By Christopher M. Matthews

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 1, 2020).

Exxon Mobil Corp. is still struggling to bolster its bottom

line, nearly two years into a plan to substantially boost oil and

gas production by spending more than rivals.

The Texas giant reported a 5% drop in fourth-quarter earnings

Friday compared with the same period in 2018, the latest in a

procession of energy companies posting declines amid low oil and

gas prices.

The results would have looked worse if not for a one-time $3.7

billion gain from the sale of assets in Norway.

Exxon Chief Executive Darren Woods embarked on an audacious

strategy in 2018 to increase spending to double profits and pump an

additional one million barrels of oil and gas a day by 2025. So

far, it hasn't yielded better results.

The company's full-year profit was $14.3 billion, down 31% from

$20.8 billion the year before. Capital expenditures, meanwhile,

were up 20% to $31 billion from nearly $26 billion in 2018. Revenue

was down nearly 9%, from $290 billion in 2018 to about $265 billion

last year.

The profit was Exxon's third lowest this century, according to

FactSet, and the lowest since 2016, when it fell to $7.84 billion

as the industry suffered a world-wide price crash.

Chevron Corp. on Friday reported a loss of $6.61 billion for the

fourth quarter as results were weighed down by a more than $10

billion write-down of U.S. shale properties and other assets that

the company had announced last month. Royal Dutch Shell PLC on

Thursday reported a nearly 50% drop in quarterly profit, and its

shares dropped after it disclosed that it would ratchet up

divestments and slow its share-buyback program.

Investors -- who have soured on fossil fuel companies in general

after several years of lackluster returns and growing concerns

about climate-change risks -- have reacted coolly to Exxon's growth

strategy. The company's shares fell 4.1% on Friday to their lowest

levels since 2010. The drop was the largest decline in nearly two

years.

Chevron shares were down more than 4%.

Exxon's spending has set it apart from competitors such as

Chevron and Shell, which have been more restrained with capital

expenditures. But none of the big publicly traded oil companies

have fared especially well in recent months, as a world-wide glut

of crude and natural gas and concerns about demand weigh on

commodity prices.

Mr. Woods said Friday that while the industry faces "extremely

challenging market conditions," Exxon wouldn't cut its spending

because it is focused on long-term supply and demand.

"We believe strongly that investing in the trough of this cycle

has some real advantages," Mr. Woods said on a call with

investors.

The large integrated companies are also being hit by weaker

margins in their chemicals and refining businesses due to excess

supply as well as higher levels of plant outages.

For Exxon investors, the question is whether 2020 will represent

a turn in the company's fortunes, as one of the reasons for its

spending surge, an oil megaproject in Guyana, turns positive. The

Guyana project began producing oil in December. This week, Exxon

raised its estimate of recoverable oil there to eight billion

barrels, up from six billion barrels.

Unlike Chevron, which has responded to Wall Street's calls for

austerity, Exxon is "marching to its own drum," said Mark Stoeckle,

chief executive of Adams Funds, which owns about $110 million in

Exxon shares and $82 million in Chevron.

"Even though it appears the market has said 'we don't want you

to outspend, we want you to do dividends, we want you to do

buybacks,' Exxon is saying 'we take a longer view than anybody, if

you don't like it, then sell the stock," Mr. Stoeckle said.

Mr. Woods had pledged to increase Exxon's output, long hovering

around 4 million barrels a day, to five million by increasing

annual spending between $4 billion to $6 billion to top $30 billion

and focusing on a handful of key projects.

Some investors have regarded the plan with skepticism: Exxon has

been pledging to produce more oil and gas for years, but its output

has remained roughly the same since its merger with Mobil Corp. in

1999.

The investments have come during a period of lower U.S. oil

prices. The West Texas Intermediate benchmark has mostly hovered

around $50 to $60 a barrel since Mr. Woods took over in 2017 and

traded around $52 Friday. The benchmark was down 1.1% Friday to

$51.56.

In addition to Guyana, Exxon has markedly outspent competitors

in the oil-rich Permian Basin of West Texas and New Mexico, adding

hundreds of wells as other companies slash shale-drilling activity

there.

Exxon's investment in the Permian has boosted production over

the past two years, but at a heavy cost. Production from the

company's U.S. operations, to which the Permian is the largest

contributor of oil, increased to 646,000 barrels of oil a day in

2019, up from 551,000 barrels in 2018. But U.S. spending also

increased to $11.6 billion, up from $7.6 billion in 2018.

Exxon's chemical and refining units reported about $2.9 billion

in combined profits, their lowest return in years, as the company

contended with increased maintenance costs. Earnings from those

units have topped $7 billion since 2013.

Exxon hasn't generated enough cash this year to cover new

expenses and dividends, and other major oil companies have

struggled to make the payments from their own cash flows, according

to FactSet data and company disclosures. Exxon increased its annual

dividend in the first quarter, a step the company has taken for 37

years in a row.

Dave Sebastian contributed to this article

Write to Christopher M. Matthews at

christopher.matthews@wsj.com

(END) Dow Jones Newswires

February 01, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

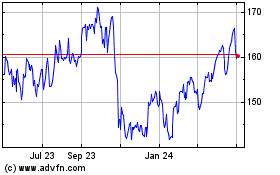

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

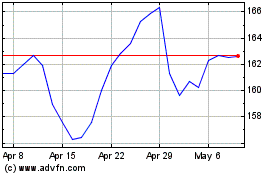

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024