Boeing Nominates Two New Directors for Board -- Update

25 February 2020 - 11:17AM

Dow Jones News

By Andrew Tangel and Doug Cameron

Boeing Co. said it has nominated two new outside directors with

safety and engineering experience and stiffened conditions on

bonuses for new Chief Executive David Calhoun by including a range

of programs beyond the crisis-hit 737 MAX.

The aerospace giant said Monday the new board nominees are Akhil

Johri, who until recently was finance chief at aerospace

manufacturer United Technologies Corp., and Steve Mollenkopf, chief

executive of chip maker Qualcomm Inc. The two would replace

longtime directors Edward Liddy and Mike Zafirovski, who Boeing

said would step down after the company's annual meeting in

April.

Boeing's board has come under scrutiny from U.S. lawmakers and

investors for its role overseeing the launch of the MAX nearly a

decade ago and its reaction to two crashes that claimed 346

lives.

Aviation industry officials and some shareholders have asked why

it took the board until late December to oust Dennis Muilenburg as

CEO, nine months after the second MAX crash in Ethiopia last

March.

The additions announced on Monday, along with the arrival in

2019 of former United Nations Ambassador Nikki Haley and retired

Navy Admiral John Richardson as directors, would mean a third of

Boeing's 13-person board has turned over since last spring.

The board decided against other potential changes, such as

adding seats or imposing tenure limits. Chairman Larry Kellner said

the new board members would bring fresh perspective while retaining

the experience of long-tenured directors.

"We just feel like this is the right balance after a lot of

debate," Mr. Kellner said in an interview.

Regulators banned the MAX from flying last March. The protracted

grounding as Boeing works on software fixes and establishing a

training protocol that will win the approval of regulators has

plunged the company into turmoil. Boeing halted the aircraft's

production in January, and potential costs and charges have

approached $20 billion.

Mr. Kellner defended the board's handling of the MAX crisis,

noting it established a safety committee after the second crash and

later ousted Boeing's commercial-airplane division chief and then

Mr. Muilenburg.

The Chicago-based company, in a regulatory filing, also said it

had extended bonus measures for Mr. Calhoun beyond the return of

the 737 MAX to service. Some $17 million in potential bonus

payments are now also tied to such headaches and opportunities at

Boeing as its KC-46A military tanker and other high-profile

military programs, the Starliner space taxi, the planned Embraer SA

joint venture and deliveries of the delayed 777X jetliner, as well

as unspecified efforts to "strengthen" engineering.

About half of the company's 13 directors have held board seats

for about a decade or longer, including Mr. Calhoun, a director

since 2009. Mr. Kellner has been a member since 2011 and six were

in place when Boeing decided in 2010 to launch the MAX.

Mr. Calhoun, who took the helm last month, once ran General

Electric Co.'s aircraft-engine business, and Mr. Kellner was CEO of

Continental Airlines before the merger that created United Airlines

Holdings Inc. Others on the board hail from other heavily regulated

industries such as insurance and energy.

Boeing's board is likely to be a focus during proxy season in

coming weeks, according to some investors and advisory firms. The

company is expected to file its latest governance documents with

securities regulators next month ahead of the April shareholder

meeting.

No one filed nominations for a competing slate of directors this

year, but the board could nonetheless face symbolic actions.

Last year proxy advisory firm Glass Lewis recommended voting

against Mr. Kellner, the head of the board's audit committee. The

firm said the MAX accidents "indicate a potential lapse in the

board's oversight of risk management."

"They're doing their best to put this controversy behind them,

but it remains to be seen if that will be accomplished," Kern

McPherson, a vice president of research and engagement at Glass

Lewis, said in a recent interview.

Last fall, Boeing's board added a board-level safety committee

as part of a broader revamp of how the company handles design and

safety matters. The change is aimed at giving senior company

leaders and directors tighter oversight, as well as reduce the

influence of schedules and cost pressures on engineering

decisions.

Write to Andrew Tangel at Andrew.Tangel@wsj.com and Doug Cameron

at doug.cameron@wsj.com

(END) Dow Jones Newswires

February 24, 2020 19:02 ET (00:02 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

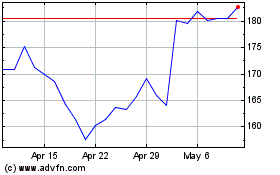

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

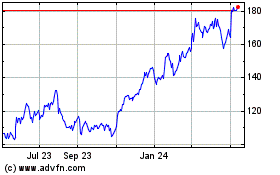

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024