By Tim Mullaney

It's one of Wall Street's best-known maxims: The "Dogs of the

Dow" principle, holding that Dow Jones Industrial Average companies

whose stocks underperform the broad market in a given year but are

basically healthy typically will bounce back and maybe even

outperform the market the next year. And it generally holds

true.

But does a similar rule apply to sectors of the S&P 500, and

sector-based mutual funds and exchange-traded funds? Inquiring

energy investors, in particular, may want to know.

The answer is, kind of, says Sam Stovall, chief investment

strategist at CFRA Research. Because any one of the 11 sectors

represented in the S&P 500 is a bigger boat to turn around than

one company, it takes longer. But market history suggests that

sectors that underperform in one decade do tend to outperform in

the next: It happened for tech shares in the 2010s after a decade

marked by two collapses in tech stocks, and it happened for

utilities in the early 2000s after they sat out the 1990s boom led

by tech stocks.

"Typically the best-performing sectors in one decade become the

worst in the following decade, and vice versa," Mr. Stovall says.

"Since energy was the best in the 2000s but the worst this [past]

decade, maybe the 2020s will be its day in the sun."

But energy, and funds that follow it, are trapped in a set of

conundrums that make the sector's potential for a rebound a tricky

question. On the positive side, energy shares have gotten cheaper:

The S&P 500 Energy subindex trades at only about 0.4 times book

value, half of 2008's level and a third below 2016, according to

Bank of America Merrill Lynch. That argues for a rebound. However,

financial stocks are significantly cheaper on the basis of

price-to-earnings ratio, so they may be more attractive to value

investors.

And the energy industry is still plagued by the prospect of

oil-and-gas overcapacity in the short term, and over time a series

of technical innovations -- including electric vehicles and

wind-powered electricity -- that threaten to make traditional

energy players smaller and less relevant.

How fast the technology moves, and becomes cheaper than existing

ways of doing business, will determine whether technological

changes threatening to push energy stocks lower overwhelm cheap

valuations that would tend to drive shares higher, CFRA energy

analyst Stewart Glickman says.

Many challenges

One scenario is that there may be a window between the time when

big energy companies fix their existing problems like oversupply of

natural gas, allowing for returns to rise, and the time when

long-term issues like the rise of electric vehicles threaten demand

growth for petroleum and pressure energy-related shares anew. Any

investors hoping for a rebound could be rewarded in that

window.

"You might get a five-year sweet spot," Mr. Glickman says.

From the start of 2017 to the end of last year, investors pulled

$12.4 billion from energy-focused mutual funds and ETFs,

Morningstar analyst Amrutha Alladi says. Combined with capital

losses from falling stock prices, that pushed the amount in energy

funds to $30.2 billion at year-end 2019 from $55.9 billion three

years earlier.

The sector has gotten off to a shaky start in 2020, falling 9.8%

compared with a 3.6% gain for the broader market, after a 1% gain

in 2019 trailed the market by 25 percentage points. Merrill

strategist Savita Subramanian rated energy shares "equal weight" in

a recent report, meaning investors should hold about as much of

their money in energy shares as the industry's share of the total

stock market, currently around 4%.

"The sector represents deep value," Ms. Subramanian says. Still,

"traditional commodities are shunned by an increasing number of

[socially conscious] investors," she says. "The secular replacement

story is also a headwind," she says, referring to the idea that

people will use less gasoline as they switch to electric cars and

less natural gas as renewable energy takes a larger share of the

electricity market.

In the short term, oil-and-gas shares also are pressured by

activist shareholders' demands that energy companies cut capital

spending, already down 35% since 2014, in the wake of criticism

that the hydraulic fracking boom led to overinvestment and too much

oil supply.

There's disagreement about how soon or how deeply lower capital

expenditures will cut into growth of U.S. oil production. But if

production growth does drop, boosting prices, that would give

energy companies room to increase profits -- and to use their

improved cash flow for more stock buybacks or dividends, Mr.

Glickman says. Chevron and Exxon Mobil boosted dividends by 6% last

year, and ConocoPhillips in November launched a share buyback that

could purchase shares worth half of the company's current market

value over 10 years.

Future risks

By an optimistic reading, this points to a possible window of

opportunity for share-price gains around 2021 or 2022, Mr. Glickman

says. But then, energy investors have to look out for the risks

coming later in the decade.

The biggest of those risks is the growth of electric-vehicle

sales, and the key thing to watch on that front is how soon

declining battery prices make EVs cheaper than gasoline-powered

cars and trucks, even without the tax subsidies that have helped

speed the adoption of electric vehicles so far. That could happen

by 2022 to 2024, according to analysts at Bloomberg New Energy

Finance, citing an 87% drop in battery costs in the past

decade.

In this scenario, gasoline demand plummets. But there would

still be winners in the energy sector, says Robert Thummel, a

portfolio manager at energy-focused fund group Tortoise Capital --

companies involved in producing electricity to power the new cars.

"Electricity demand will be the driver in the next decade," he

says.

That could lead energy investors and funds in new directions, he

says -- especially big bets on utilities and energy infrastructure

like electric grids.

A decade is a long time, of course, and even newer innovations

than fracking, EVs and widespread wind power could disrupt energy

markets by 2030 -- it has happened before.

Mr. Mullaney is a writer in Maplewood, N.J. He can be reached at

reports@wsj.com.

(END) Dow Jones Newswires

February 09, 2020 22:23 ET (03:23 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

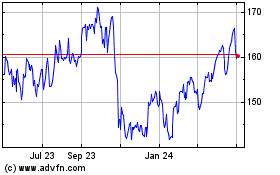

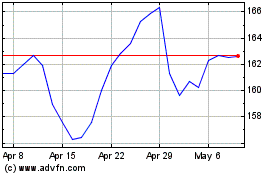

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024