Australian Dollar Higher After Strong China Consumer Inflation Data

10 February 2020 - 1:48PM

RTTF2

The Australian dollar climbed against its major counterparts in

the Asian session on Monday, after a data showed that China's

consumer inflation accelerated in January due to the coronavirus

outbreak.

Official data showed that consumer prices gained 5.4 percent

year-on-year in January. That exceeded forecasts for an increase of

4.9 percent following the 4.5 percent gain in December.

The bureau also said that producer prices sank 0.5 percent

year-on-year versus expectations for a flat reading following the

0.5 percent decline in the previous month.

Investors also monitored developments on the coronavirus

outbreak.

The death toll in China due to the epidemic jumped to 908 and

the number of confirmed cases has risen over 40,000, Chinese health

officials said today.

The aussie rose to 0.6707 against the greenback and 73.67

against the yen, from its early lows of 0.6665 and 73.05,

respectively. If the aussie rises further, 0.68 and 75.00 are seen

as its next resistance levels against the greenback and the yen,

respectively.

The aussie climbed to a 1-1/2-month high of 1.0461 against the

kiwi and held steady thereafter. The pair had ended last week's

deals at 1.0433.

Reversing from its early low of 1.6424 against the euro and a

1-week low of 0.8867 against the loonie, the aussie gained to

1.6331 and 0.8916, respectively. The next possible resistance for

the aussie is seen around 1.61 against the euro and 0.91 against

the loonie.

Looking ahead, Swiss CPI for January is due at 2:30 am ET.

Eurozone Sentix investor sentiment index for February is

scheduled for release in the European session.

Canada housing starts for January are set for release at 8:15 am

ET.

Fifteen minutes later, Canada building permits for December will

be released.

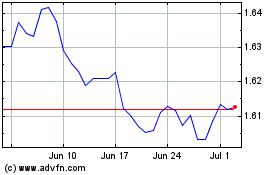

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024