Pound Climbs After U.K. Consumer Inflation Hits 6-month High

19 February 2020 - 5:33PM

RTTF2

The pound advanced against its major trading partners in the

European session on Wednesday, as U.K. consumer inflation

accelerated to a six-month high in January, supporting hopes that

the Bank of England would keep rate unchanged in near term.

Data from the Office for National Statistics showed that

inflation improved to 1.8 percent in January from 1.3 percent in

December. Economists had expected a 1.6 percent rise.

On a monthly basis, consumer prices fell 0.3 percent after

remaining flat in the previous month. The rate was forecast to fall

by 0.4 percent.

Another report from ONS showed that output price inflation

accelerated to 1.1 percent in January from 0.9 percent in

December.

Month-on-month, output inflation was 0.3 percent in January,

compared to a flat reading in December.

Input prices rose to 2.1 percent in January from 0.9 percent in

December.

On a monthly basis, input price inflation remained unchanged at

0.9 percent in January.

Sentiment was underpinned by a fall in the number of new

coronavirus cases in China.

Markets also remain hopeful that China will cut its benchmark

loan prime rate Thursday to offset the economic damage caused by

the coronavirus outbreak.

The currency exhibited mixed trading in the Asian session. The

currency advanced against the yen but held steady against the euro

and the franc. Versus the dollar, it dropped.

Extending early rally, the pound spiked up to nearly a 4-week

high of 143.51 against the yen. The GBP/JPY pair had ended

yesterday's trading session at 142.77. Immediate resistance for the

pound is possibly seen around the 145.00 level.

Data from the Ministry of Finance showed that Japan posted a

merchandise trade deficit of 1,312.6 billion yen in January.

That beat estimates for a shortfall of 1,684.8 billion yen

following the 154.6 billion yen deficit in December.

The pound was up against the franc at 1.2811, gaining 0.4

percent from a low of 1.2762 set at 4:15 am ET. Next key resistance

for the pound is likely seen around the 1.30 level.

Following a brief fall to 1.2975 at 4:15 am ET, the pound

bounced back against the greenback, touching 1.3023. On the upside,

resistance is seen near the 1.32 level.

The pound rose against the euro, with the EUR/GBP pair reaching

0.8295. The pound is likely to face resistance around the 0.80

region, if it gains again.

Looking ahead, at 8:30 am ET, Canada CPI for January will be

published.

At the same time, U.S. housing starts, building permits and

producer price index, all for January, are due out.

The Federal Reserve will release minutes from its January 28-29

meeting at 2:00 pm ET.

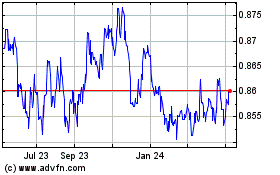

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

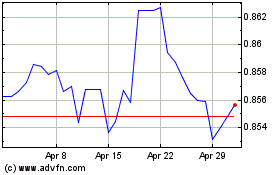

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024