Dollar Drops Before Powell's Testimony

11 February 2020 - 7:34PM

RTTF2

The U.S. dollar was lower against its most major opponents

during the European session on Tuesday, as investors awaited

testimony from Federal Reserve Chairman Jerome Powell to see

whether he would downplay the risks posed by the coronavirus.

Powell will testify before the House at 10:00 am ET.

The Chairman is expected to sound fairly upbeat about the

outlook for U.S. economic growth and will face pointed questions

from lawmakers related to the impact of the spreading

coronavirus.

The Fed had adopted a 'wait-and-see' attitude, after reducing

interest rates three times in 2019.

Powell will face the Senate Banking Committee on Wednesday.

Fed Vice Chair Randal Quarles, Minneapolis Fed President Neel

Kashkari and Federal Reserve Bank of St. Louis President James

Bullard are scheduled to speak at separate events later in the

day.

The dollar was also weighed by improving risk sentiment, as the

new coronavirus cases slowed in China.

In remarks on state television, Xi Jinping vowed to win the

fight against the coronavirus outbreak.

Jinping said that China will speed up the development of drugs

aimed at treating the deadly pneumonia-like virus.

The greenback dropped to 1.2943 versus the pound, following a

gain to 1.2894 at 3:15 am ET. The next possible support for the

greenback is seen around the 1.32 level.

Data from the Office for National Statistics showed that the UK

economy logged flat growth in the fourth quarter.

Gross domestic product remained unchanged on quarter, as

expected, after expanding 0.5 percent in the third quarter.

The greenback pulled back to 1.0921 against the euro, from a

rally to 1.0906 at 2:15 am ET, which was its strongest since

October 2. On the downside, 1.12 is possibly seen as the next

support level for the greenback.

After rising to a 1-1/2-month high of 0.9788 versus the franc in

the Asian session, the greenback retreated to 0.9765. The greenback

is seen locating support around the 0.96 level.

The greenback eased off to 109.82 against the yen, from a 4-day

high of 109.95 at 3:00 am ET. If the greenback slides further,

108.00 is likely seen as its next support level.

The greenback edged down to 1.3288 against the loonie, from

yesterday's closing value of 1.3317. Further downtrend may take the

greenback to a support around the 1.30 region.

In contrast, the greenback recovered to 0.6703 against the

aussie, from an early 4-day low of 0.6719. The greenback is poised

to challenge resistance around the 0.625 mark.

Data from the Australian Bureau of Statistics showed that

Australia's home loans rose in December.

The new loan commitments for housing rose a seasonally adjusted

4.4 percent month-on-month in December. On an annual basis, loans

increased 14.0 percent.

The greenback held steady against the kiwi, after falling from a

3-month high of 0.6378 hit in the Asian session. At yesterday's

trading close, the pair was valued at 0.6384.

Looking ahead, European Central Bank President Christine Lagarde

will deliver a speech before the European Parliament in Strasbourg

at 9:00 am ET.

Federal Reserve Chair Jerome Powell testifies on the Semiannual

Monetary Policy Report before the House Financial Services

Committee in Washington DC at 10:00 am ET.

At 10:35 am ET, Bank of England Governor Mark Carney will

testify before the House of Lords Economic Affairs Committee in

London.

Federal Reserve Governor Randal Quarles will give a speech about

bank supervision at the Yale Law School Dean's Lecture in

Connecticut at 12:15 pm ET.

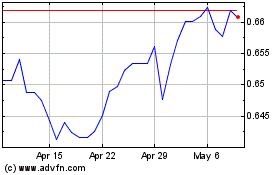

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024