.

The deal is a major step towards ending the tariff war that has

hurt the global economy.

Ahead of the signing ceremony, the U.S. Treasury Department

dropped its designation of China as a currency manipulator.

U.S. Trade Representative Robert Lighthizer told Fox Business

that the Chinese translation of the deal's text was almost done and

would be made public before the signing ceremony on January 15.

The currency held steady against its major counterparts in the

Asian session, except the yen.

The greenback rose to a 4-day high of 1.1105 against the euro

from Monday's closing value of 1.1134. Next key resistance for the

greenback is likely seen around the 1.10 level.

The USD/JPY pair held steady, trading at 110.00. This followed

an 8-month peak of 110.21 seen in the Asian session. The dollar-yen

pair was worth 109.94 when it ended deals on Monday.

Data from the Ministry of Finance showed that Japan posted a

current account surplus of 1,436.8 billion yen in November- up 75

percent on year.

That exceeded expectations for a surplus of 1,424.8 billion yen

following the 1,816.8 billion yen surplus in October.

The greenback bounced off to 0.9705 against the franc, from a

6-day low of 0.9668 hit at 6:45 am ET. The greenback is seen

finding resistance around the 0.98 mark.

After easing off from a 3-week high of 1.2954 set at 3:15 am ET,

the greenback held steady against the pound. The pound-greenback

pair had ended yesterday's trading session at 1.2989.

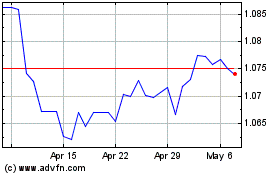

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Apr 2023 to Apr 2024